In 2016, Cignal AI was the first research firm to identify and track a new optical hardware market segment characterized by disaggregated platforms in data center-oriented form-factors, dubbed Compact Modular. Since that time, sales in this category have increased to over $3B annually, grown at more than 25% CAGR, and now represent more than 20% of total optical hardware sales.

This report provides historical information, industry context, and product examples. Quarterly data, forecasts, and vendor market share for Compact Modular are available in Cignal AI’s Transport Hardware Report.

PDFOrigin Story

Over the past decade, spending by Cloud and Colo network operators – particularly hyperscale internet content providers – has become the fastest growing source of capex in IT and Telecom equipment. The needs of these network operators redefined hardware architectures for computing, storage, and networking. As architectures were implemented, the supply chain felt a ripple effect as these operators pursued a white box model and built much of their own equipment. Hardware manufacturers that did not adapt to the new environment lost the opportunity to serve this market. Optical transport equipment vendors, wanting to avoid the same fate, instead proactively engineered products that were precisely designed for these customers and their unique requirements, thereby creating a new hardware category.

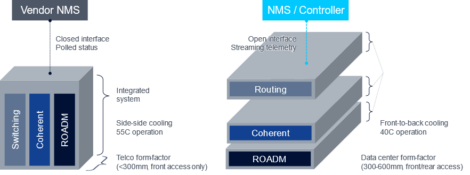

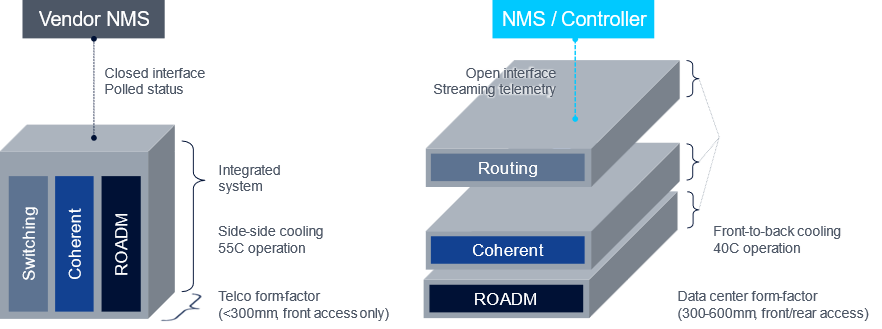

Disaggregation Drives Physical Changes

Optical transport equipment had always been strictly engineered for the central office and roadside hut environments of large Telcos, which entail high operating temperatures, shallow depth, DC power, and side-to-side airflow, among others. These new platforms adopted the physical and operational characteristics of data center hardware, including greater depth, relaxed environmental constraints, front-to-back airflow, rear access, and AC power.

Clients log in to access full report