Cignal AI provides active and insightful market research for the networking component and equipment market as well as its end customers.

Cignal AI creates insightful analysis on the telecommunications transport industry, with a focus on packet and optical equipment and components. Our reports provide historical, current, and forecasted sales by region, technology, vendor, and customer segment. We examine specific applications and companies, new technology developments, and trends in the industry.

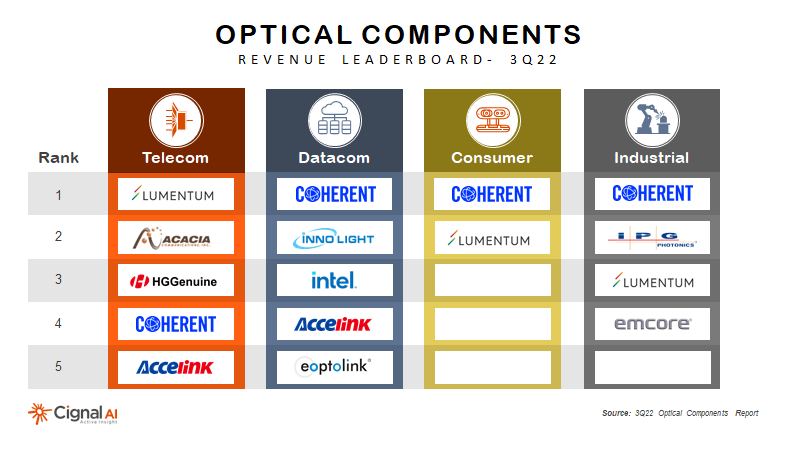

Our infrastructure and reports are oriented towards rapid publishing and allow clients to view data in real time. Dynamic dashboards and Excel files display ongoing market updates, capturing company results immediately upon release. A final snapshot of the market is provided in the end-of quarter reports.