1Q22 Transport Applications Report

Coherent bandwidth growth returns to historical levels & ROADM coverage initiated.

4Q21 Transport Applications Report

400ZRx Pluggable shipments surge while lower cloud spending holds back Compact Modular in North America.

3Q21 Transport Customer Markets Report

Cloud operator and traditional telco spending leads rebound in North America

3Q21 Transport Applications Report

Compact Modular equipment sales continued to surge while Chinese coherent port shipments stalled.

2Q21 Transport Applications Report

Compact modular sales again outperformed the overall optical hardware market while Packet-OTN sales declined. 400ZR is shipping but is supply limited.

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

1Q21 Transport Applications Report

400Gbps+ port shipments doubled YoY, 400ZR ports started to ship, and compact modular sales significantly outperformed the overall optical hardware market this quarter.

1Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined steeply YoY compared to a heavily frontloaded 1Q20, but show signs of longer term recovery. Cloud & Colo optical spending worldwide slowed as NA spending stalled in 2020 and APAC is just beginning to take off.

4Q20 Transport Applications Report

4Q20 Compact Modular sales significantly outperformed the overall optical market, as APAC sales more than doubled and surpassed EMEA sales for the first time. 400ZR forecasts for 2022 and beyond were increased based on growing operator interest.

4Q20 Transport Customer Markets Report

North American Traditional Telco spending on optical and packet hardware declined significantly in the 4th quarter, due to a dramatic reshuffling of capex spurred by the pandemic during the first half of 2020. Meanwhile, APAC Cloud & Colo spending exploded. Long term, hardware sales in all markets are predicted to return to growth in the second half of 2021.

3Q20 Transport Applications Report

Compact modular sales grew much faster than the optical market overall, with significant growth in APAC this quarter. 400ZR and ZR+ modules began sampling with several hundred modules shipped for evaluation.

3Q20 Transport Customer Markets Report

North America transport hardware spending growth shifted dramatically this quarter from Cloud & Colo operators to Incumbents. APAC Cloud & Colo optical sales grew again.

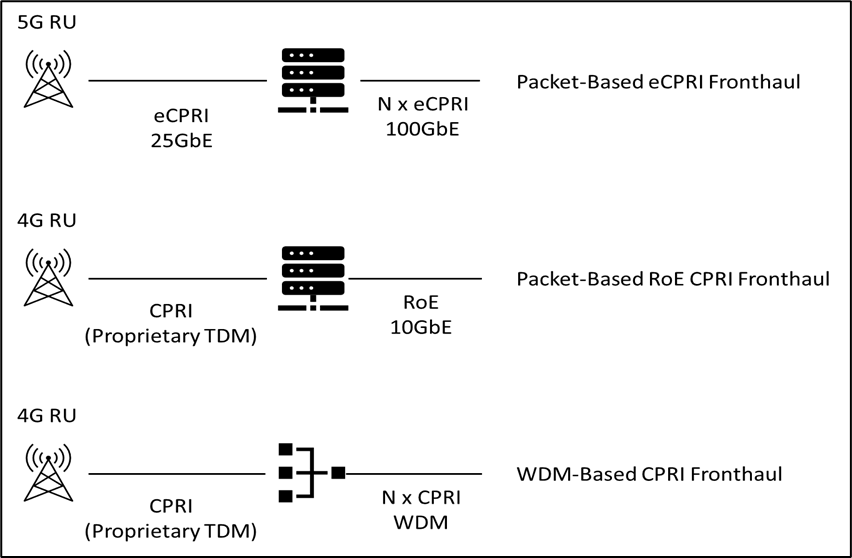

5G Optimized Packet Transport for Mobile Fronthaul

The diverse requirements of 5G require both the radios and the network supporting the radios to be updated. This report covers advances in 5G packet fronthaul and includes an overview of existing vendor solutions.

2Q20 Transport Customer Markets Report

Cloud & Colo optical spending in North America cooled while spending in APAC was unexpectedly strong this quarter.

2Q20 Transport Applications Report

This report includes our initial forecasts of the 100ZR and 400ZR+ markets.. Compact Modular sales grew much faster than the overall market this quarter as disaggregation continues to gain traction in networks outside of Cloud & Colo.

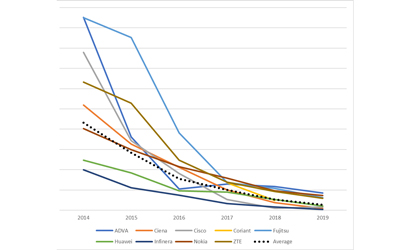

Coherent Port Pricing Trends (1Q20)

Our 3Q18 report showed coherent optical port pricing dropping at 26% per year. This report examines the stability of that trend over the last 12 months as new coherent systems entered the market.

1Q20 Transport Applications Report

Packet-OTN sales doubled in NA as carriers responded to COVID-19, and shipments of 400Gbps+ ports doubled YoY as Chinese equipment companies entered production.

1Q20 Transport Customer Markets Report

North American Incumbent optical spending was up almost 50% YoY while Wholesale, Cable/MSO, and Cloud spending all declined this quarter.

Acacia 1Q20 Vendor Summary Report

Acacia’s results are a bellwether to the industry. This report looks at the most recent results for the company and examines them in the context of historical trends.

4Q19 Transport Customer Markets Report

Cloud & Colo optical spending growth cooled in the 4th quarter but still led growth for the year with Ciena as market share leader. North American Incumbent and Cable/MSO optical spending came back strong in the 4th quarter.