In our final OFC 2017 report we discuss new product announcements on purpose-built datacenter hardware and components, and share our thoughts on market developments.

- Evolution of the compact DCI market, including recently published 4Q16 market share and adoption by new customers

- New products and solutions, investigating announcements by Nokia, Fujitsu, and Juniper

- Direct detect – one year later, the appearance of Ranovus, and network operator of the technology’s long term prospects

Evolution of Compact DCI

Spending by cloud and colo network operators – particularly hyperscale datacenter companies – is now the fastest growing source of capex for computing and networking equipment. The needs of these network operators redefined hardware architectures for computing, storage, and networking over the past decade. As these architectures were implemented, the supply chain felt a ripple effect as the operators pursued the white box model and built much of their own equipment.

Equipment vendors that did not adapt to customers’ hyperscale needs lost the opportunity to serve this market. Optical transport equipment companies, wanting to avoid the same fate, learned from this example and instead proactively architected and delivered products that were precisely designed for connecting large-scale datacenters, creating a new hardware category.

This new market is known as Compact DCI. Cignal AI was the first research firm to identify and track this new market segment and we provide detailed market share and forecasts in our Optical Applications Report. Platforms in this category embrace the “rack-and-stack” model preferred by cloud and colo operators because it allows them to quickly scale out new equipment and thereby more easily build and manage large networks.

| Compact DCI Platform | Introduced |

| Infinera Cloud Xpress | Sep ’14 |

| Ciena Waveserver | May ’15 |

| ADVA Cloudconnect | Jun ’15 |

| Fujitsu T-Series | Aug ’15 |

| Cisco NCS 1000 | Nov ’15 |

| Coriant Groove G30 | Dec ’15 |

| Huawei OSN 902 | June ‘16 |

| Nokia PSI-2T | March ‘17 |

Source: Cignal AI, Optical Applications Report (2H16)

It’s no longer just about DCI though. In 2017, more traditional operators are exploring this format to determine if they can achieve more flexible networks by coupling these Compact DCI transponders with open line systems and open ROADMs. AT&T, NTT, and several cable MSOs are among those investigating this format right now.

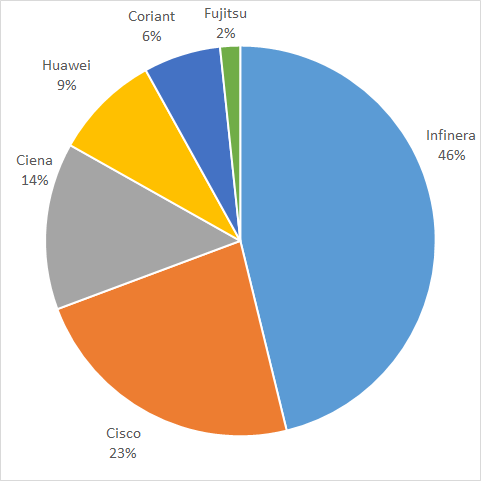

Compact DCI Hardware Share (4Q16)

As the Compact DCI market gained traction, Infinera had an early lead. Now that this sector represents most of the growth in the WDM transport market, it has attracted other vendors – and they are gaining sales. Cloud and colo operators couldn’t be happier to have such an eager group of suitors – it keeps the market competitive and technically advanced. These customers leverage their buying power over the Compact DCI providers; they are not afraid to change suppliers more rapidly than traditional incumbent operators. As a result, this segment will have more volatile market share shifts than other segments.

Key Takeaways:

- Advocates for whitebox optical hardware overlook that an entire hardware ecosystem has evolved to give cloud and colo operators exactly what they want. The initial conditions that led to whitebox servers and Ethernet switches don’t exist in the optical market. It is foolish to extrapolate the success of this model in one market into another.

- There is deep interest among traditional operators in compact DCI, so much so that the term “Compact DCI” is misleading – this hardware can be used very well in non-DCI applications.

- Market share for this category will shift much faster than other optical markets as the customer mix is more fickle, and switching suppliers is easier when you have a disaggregated hardware deployment model.

Expanding the Compact DCI Market

Compact DCI commanded many announcements and activities during this year’s OFC. Nokia jumped into the mix by taking its production-grade coherent technology from its traditional PSS chassis-based transport system and incorporating it into a compact DCI chassis. The resulting PSI-2T has an impressive 250G of capacity per wavelength and provides a total of 1T of coherent transport. Nokia’s move puts it into good company with Cisco, which is already shipping 250G per lambda capability in its NCS1000. Yet, other vendors, such as Ciena with its Waveserver Ai, are already looking ahead to 400G.

Compact DCI is not a strategic focus for Juniper Networks. Instead, it chooses to offer coherent transport to its established customers, most of which are more traditional operators. Juniper announced a 1.2T coherent line card that fits into its QFX10000 L2 Ethernet spine switch. This is not a Compact DCI platform, but it is worth noting in that it is the first instance of high density coherent transport being made available in the datacenter switches itself. Juniper also announced a new 2x200G line card upgrade to its 7800 optical transport system, originally built by BTI Systems (acquired by Juniper) which had a long history of supplying cloud and colo operators.

Fujitsu presented several new DCI advancements during OFC. It expanded its 1Finity line of compact DCI products with the T400, providing high density 10GbE to 100GbE aggregation to feed existing T-series T100 and T300 coherent transport platforms. The T-series is just one of several compact DCI functions made by Fujitsu including ROADMs (L-series) and L2 switches (S-Series). Fujitsu introduced the C200, a new controller card designed to virtualize of disaggregated hardware by allowing operators to control Compact DCI systems, Open ROADMs, and open line systems. As a major supplier to large incumbent operators, Fujitsu is in a unique position to bring the benefits of compact DCI to these more traditional markets.

Key Takeaways:

- Fujitsu is re-positioning the company to enable traditional operators to adopt a new hardware disaggregation model. The company is uniquely positioned to execute this strategy given it’s strong ties to Incumbent operators. It is also refreshing to see such a large company attempt such a change – but Fujitsu was faced no choice given its key customer base was eroding.

- Juniper is pursuing the transport market with incremental steps and not trying to compete head on with incumbent vendors. The company can leverage open line systems from other vendors and offer point products integrated with it’s area of strength – switching and routing. But Juniper would need to make an acquisition to be a significant optical supplier. Outside of Juniper and Arista, no suitors for constructive optical consolidation exist in the equipment market.

- Nokia is one of the largest providers of hardware to the cloud and colo sector and we’re surprised it took them this long to join the compact DCI club. They lead the market in 200G port volumes and should have some success here.

Direct Detect One Year later

Hands down, Ciena’s DSP announcement stole the show at this year’s OFC. One might remember that just one year ago at OFC 2016, it was InPhi who caused the big ruckus. InPhi, in conjunction with Microsoft, announced the ColorZ, a QSFP28 form factor module providing up to 80km of reach. ColorZ allows existing pluggable ports that are designed for short reach clients to span much larger distances, thereby altogether eliminating the need for standalone compact DCI chassis. Recall that the design specifications for the controversial OSFP were developed to accommodate a similar application for coherent 400G.

Now, InPhi is beginning to make good on ColorZ’s promises. It shipped several thousand units of ColorZ in 4Q16, and will ship more as the product is currently ramping up for its lead customer, Microsoft.

On other fronts, Ranovus emerged to announce a 200G CFP2-DCO based on Direct Detect. Its product is a non-coherent, less expensive alternative to the Acacia coherent CFP2-DCO and is suitable for applications in which less performance is required. It also has greater spectral efficiency than the Inphi ColorZ. It is undergoing trials now, and is expected to be in production by mid-2017. Ranovus’ 200G CFP2-DCO is based on quantum dot laser technology, and we anticipate that it will have some interesting applications for other areas in the future.

Direct detect has some downside. It requires complex optical link engineering to function, particularly for longer distances. Two vendors, ADVA and Coriant, made announcements regarding their intent to remove the inherent operational complexity in Direct Detect. ADVA announced that it is shipping an open line system (OLS) that includes features for operators who wish to deploy ColorZ in existing equipment (ADVA did not, as some have mis-reported, go so far to say that it is selling the ColorZ with its systems.)

Meanwhile, Coriant demonstrated an OLS in conjunction with InPhi’s ColorZ and Dell/EMC as part of its Groove G30 Compact DCI platform. Both ADVA and Coriant’s open line systems support open optical networks.

Key Takeaways:

- It remains difficult to get a clear perspective on ColorZ for 2017. One equipment company indicated they are shipping more coherent systems than planned as the ColorZ isn’t ramping and performing as expected for long reaches. We also recently spoke with a large DCI operator (not Microsoft) who says the product is not meeting its initial reach expectations. We have not changed our forecasts for 2017 but continue to seek direct operator feedback.

- Long term, direct detect faces adoption challenges outside of large DCI customers. Coherent technology has spoiled operators with its ease of deployment. When 10G links in the metro at traditional operators are upgraded to 100G, these new wavelengths must operate on the same existing links. Current direct detect technology is not capable of doing this.

- The endgame remains 400G ZR coherent technology which should be compelling vs. direct detect in 2020 for DCI. A lower speed 100G variant of this technology will offer traditional operators an upgrade path from 10G. The lifetime for direct detect will be limited until pluggable 400G ZR products reach market.