3Q23 Optical Components Report

Datacom revenues are recovering from the Q1 drop and are poised to explode along with 800GbE shipments in 2024. Telecom revenue continues to lag, as deployed bandwidth declined YoY for the first time this quarter.

2Q23 Optical Components Report

Datacom revenue and module shipments plummeted as inventory adjustment hit hard this quarter.

1Q23 Optical Components Report

Datacom revenue and module shipments plummeted as inventory adjustment hit hard this quarter.

4Q22 Optical Components Report

Datacom and Telecom revenue was up for the year, but headwinds are pushing down forecasts for both revenue and shipments in the first part of 2023.

Optical Components – 4Q22 Preliminary Report

The Optical Components report is expected to release in mid-April. In the meantime, this interim report provides an overview of how quarterly results are trending.

3Q22 Optical Components Report

400GbE shipments recovered from last quarter’s dip leading to a strong revenue quarter for Datacom. Telecom optical component revenue grew as more than 61k Gen60C modules shipped in the quarter.

2Q22 Optical Components Report

Pluggable 400Gbps optics continues to drive Telecom bandwidth as operators migrate away from lower speeds. Datacom component shipment growth slowed this quarter, but revenue for Datacom is still growing faster than in any other optical segment.

1Q22 Optical Components Report

It’s all about the supply chain again this quarter, but signs point to gains in the second half of the year. 400GbE datacenter optics and 400Gbps pluggable telecom optics are driving their respective segments.

4Q21 Optical Components Report

This inaugural report commences Cignal AI’s complete coverage of Optical Components, including both revenue and detailed component shipments.

3Q21 Optical Components Report

Initial Optical Components report, in Beta – for access to the report, please contact [email protected].

OFC2019 – 5G and MSO Access

5G mobile technology and the cable/MSO initiative Fiber Deep are generating interest in new and unique optical networking solutions

OFC2019 – Inside the Datacenter

The next major stop on the road to faster speeds in the datacenter is 400Gbps Ethernet, and activity at OFC2019 centered on making this speed a feasible commercial option.

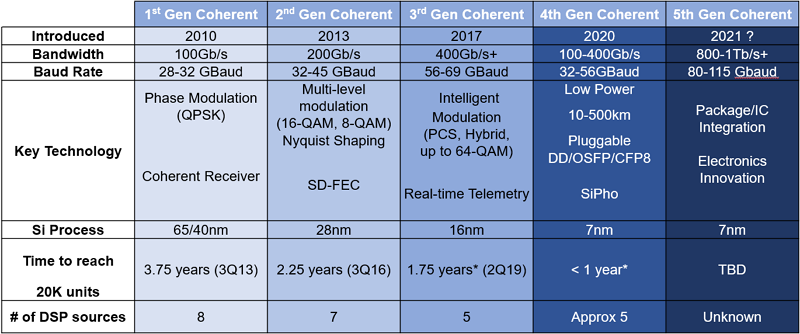

OFC2019 – Coherent Technology

Coherent announcements and roadmaps at the show focused on two themes: lowering the power of coherent technology for use in pluggable applications and increasing baud rates to raise the maximum capacity of a single wavelength beyond 600Gbps. And despite few new ROADM announcements, there was a spirited debate about future ROADM architectures.

OFC 2019 Preview and Predictions

The 2019 Optical Fiber Conference is less than a month away. Cignal AI’s analysts have compiled a list of predictions and expectations for what we expect to see from vendors and other OFC participants.

400ZR – The 4th Generation Coherent Opportunity

The arrival of standardized, pluggable 400ZR and derivative technologies – fourth generation coherent – is poised to be the most disruptive event in optical hardware since the advent of coherent 100G in 2010.

II-VI to acquire Finisar for $3.2 billion

Lightwave summarized the acquisition of Finisar by II-VI and requested commentary from Cignal AI.

2018 SCTE Cable-Tec Expo: Key Optical Topics

The SCTE Cable-Tec Expo is the premiere technical trade show for North American Cable MSOs and has historically been oriented towards software, analog hardware, outside plant, and HFC-specific equipment. This year a greater number of prominent optical companies joined in. Factor such as fiber deep, native optics, 5G, and virtualization are driving optical deployments into the MSOs.

Packet Pushers Hosts Cignal AI

Andrew Schmitt was invited by Packet Pushers and Scott Wilkinson of ECI to participate in one of its weekly podcasts. While not well known in the service provider world, it is popular among the network engineers of small to large Enterprises. Each podcast has about 10,000 downloads per episode.

OFC 2018 – 400G Inside the Datacenter

When the conversation at OFC turned to short reach client optics, faster speeds were the central focus. Several companies announced products and gave demonstrations of 400G capable technology. The 100G…

OFC 2018 – Coherent Technology

Trends in coherent technology generated enthusiasm among the participants at OFC 2018, and 400G ZR applications were of particular interest. Nokia and Infinera outlined next-generation coherent roadmaps, and Acacia and…