OFC 2020 Preview and Predictions

The Optical Fiber Communications Conference is the most significant industry trade and technical show for optical communications. In preparation for the event, Cignal AI has compiled a list of what to watch at OFC and what announcements to expect.

ECOC 2019 Notes and Observations

Hosted in Dublin this year, ECOC 2019 offered three days of interaction with primarily component companies. Equipment and service provider attendance was minimal, although a handful did make the trip to the component-centric show.

OFC 2019 Preview and Predictions

The 2019 Optical Fiber Conference is less than a month away. Cignal AI’s analysts have compiled a list of predictions and expectations for what we expect to see from vendors and other OFC participants.

400ZR – The 4th Generation Coherent Opportunity

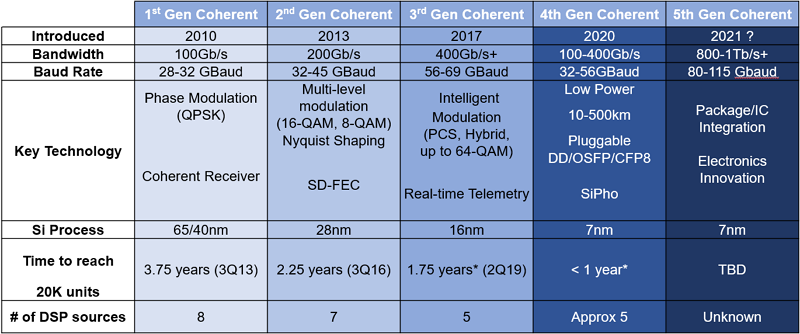

The arrival of standardized, pluggable 400ZR and derivative technologies – fourth generation coherent – is poised to be the most disruptive event in optical hardware since the advent of coherent 100G in 2010.

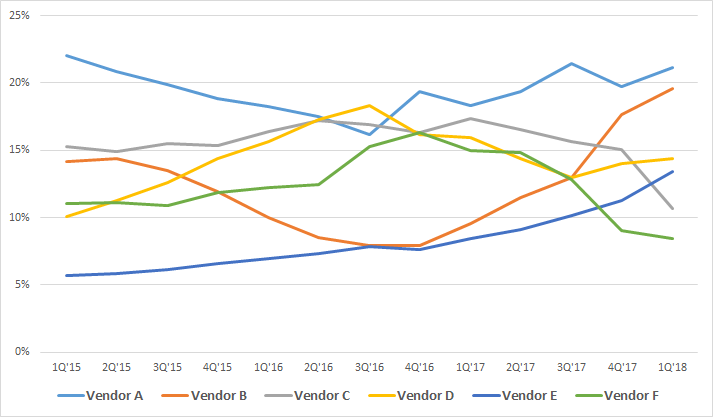

Cloud Spending on Optical Hardware – 1Q18 Update

In October 2017, Cignal AI analyzed the occurrence of a slowdown in spending by cloud & colo operators and quantified the magnitude of its impact (see Analysis: 1H17 Cloud and Colo Spending Slowdown).

Impact of US Technology Ban on ZTE

On April 16, the United States Department of Commerce announced that ZTE would no longer be allowed to import American technology products. While there is no shortage of media coverage of the ban, Cignal AI aims to provide you with unique insight. We have assembled our observations and conclusions on this remarkable event, and we share answers to some common questions we’ve received as it has transpired.

OFC 2018 – Coherent Technology

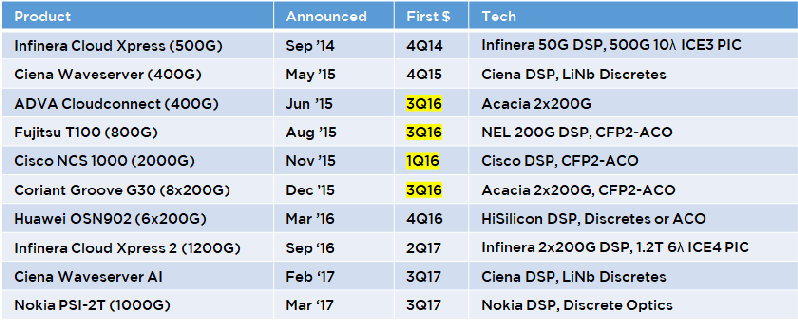

Trends in coherent technology generated enthusiasm among the participants at OFC 2018, and 400G ZR applications were of particular interest. Nokia and Infinera outlined next-generation coherent roadmaps, and Acacia and…

OFC 2018 – Consolidation

Each year, there is at least one announcement at OFC which surprises the industry. In 2016, the announcement was the introduction of Inphi’s ColorZ, while in 2017 it was news…

Investor Call – Piper Jaffray Optical Event

Andrew Schmitt was the featured speaker on an investor call hosted by Troy Jensen of Piper Jaffray on February 21st. Forty-four participants listened in and posed their questions as Andrew…

China’s 5 Year Optical Component Plan

China’s Ministry of Industry and Information Technology (MIIT) released a five-year plan in December 2017 outlining a roadmap for commercial and technological progress in a broad set of optical technologies. The…

Analysis: 1H17 Cloud and Colo Spending Slowdown

Cignal AI’s recent Optical Customer Markets Report discovered an unexpected weakness in 2017 optical transport equipment spending from cloud & colo operators (see Cignal AI Reports Unexpected Drop in Cloud and Colo Spending). This surprising trend was then further supported by public comments later made by Juniper and Applied Optoelectronics, prompting us to examine the situation in greater detail.

ECOC2017 – Coherent 100G+

ECOC is one of the most significant conferences in optical networking worldwide. This year’s conference was held in Gothenburg, Sweden, and the event was well attended by the engineering community,…

OFC 2017 – Coherent Technology

400G Coherent and Beyond

Ciena had a blockbuster announcement at OFC 2017, but there was plenty of other interesting news to feast on. Cignal AI’s key takeaways concerning coherent…

OFC 2017 – Inside the Datacenter

100G and the Road to 400G

The transition to 100G network speeds inside the data center is underway at every major hyperscale operator simultaneously, creating major industry bottlenecks. Despite QSFP28…

Investor Call – OFC 2017 Takeaways

Andrew Schmitt provided key OFC 2017 takeaways during an investor call hosted by Troy Jensen of Piper Jaffray.

LIGHTWAVE: Inphi to buy coherent DSP developer ClariPhy for $275M

Lightwave quotes Andrew Schmitt in its article regarding the acquisition of Clariphy Communications by Inphi:

Investor Call – China 2017, CFP2-ACO, Coherent DSPs

Andrew Schmitt gave an update on the optical equipment and component market during an investor call hosted by Troy Jensen of Piper Jaffray on Tuesday, October 4. Sixty-eight investors participated….

ECOC 2016 Notes and Observations

Andrew Schmitt presented at the ECOC (European Conference for Optical Communications) in Dusseldorf, Germany during the week of Sept. 19. No time was wasted during the trip as Andrew fit…

Investor Call – China, CFP2-ACO, ROADMs & More

Andrew Schmitt created some excitement when he spoke about optical component and equipment market trends on a Piper Jaffray investor call on April 22. 83 investor clients were on the…

USA Stops All Exports to ZTE

The US Commerce department just dropped a bomb on ZTE, requiring all US companies to obtain an export license if they wish to do business with the company. Article updated…