3Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales, supply chains remained strained.

2Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales, supply chains remained strained.

1Q22 Transport Hardware & Markets Report

First-quarter 2022 worldwide optical hardware spending increased 2.5% YoY, while packet gained 2%. North America led growth in both categories.

4Q21 Transport Hardware & Markets Report

Fourth-quarter 2021 worldwide optical hardware spending increased 3.5% YoY. Declines centered in APAC for the second consecutive quarter, while all other regions grew YoY.

3Q21 Transport Customer Markets Report

Cloud operator and traditional telco spending leads rebound in North America

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

1Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined steeply YoY compared to a heavily frontloaded 1Q20, but show signs of longer term recovery. Cloud & Colo optical spending worldwide slowed as NA spending stalled in 2020 and APAC is just beginning to take off.

4Q20 Transport Customer Markets Report

North American Traditional Telco spending on optical and packet hardware declined significantly in the 4th quarter, due to a dramatic reshuffling of capex spurred by the pandemic during the first half of 2020. Meanwhile, APAC Cloud & Colo spending exploded. Long term, hardware sales in all markets are predicted to return to growth in the second half of 2021.

3Q20 Transport Customer Markets Report

North America transport hardware spending growth shifted dramatically this quarter from Cloud & Colo operators to Incumbents. APAC Cloud & Colo optical sales grew again.

2Q20 Transport Customer Markets Report

Cloud & Colo optical spending in North America cooled while spending in APAC was unexpectedly strong this quarter.

1Q20 Transport Customer Markets Report

North American Incumbent optical spending was up almost 50% YoY while Wholesale, Cable/MSO, and Cloud spending all declined this quarter.

4Q19 Transport Customer Markets Report

Cloud & Colo optical spending growth cooled in the 4th quarter but still led growth for the year with Ciena as market share leader. North American Incumbent and Cable/MSO optical spending came back strong in the 4th quarter.

3Q19 Optical Customer Markets Report

Cloud & Colo led growth in North America, up 45% this quarter. Ciena increased its market share to over 50% in 3Q19.

2Q19 Optical Customer Markets Report

Incumbent spending grew in every region, Cloud & Colo spending growth slowed, and Cable & MSO sales declined.

1Q19 Optical Customer Markets Report

Cignal AI has issued the 1Q19 Optical Customer Markets Report.

4Q18 Optical Customer Markets Webinar

Cignal AI presents the results from the 4Q18 Optical Customer Markets Report.

4Q18 Optical Customer Markets Report

Cignal AI has issued the 4Q18 Optical Customer Markets Report.

3Q18 Optical Customer Markets Report

Cignal AI has issued the 3Q18 Optical Customer Markets Report.

2Q18 Optical Customer Markets Report

Cignal AI has issued the 2Q18 Optical Customer Markets Report.

Cloud Spending on Optical Hardware – 1Q18 Update

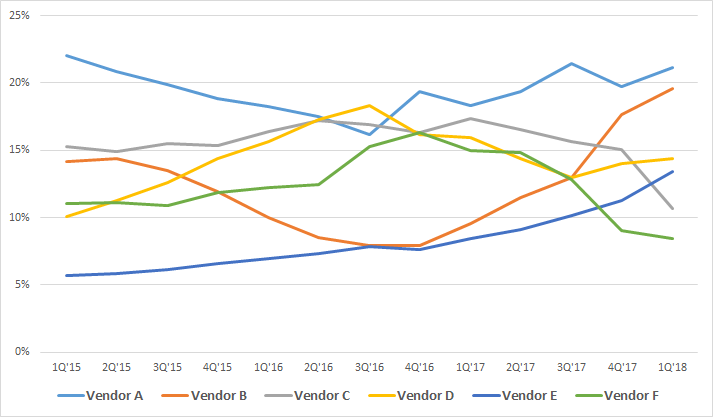

In October 2017, Cignal AI analyzed the occurrence of a slowdown in spending by cloud & colo operators and quantified the magnitude of its impact (see Analysis: 1H17 Cloud and Colo Spending Slowdown).