2Q20 Transport Customer Markets Report

Cloud & Colo optical spending in North America cooled while spending in APAC was unexpectedly strong this quarter.

2Q20 Transport Applications Report

This report includes our initial forecasts of the 100ZR and 400ZR+ markets.. Compact Modular sales grew much faster than the overall market this quarter as disaggregation continues to gain traction in networks outside of Cloud & Colo.

2Q20 Transport Hardware Report

Second quarter results were mixed. Forecasted growth in Q2 from sales pushed out of Q1 did not materialize as anticipated and carriers indicated that annual CapEx will not be increased – suggesting a flat to down second half of the year.

1Q20 Transport Applications Report

Packet-OTN sales doubled in NA as carriers responded to COVID-19, and shipments of 400Gbps+ ports doubled YoY as Chinese equipment companies entered production.

1Q20 Transport Customer Markets Report

North American Incumbent optical spending was up almost 50% YoY while Wholesale, Cable/MSO, and Cloud spending all declined this quarter.

1Q20 Transport Hardware Report

Vendors generally claimed a 5-10% reduction in sales due to COVID-19 operational issues this quarter. While demand increased, the inability to get parts, manufacture equipment, and deliver to end customers reduced sales in all areas.

OFC2020 Optical Hardware Review

Major optical transport equipment vendors did not present at OFC in March due to COVID-19 concerns, but that did not stop announcements of products and online updates to customers and analysts.

4Q19 Transport Customer Markets Report

Cloud & Colo optical spending growth cooled in the 4th quarter but still led growth for the year with Ciena as market share leader. North American Incumbent and Cable/MSO optical spending came back strong in the 4th quarter.

4Q19 Transport Applications Report

Compact Modular sales growth slowed in North America in the 4th quarter, but sales growth outside of NA was exceptionally strong and total worldwide sales grew nearly 50% year-over-year.

4Q19 Transport Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2024.

3Q19 Optical Customer Markets Report

Cloud & Colo led growth in North America, up 45% this quarter. Ciena increased its market share to over 50% in 3Q19.

3Q19 Optical Applications Report

200G coherent shipments from China exceeded forecasts, worldwide shipments of 100G coherent ports will now decline until lower-cost alternatives emerge.

3Q19 Optical Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2023.

The State of 5th Generation Optics

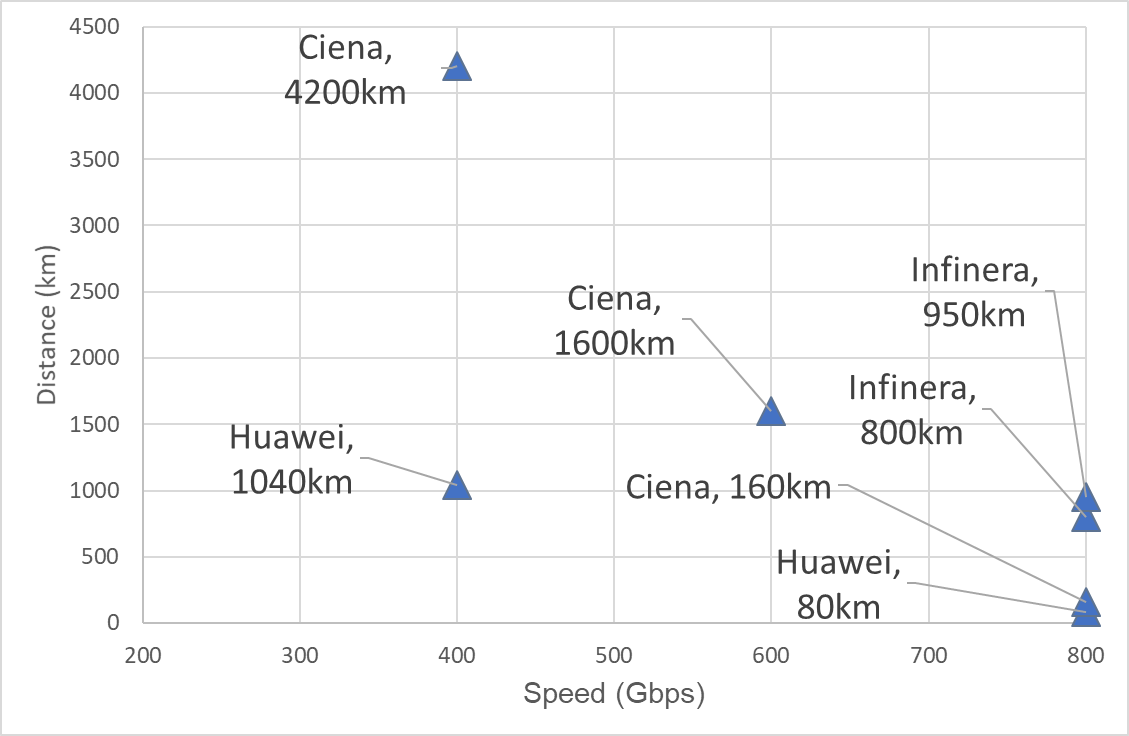

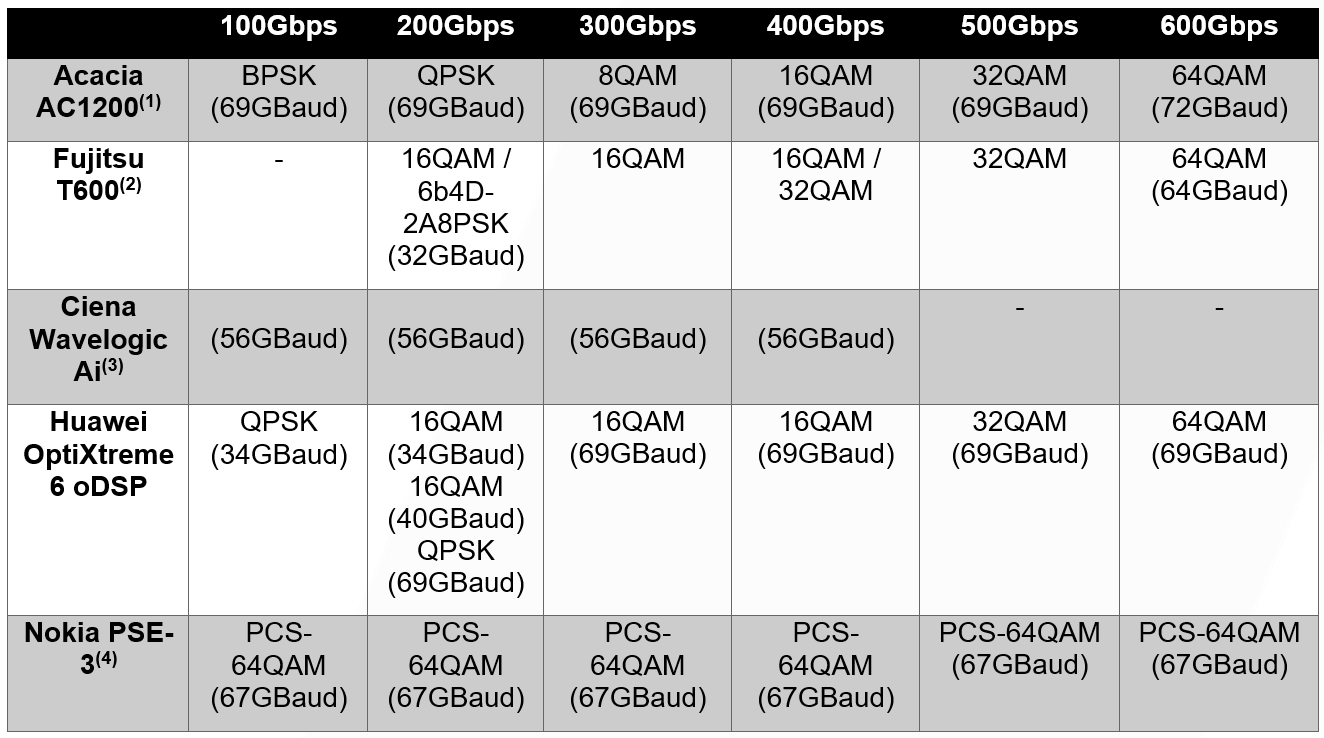

In this report, we survey recent coherent optical progress and provide an overview of the market status of 5th generation coherent optics.

2Q19 Optical Customer Markets Report

Incumbent spending grew in every region, Cloud & Colo spending growth slowed, and Cable & MSO sales declined.

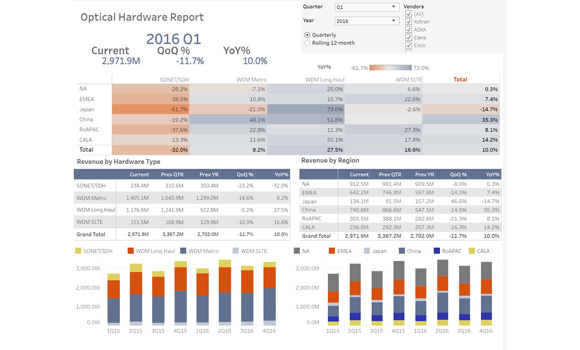

3Q19 Optical Hardware Tracker

The Cignal AI 3rd quarter 2019 (3Q19) Optical Hardware market share tracker is now active. The tracker gives clients a real-time view of market results as they are released.

2Q19 Optical Applications Report

Over a quarter of North American compact modular sales were for long haul deployments as applications continue to expand.

2Q19 Optical Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2023.

2Q19 Optical Hardware Tracker

The Cignal AI 2nd quarter 2019 (2Q19) Optical Hardware market share tracker is now active. The tracker gives clients a real-time view of market results as they are released.

1Q19 Optical Customer Markets Report

Cignal AI has issued the 1Q19 Optical Customer Markets Report.