NGON 2023 Show Report

Observations on IP over DWDM and the Optical Edge

4Q22 Optical Components Report

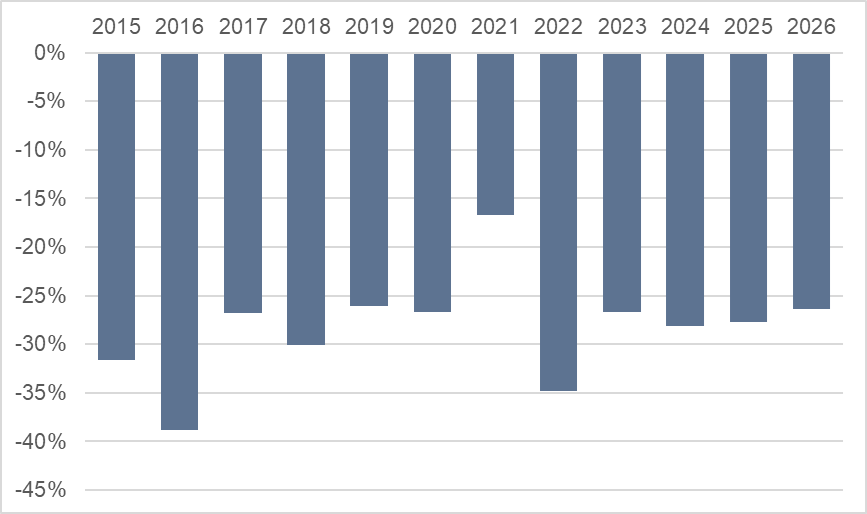

Datacom and Telecom revenue was up for the year, but headwinds are pushing down forecasts for both revenue and shipments in the first part of 2023.

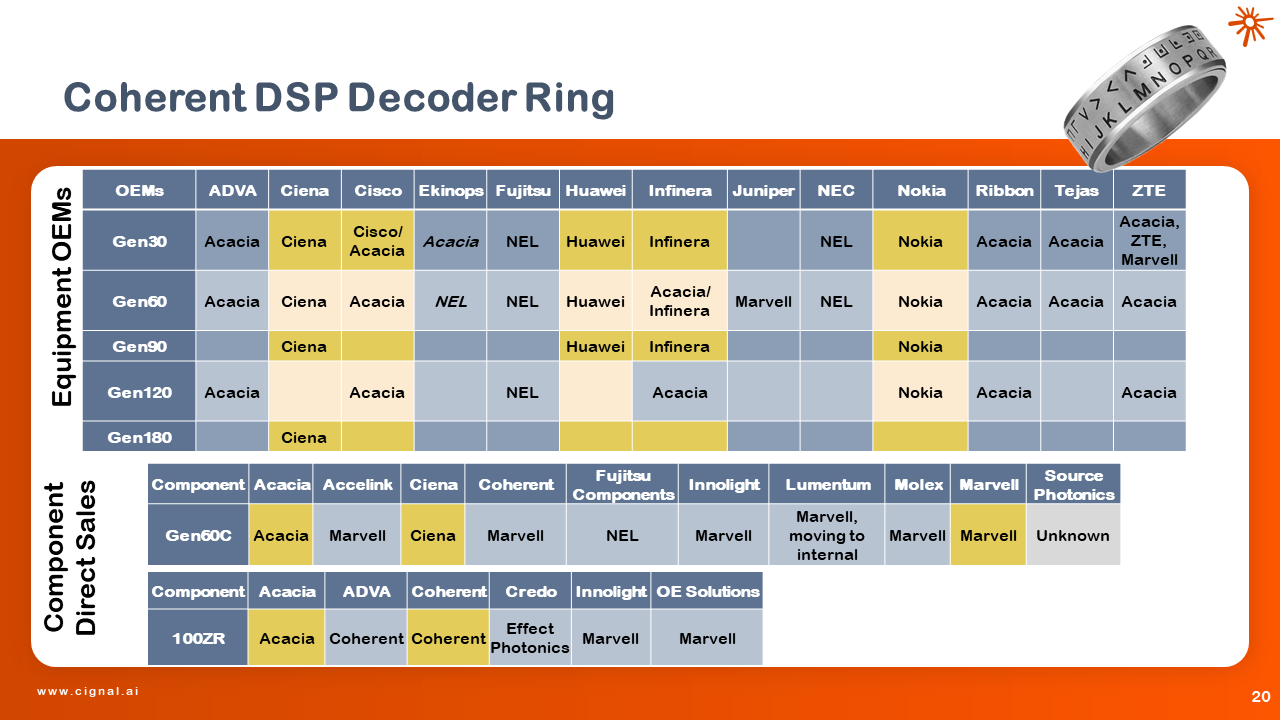

Tracking the Coherent DSP Supply Chain

Uncovering who uses which DSP, and which DSP vendors ship the most volume.

Optical Components – 4Q22 Preliminary Report

The Optical Components report is expected to release in mid-April. In the meantime, this interim report provides an overview of how quarterly results are trending.

4Q22 Transport Applications Report

Gen60C shipments slow, ROADM shipments in line with hardware as supply chain issues resolve

OFC 2023 Show Report

Key technology takeaways from OFC 2023.

3Q22 Optical Components Report

400GbE shipments recovered from last quarter’s dip leading to a strong revenue quarter for Datacom. Telecom optical component revenue grew as more than 61k Gen60C modules shipped in the quarter.

3Q22 Transport Applications Report

Gen60C modules drive coherent bandwidth growth this quarter while Compact Modular and ROADM equipment sales outperform.

2Q22 Optical Components Report

Pluggable 400Gbps optics continues to drive Telecom bandwidth as operators migrate away from lower speeds. Datacom component shipment growth slowed this quarter, but revenue for Datacom is still growing faster than in any other optical segment.

2Q22 Transport Applications Report

Coherent bandwidth growth remains muted outside of 400ZR

Coherent Port Pricing Trends (1Q22)

Cignal AI revisits our Coherent Pricing Trends report from 2019 and provides an update based on recent technology advances.

1Q22 Optical Components Report

It’s all about the supply chain again this quarter, but signs point to gains in the second half of the year. 400GbE datacenter optics and 400Gbps pluggable telecom optics are driving their respective segments.

1Q22 Transport Applications Report

Coherent bandwidth growth returns to historical levels & ROADM coverage initiated.

4Q21 Transport Applications Report

400ZRx Pluggable shipments surge while lower cloud spending holds back Compact Modular in North America.

3Q21 Transport Customer Markets Report

Cloud operator and traditional telco spending leads rebound in North America

3Q21 Transport Applications Report

Compact Modular equipment sales continued to surge while Chinese coherent port shipments stalled.

2Q21 Transport Applications Report

Compact modular sales again outperformed the overall optical hardware market while Packet-OTN sales declined. 400ZR is shipping but is supply limited.

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

1Q21 Transport Applications Report

400Gbps+ port shipments doubled YoY, 400ZR ports started to ship, and compact modular sales significantly outperformed the overall optical hardware market this quarter.

1Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined steeply YoY compared to a heavily frontloaded 1Q20, but show signs of longer term recovery. Cloud & Colo optical spending worldwide slowed as NA spending stalled in 2020 and APAC is just beginning to take off.