Each year, there is at least one announcement at OFC which surprises the industry. In 2016, the announcement was the introduction of Inphi’s ColorZ, while in 2017 it was news of Ciena choosing to license the Wavelogic DSP to module vendors. And yet, OFC2018 delivered a surprise that exceeded both: Lumentum will acquire Oclaro.

Industry consolidation is a subject of speculation for the past decade at OFC. These discussions became circular and tiresome after years of no action.

That changed during OFC 2018 as Lumentum and Oclaro, the market’s second and third largest optical component companies, announced their merger. Unlike the mergers in the 2000s, which were examples of the strong consuming the weak, this agreement was more an alliance of choice made by management bent on realizing all of those benefits so many had preached of over the years. The move sparked excitement and new conversations at OFC, and highlights and analysis follow:

Key Takeaways

- Lumentum’s acquisition of Oclaro is a merger of equals if considering only telecom and datacom revenue.

- The perceived product overlap between Lumentum and Oclaro does not take into account the stronger position Oclaro has in 400G InP technology.

- Neophotonics, Fujitsu, and other suppliers may reap incremental benefits from second source activity.

- The acquisition puts Finisar in a defensive position, as it lacks growth product areas and investment when compared to the new Lumentum.

- Finisar has either under-invested in its WSS business or it has poorly executed in this market, and as a result, Nistica is taking market share.

- An Acacia/Oclaro pairing was plausible, but ultimately unlikely given Acacia’s market cap and it’s desire to remain technologically specialized.

- It is likely that the Lumentum move will inspire more horizontal consolidation among component companies.

Lumentum Acquires Oclaro

Lumentum is paying a combination of cash and stock to acquire Oclaro for $1.8B based on Lumentum’s stock price on March 12, 2018. Lumentum ($1126M) has nearly twice the annual revenue of Oclaro ($606M), although both companies’ telecom and datacom component businesses are roughly equal. Therefore, from the perspective of the customers at OFC, it is considered a merger of equals. Lumentum indicated it expects to realize $60M in annual cost synergies from the combination, roughly a 3% improvement in operating margins for the combined entity.

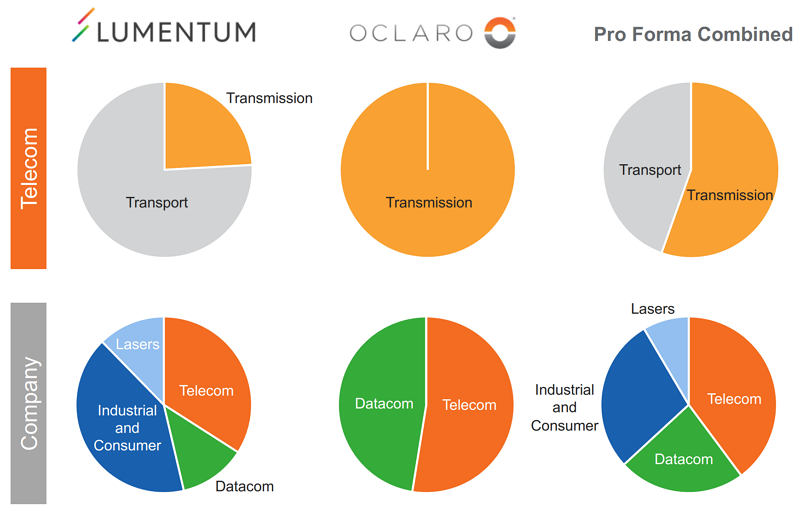

Pre and Post transaction revenue share for Lumentum and Oclaro product lines.

Source: Lumentum

Consolidation discussions in the industry pointed to Oclaro as a prime candidate for acquisition, but Finisar (not Lumentum) was the consensus buyer. Finisar has the least product overlap with Oclaro and therefore such a merger would retain the most value. Lumentum, on the other hand, already had deep expertise in Indium Phosphide manufacturing and high-performance client optics, so the perceived value was less.

So why then did Lumentum pursue Oclaro? First of all, Oclaro’s R&D for the 400G generation of client and coherent optics was ahead of Lumentum’s. Furthermore, Lumentum’s revenue will be distributed equally between three separate end markets – telecom, datacom, and consumer/industrial after the merger. This diversification, combined with the company’s size, will result in a more stable and manageable business; a new entity with total revenue that is greater than previous market leader Finisar.

Impact on Industry

Customers who purchased from both Oclaro and Lumentum may now seek a new second source option. This gives new design win opportunities to Neophotonics and Fujitsu. Vendors of LR4 100G optics and upcoming 400G QSFP-DD designs will also benefit, such as Finisar, Mitsubishi Electric, and Applied Optoelectronics.

Longer term, the impact of Lumentum/Oclaro is less clear. While both Finisar and the new Lumentum have about the same amount of telecom and datacom revenue, Lumentum’s revenue is more concentrated in the latest generation components for 100G/400G, 5G fronthaul, and coherent WDM where Finisar has a higher concentration of legacy 10G revenue.

Investors we spoke with at OFC felt that the new Lumentum will be in a much stronger position than Finisar to grow, and in response, Finisar will need to acquire new products and technology to remain competitive. Multiple equipment vendors also commented that Finisar has either under-invested or has not executed well in the ROADM & WSS space, and consequently Nistica is taking share.

Also, Acacia could have paired well with Oclaro. Customers of Acacia’s brand new DSP are planning to use both its silicon photonics optics solution and Indium Phosphide based optics. Had Acacia combined with Oclaro, it could have offered both options and secured the tunable laser technology it lacks. Acacia + Oclaro has none of the overlap of the horizontal integration of Lumentum + Oclaro (InP, client optics) and brings the benefits of vertically integrating DSP electronics with additional optical technologies.

Horizontal vs. Vertical Integration

Hearing of Lumentum’s bold move, OFC hummed with conjecture about other potential horizontal integrations. Missing from the discussions were vertical integrations – the combining of product lines that share a common application but do not have complementary production and design.

Previous examples of vertical integration include Ciena’s acquisition of Teraxion Indium Phosphide component assets, Cisco’s acquisition of Lightwire silicon photonics and CoreOptics DSP, and Juniper Networks acquisition of Aurrion hybrid silicon photonics technology.

One fact highlighted by many presenters was the staggering cost of 7nm silicon needed to deliver the next generation of coherent DSPs and PAM-4 devices. Arista Networks CTO Andy Bechtolsheim stated that the first manufacturing run of 7nm silicon costs more than $10M, not including development costs.

There are six separate companies developing PAM-4 silicon, all of which will migrate to 7nm next year in order to remain competitive. How will these companies overcome such enormous up-front fixed costs? One possibility is by selling complementary optical technology alongside the PAM-4 DSP – optical technology that few of these companies have today. MACOM has some in-house optical technology, as does Broadcom (acquired from Avago).

Cignal AI spoke with InPhi CEO Ford Tamer about the possibility of his company engaging in an acquisition of optics technology. InPhi is a leader in PAM-4 silicon. Tanner dismissed the combination with the explanation that adding an optics business would not help leverage his company’s fundamental cost drivers, which are fab costs and design software. In this situation, vertical integration does little to improve costs and has no financial synergy. We cannot argue with this logic – and also note it would create a situation where Inphi is competing against its own customers.

Regardless, one must examine the question of whether or not future combinations could yield technical synergy and superior products.

An example of successful vertical integration lies in how Ciena, Cisco, and Nokia designed their own DSPs (rather than purchasing them from a component supplier) and accounted for almost all of the 200G coherent ports shipped during 2017. These companies leveraged investments in DSP chip development to gain the time-to-market and a technology edge.

Another example of successful vertical integration can be found in Acacia’s combining of the coherent DSP with optical module development. Rather than sell only a DSP chip with 70% gross margins, Acacia sells optical modules containing the chip at much higher prices (but lower gross margins), in effect selling a kit of commodity parts surrounding a crown jewel component to gain greater profits. Intel, Broadcom, and others have used a similar approach. These companies record a lower gross margin percentage but collect much more absolute gross margin dollars.

Horizontal integration and vertical integration are very different market strategies which entail unique benefits. Horizontal integration is concerned with saving R&D and SG&A costs, while vertical integration combines technologies to create superior and sustained competitive advantage. After Lumentum’s acquisition, next year the market will probably show us more of both.