400G Coherent and Beyond

Ciena had a blockbuster announcement at OFC 2017, but there was plenty of other interesting news to feast on. Cignal AI’s key takeaways concerning coherent WDM include:

- The outlook for 200G and CFP2-ACO volumes in 2017

- Opinions on Ciena WaveLogic Ai Licensing

- The roadmap review for 400G/600G & Acacia Pico

- Sizing the risk and reward for the 400G ZR market

200G Coherent Ramps Up in 2017

Data center interconnect (DCI) was the first application mentioned at OFC when component vendors presented plans for faster coherent WDM transmission. The desire to meet the needs of the cloud and colo hyperscale customers was cited first and foremost by a number of companies.

This included Facebook and Nokia, which together presented a joint paper on a record-breaking trans-Atlantic coherent transmission, and several component vendors with plans for 400G 80km inter-data center connectivity.

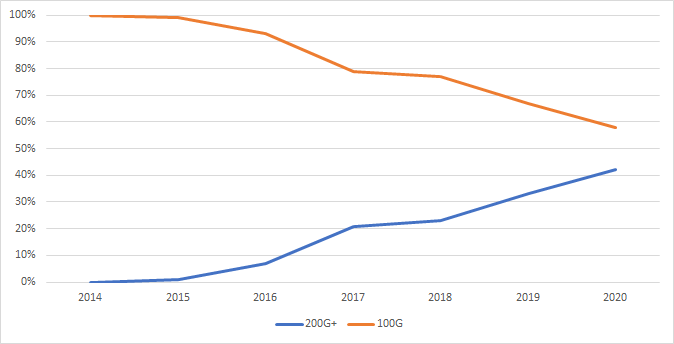

Cloud and Colo customers push the edges of technology harder than other customer segments. Yet Cloud and Colo accounted for only a small fraction of coherent deployments in 2016. Instead, the vast majority of coherent ports were deployed by Chinese incumbent carriers and wholesale, incumbent cable MSO operators in the West. Roughly half of all coherent ports built in 2016 are attributable to just to Chinese equipment makers Huawei, ZTE, and Fiberhome. Despite the buzz around faster 200/400 coherent technology, almost all of the ports shipped last year were 100G.

The market will indeed transition to speeds beyond 100G and this will start with rapid coherent 200G growth in 2017. Ciena and Nokia currently lead the market in 200G deployments, but companies such as ADVA, Cisco, Fujitsu, and Huawei, Infinera are looking to catch up, and they touted their upcoming production rollout of 200G coherent technology. All the expected availability created by a wider component and equipment supply chain will create an inflection point this year in the proportion of coherent ports that are 200G or faster.

Source: Cignal AI Optical Applications Report (1H16)

Cignal AI expects that roughly 40k CFP2-ACO units will reach the market in 2017, and almost all of this will be outside of China. Our conclusion is supported by extensive research and discussions up and down the supply chain.

Huawei indicated that it has no plans to use CFP2-ACO in its OSN 902 system in 2017, due to high prices and low availability. Cisco is a major buyer, and based on the success of the NCS1000 in the market as well as Verizon metro we would expect them to deliver 20-25k ports based on ACO in 2017. The remainder of CFP2-ACO shipments will be made by Ciena, Coriant, Nokia, and Fujitsu. Oclaro remains the only ACO qualified with multiple DSPs from Cisco, Ciena, and Acacia and is still the only vendor that can ship into all applications.

While 200G will be the fastest speed for 2017 production shipments from most vendors, a few select equipment vendors like Ciena and Nokia should be shipping 400G single wavelength coherent technology shortly. Expect multiple component vendors to sample DSPs and pluggable components to the broad market in 2018. The widespread production availability of 400G coherent technology ques up another demand inflection point in 2019. Cloud and Colo customers are the early adopters, but volume from the broader market will arrive 6-12 months later.

Key Takeaways:

- Cloud and Colo operators, despite being a fraction of the market, have captured the attention of the market. They are the first to deploy the latest technology and are comfortable switching vendors back and forth to obtain it.

- All of the necessary pieces for successful 200G growth in the West are in position in 2017. The majority of these ports will be ACO-based, with the exception of Infinera’s PIC approach.

- In 2017, 400G coherent ports will be limited to two vendors, with demand limited to Cloud and Colo operators and perhaps fiber constrained Cable MSOs.

Ciena’s WaveLogic Licensing

Each year, every OFC has one blockbuster announcement – one that sparks discussion and debate in the show aisles, session hallways, and during client dinners. This year, that announcement was made by Ciena. The company struck deals with three component vendors – Oclaro, Neophotonics, and Lumentum – to sell its WaveLogic 400G DSP in order to manufacture and sell optical modules to the broad market. These three vendors are working to commercialize the Wavelogic Ai as a standard product and they expect to sample 5×7 modules at the end of 2017 (though different sources provide different timelines on this). The three companies will be unrestricted by Ciena and may sell these modules to anyone, including Ciena competitors and network operators desiring to build white box equipment.

On paper, Ciena has an impressive product; a 400G 56 Gbaud solution that has evolved from a long history of DSP development. Ciena will itself bring equipment using the DSP to market in mid-2017. Some observers at OFC noted that the Ciena module solution would reach the broad market at the same time as new DSPs from NTT Electronics, Acacia, and InPhi arrive. But there are distinctions between Ciena’s product and the others. It will be earlier to market with silicon, and its 1Q18 platform should already have six to nine months of testing and debug time, while the other solutions will be just reaching the lab for the first time.

The long-term implications of Ciena’s announcement fueled enormous debate among OFC attendees, and definite conclusions were elusive as such a range of opinion gave no ground for consensus. One area where people agree – there does not appear to be a significant downside for the parties involved. But it just isn’t clear where the design wins will originate – Ciena intends to win share in China, yet much of the country is moving to CFP-DCO, a format which is not supported by the announcement.

Still, component vendors welcomed the entry of such a credible DSP veteran to the market, as Ciena’s arrival helps ensure a competitive marketplace. Also, 400G WaveLogic Ai DSP is just the beginning of a new relationship between Ciena and its three module partners. Given the conversations we had with them, we expect they will continue their collaborations together for other developments in the future.

Key Takeaways:

- Ciena anticipates having in-house WaveLogic Ai hardware in mid-2017. If this is the case, it should have a solid 6-9 month lead on Acacia and others.

- It is very difficult to predict how the WaveLogic Ai product will be accepted. The best users for the product look to be China LH WDM markets, IPoDWDM at Arista & Juniper, and Cloud and Colo white boxes.

- We believe Infinera should consider licensing the PIC for IPoDWDM applications that don’t compete with its core transport business.

- Ciena has a long-term gain in mind as it lines up a supply chain for the DSPs to follow the WaveLogic Ai.

600G Coherent

OFC 2017 had multiple announcements pertaining to the advancement of 400G and beyond. It was concluded that 600G is the maximum speed suppliers are targeting for the next generation.

600G speed is the product of combining two optical polarizations of 64 Gbaud signals with 64-QAM modulation, bringing eight potential symbols per transmitted bit. This yields a staggering raw data rate of 768Gbs, and after removing a 28% over speed for forward error correction, this becomes an effective data rate of 600G. Though working details are scarce to come by, the effective reach of this speed is expected to be short; around 100km or so.

Both Neophotonics and Fujitsu are in the 600G game, and they announced discrete components and ACO modules designed to support coherent transmission at this speed. Initial designs use Lithium Niobate, which is the highest performing material technology for modulation, though the companies plan to transition to InP using more photonic integration. Other companies, such as Oclaro, Elenion, and Lumentum, which all had previously announced 400G capable components, are also working to even faster speeds and higher levels of monolithic design in InP or Silicon Photonics.

Acacia announced an exciting milestone. It developed new packaging techniques for its silicon photonic integrated circuits (PICs) by leveraging conventional ball-grid-array (BGA) semiconductor technology used in traditional semiconductors. Acacia’s announcement hints at the possibility of the PIC being co-packaged with the DSP silicon itself, which should improve density, performance, and manufacturability.

Acacia also presented its roadmap for its coherent DSP – dubbed ‘Pico.’ It is a beast of a chip, providing a 2x600G DSP dual wavelength WDM interface and support for client interfaces on board, and essentially creating a full optical transponder line card on a chip. Acacia did not provide guidance on its DSP availability.

ADVA announced a future product based on Acacia’s DSP – Teraflex – that it expects to sample to customers by the end of 2017. Several other equipment OEMs at OFC expressed interest in Acacia’s DSP and appeared impressed with the device’s proposed capabilities.

Key Takeaways:

- Ciena and Nokia have a six-month lead on Acacia arming the industry with single wavelength 400G technology, depending on execution of course.

- Acacia is planning to sample DSPs by the end of the year, and InPhi (Clariphy) likely has something coming as well. Acacia is widely perceived as a technology leader among equipment vendors and an aggressive investor in new markets & technology. Acacia also already has several major OEMs committed to using the Pico chip.

- ADVA felt compelled to pre-announce a new product by nine months, which is not typical for the company. We’re not sure what to make of this.

Metro DCI – 400G ZR

While OFC offered no specific announcements regarding the ongoing development of the OIF 400ZR (80km) specification, it is clear that component makers are focusing on delivering products. The OIF 400ZR (80km) specification is designed to bring full vendor interoperability to coherent interfaces for reaches up to 80 to 120 km, at speeds up to 400G, makes the technology available in multiple form factors. Coherent interoperability has been an elusive feature in the market, but its need is increasing in the metro as different equipment types are more likely to be interconnected.

The desired form factor that hyperscale operators such as Microsoft are looking for is a DCO pluggable that can occupy the same socket used by short reach client interfaces – QSFP DD or OSFP (the extensive debate on these interfaces is detailed here).

The incorporation of coherent 400G technology into DCO modules as compact as these will push the limits of technology, particularly in regard to DSP power consumption. Vendors are also hesitant of the high cost of developing the required 7nm DSP silicon.

A simple thought experiment illustrates the dilemma DSP developers face. These are rough guesses, to be sure, but the business case remains tough.

- Microsoft is expected to purchase roughly 40,000 100G 80km or less links from InPhi in 2017.

- Assume the entire Hyperscale market is approximately 3x Microsoft.

- Assume bandwidth needs grow 50% per year for next 3 years

- In 2020, that would translate into demand for 135,000 100G ports at Microsoft or roughly 35,000 400G ZR ports. This would suggest 100,000 400G ports for the entire hyperscale market in 2020.

- Assume development costs $50M per supplier and that there are three suppliers involved – a total development cost of $150M.

- If the DSP was sold at $500, it would take 3 years of Cloud and Colo revenue to just match the upfront investment costs for all three suppliers.

Clearly, this is not a race you want to finish in third place.

With these sorts of economics in mind, component vendors turn with hope to the hyperscale computing customers, such as Microsoft and Google, to help shoulder the cost to develop. Ciena and its partners might also license a 400ZR chip. Bottom line, a company simply cannot make an investment of this size and not end up as the #1 or #2 supplier if it is to make a profit – the economics of the scenario just don’t work.

Key Takeaways:

- Component companies are wrestling with the needs of the hyperscale market and the economic realities of the 400G ZR.

- Consequently, risk management for 400G ZR development is crucial, as is a plan to extract maximum gross margin dollars from the investment.

- The market outside of Cloud and Colo applications is a low-cost 100G coherent pluggable. This technology is needed to allow a migration from 10G at the edge of the network. Low cost 100G pluggable coherent as a replacement for 10G is the market that can change the math.