OFC21: Co-packaged Optics

Co-packaged optics (CPO) moved from hero experiments to discussions of commercial roadmaps this year. In this update from OFC21, we cover the key points about CPO discussed at the show.

3Q18 Optical Applications Report

Cignal AI’s 3Q18 Optical Hardware Applications Report has been issued.

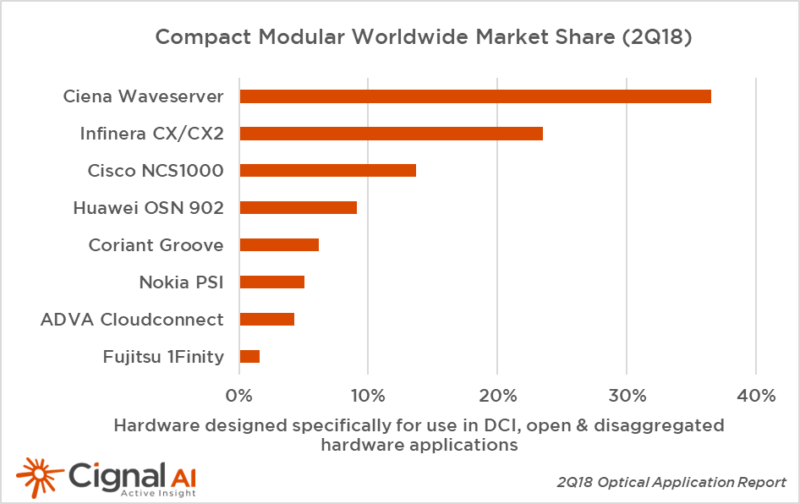

2Q18 Optical Applications Report

Cignal AI’s 2Q18 Optical Hardware Applications Report has been issued.

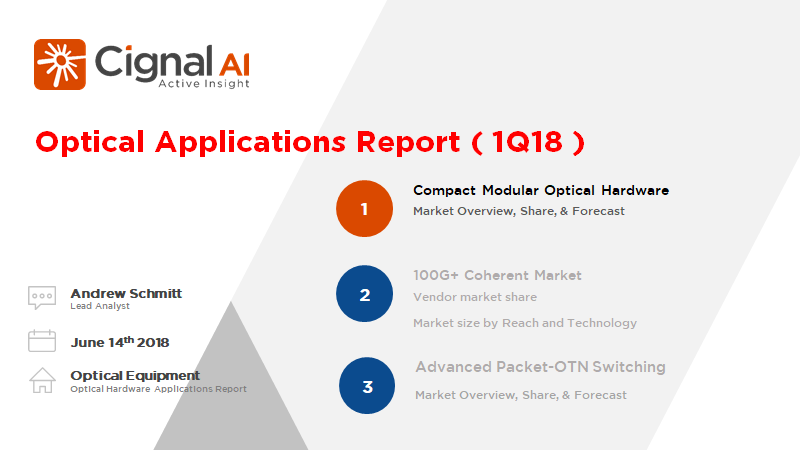

1Q18 Optical Applications Report

Cignal AI’s 1Q18 Optical Hardware Applications Report has been issued. Its arrival marks the first quarterly release of this report, which will now be standard practice; previously the report was published every six months.

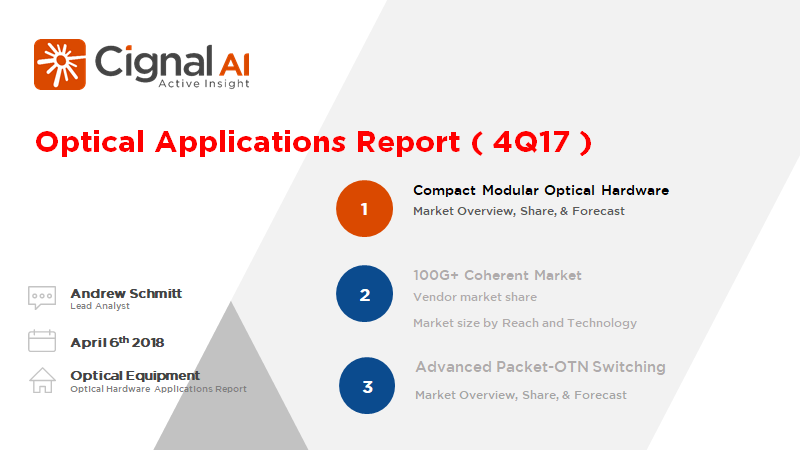

4Q17 Optical Applications Report

The 4Q17 edition of the Optical Hardware Applications report has been released. The report contains details on the following areas:

1H17 Optical Applications Report

Our 1H17 edition of the Optical Hardware Applications report has been released.

OFC 2017 – Compact DCI Equipment

In our final OFC 2017 report we discuss new product announcements on purpose-built datacenter hardware and components, and share our thoughts on market developments.

Ranovus Announces Worlds First 200G Direct Detect Tranceiver

Ranovus announces a new direct detect solution in CFP2 DCO format, joining InPhi in offering solutions to the DCI marketplace.

4Q16 Optical Hardware Forecast

On February 27th, Cignal AI issued full optical equipment market share analysis for 4th quarter 2016 (4Q16). This second report, issued on March 9th, extends our analysis and summarizes forecasts and outlooks for the industry through 2021.

Investor Call – China 2017, CFP2-ACO, Coherent DSPs

Andrew Schmitt gave an update on the optical equipment and component market during an investor call hosted by Troy Jensen of Piper Jaffray on Tuesday, October 4. Sixty-eight investors participated….