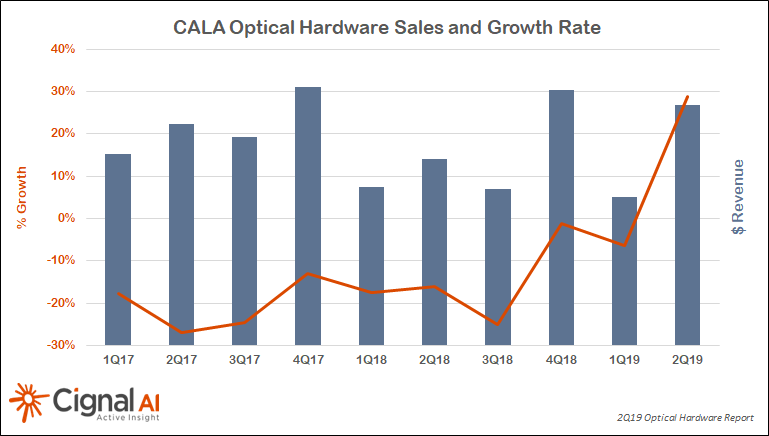

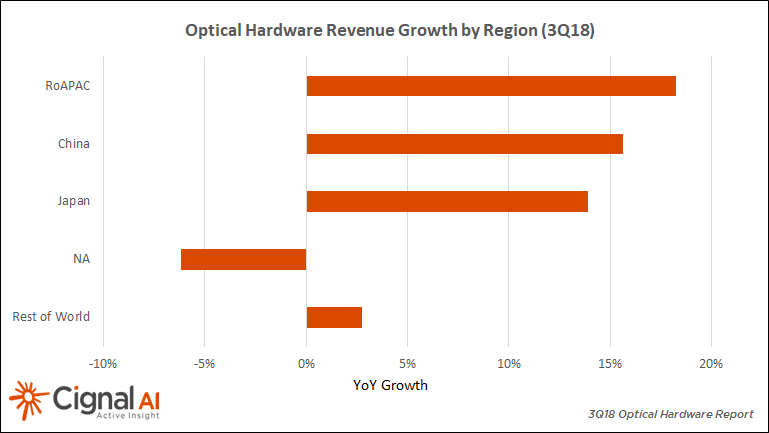

Growth Returns as Optical Hardware Spending Increases in Every Region

Optical hardware spending grew in every region and for every business segment during 2Q19.

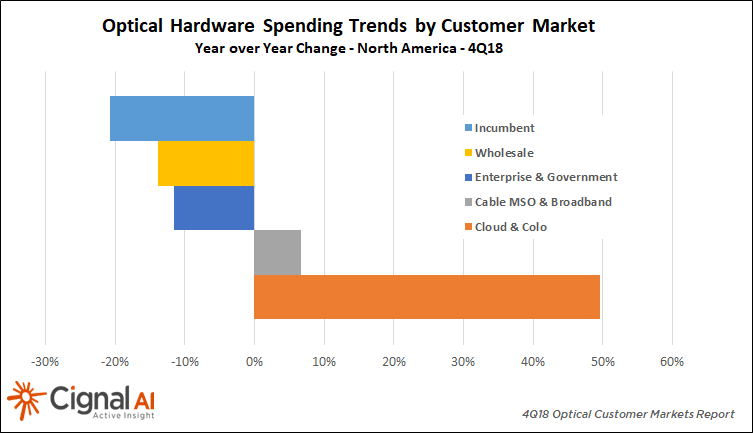

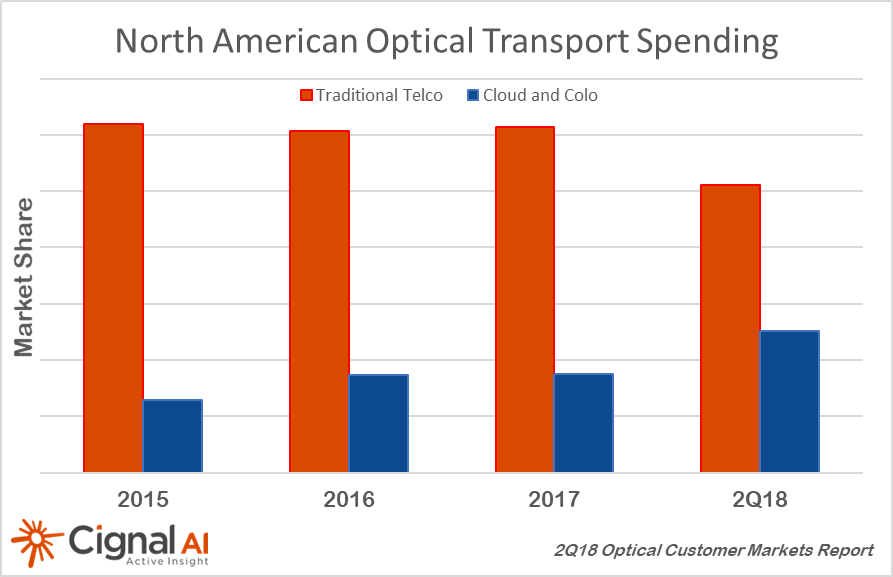

Cloud and Colo Optical Hardware Spending Increases by 50% in North America

Cloud and colo operator spending on optical communications hardware continued to spur market growth in the first quarter of 2019.

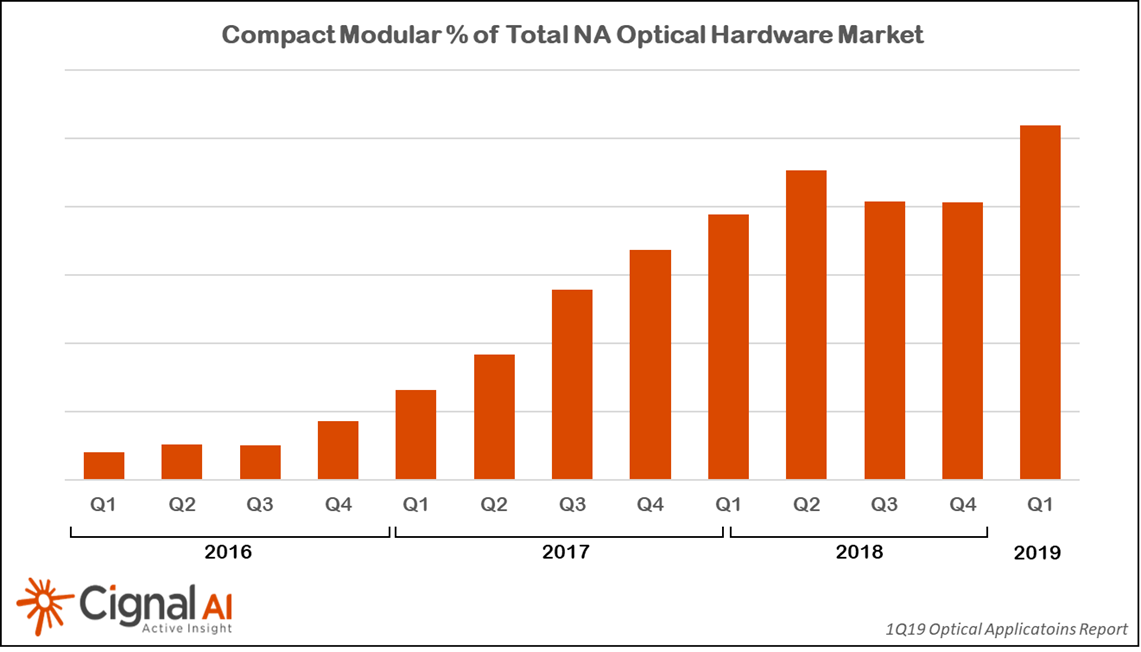

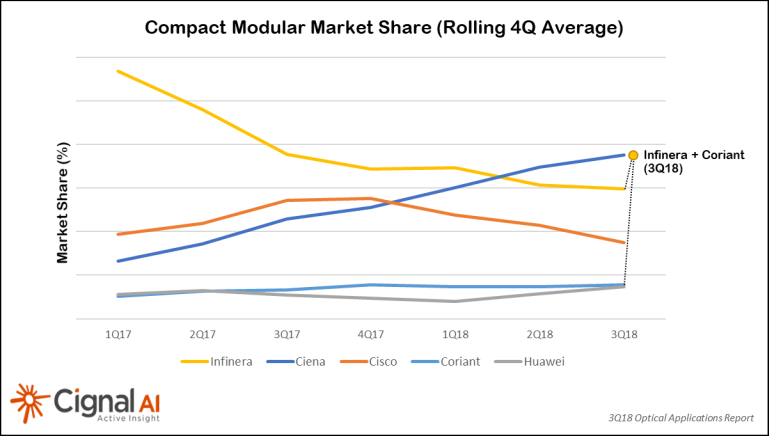

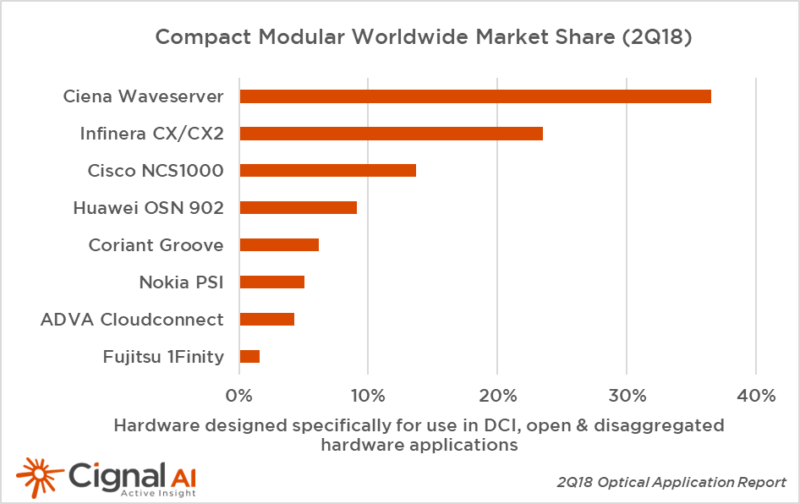

Compact Modular Optical Sales Expand, Reaching Over $275M

Compact modular optical hardware is being used in more network applications than ever before, driving up sales during the first quarter of 2019 as reported in the latest Optical Applications Report from market research firm Cignal AI.

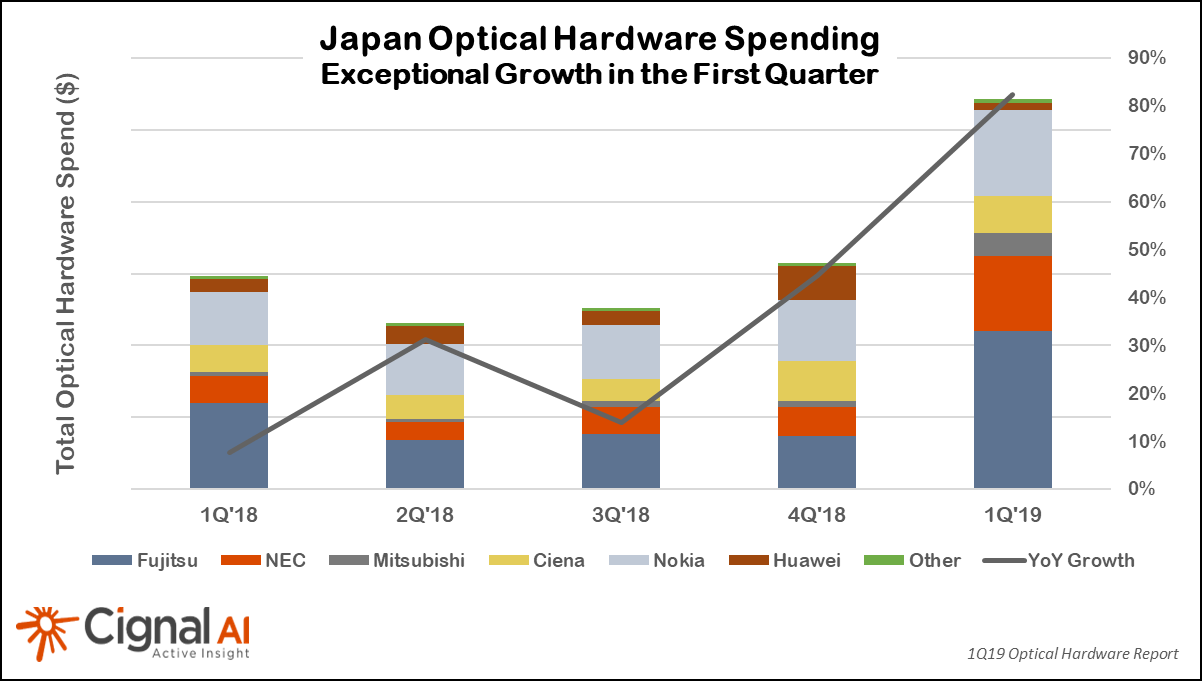

Optical Hardware Spending Growth Surges Over 80% in Japan

Japan’s optical hardware spending surge continued for the fourth quarter in a row with an extraordinary 82% year-over-year increase in the first quarter of 2019.

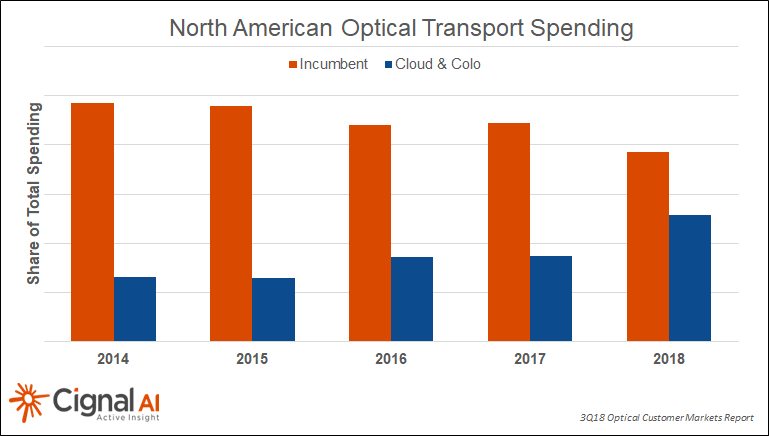

Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

Cloud operator spending on optical hardware grew almost 50 percent year-over-year to reach well over over $1 billion in 2018, according to the most recent (4Q18) Optical Customer Markets Report from research firm Cignal AI.

Long-Haul Deployment Growth Sets Stage for Increased Spending in 2019

Long-haul WDM deployments rebounded in the fourth quarter of 2018 (4Q18) with growth of nearly 20 percent, fueled by a reversal of almost two years of a terrestrial spending decline in North America and a year-over-year surge in Japan.

2018 Cloud and Colo Optical Equipment Spending Will Exceed $1.4 Billion

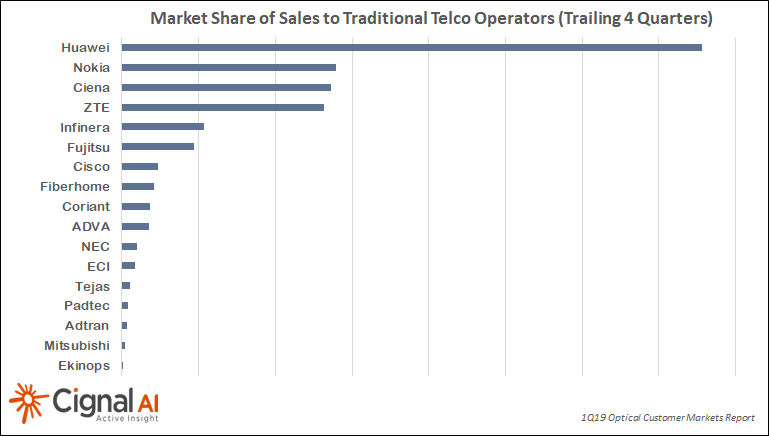

Incumbent operator spending in Asia remains strong and now represents 35% of all optical hardware spending worldwide according to the 3Q18 Optical Markets Report.

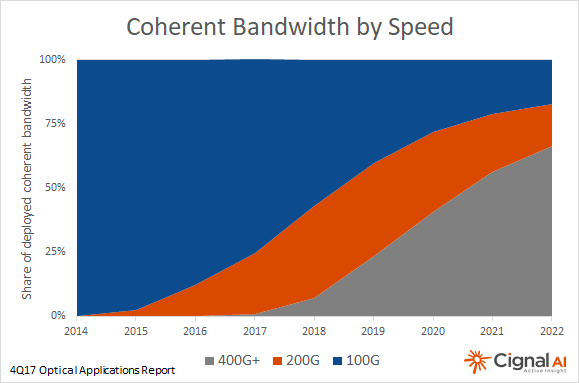

200G to Capture Over a Quarter of Coherent WDM Market in 2018

Infinera + Coriant Challenge Ciena for Compact Modular Market Leadership

Cignal AI Increases Forecasts for Asia Based on Strong 3Q18 Results

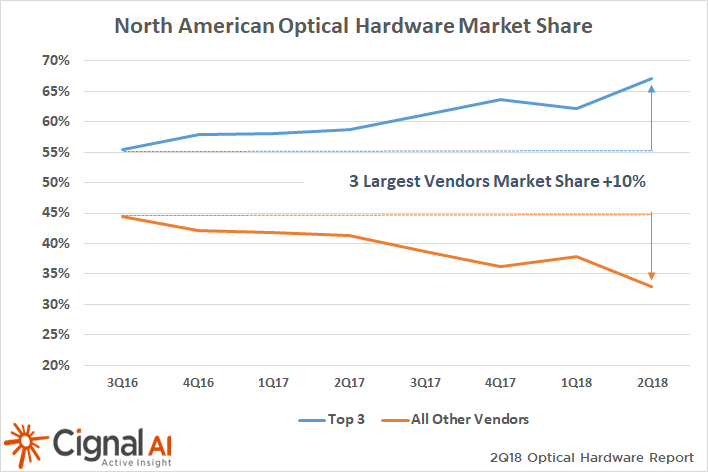

Optical Hardware Report Shows 8th Consecutive Quarter of Spending Declines in North America Despite Strength of Cloud and Colo Market

Cignal AI Reports Record Cloud and Colo Optical Hardware Spending

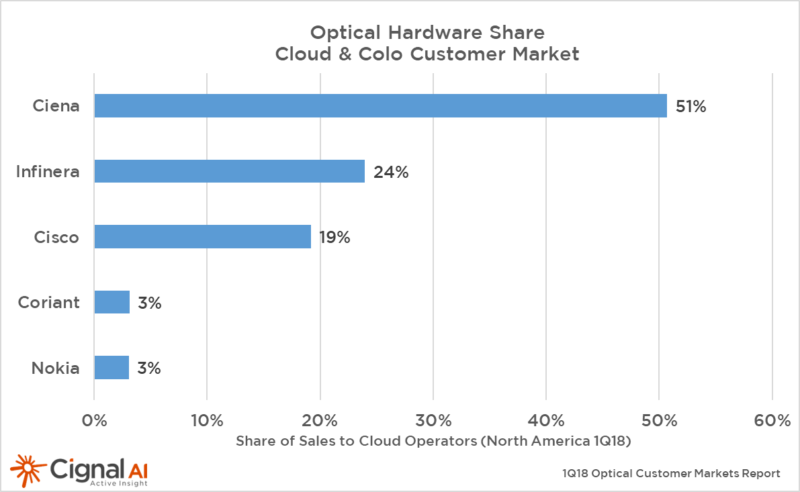

Ciena Leads Sales to North American Cloud/Colo Operators as Spending Increases 6 Percent Quarter-Over-Quarter; Huawei Sees Strong Demand from Chinese Cloud Giants

Cignal AI Welcomes Scott Wilkinson as Lead Analyst for Optical Hardware Segment

Addition Will Expand Coverage of New Applications for Optical Hardware and Custom Research Capabilities

Compact Modular Optical Equipment Market on Track to Break $1 Billion in 2018

Cignal AI Raises CY18 200G and 400G Coherent Forecasts

Cignal AI Reports 2Q18 EMEA Optical Spending Offset Weakness in North America

Huawei Reports Record Revenue in China During ZTE Shutdown

Cable MSO Spending Increases Sharply in North America

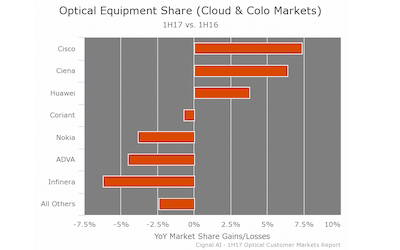

Ciena and Infinera Continue to Take Share in Cloud Market

Cignal AI Increases 100G Forecast as Low-Cost Pluggable Module Demand Expected to Soar in 2021

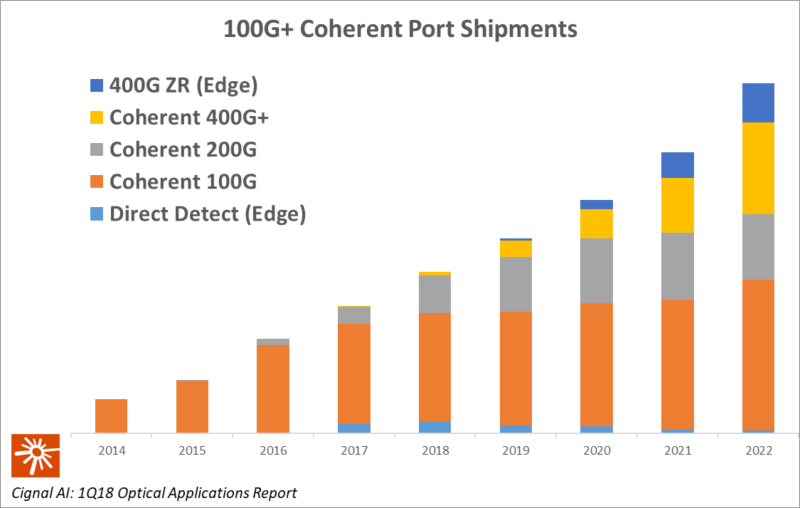

Optical Applications Report Provides In-Depth Analysis of Coherent Port Shipments by Speed

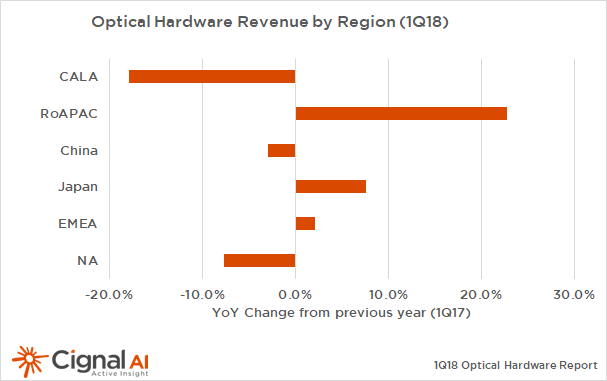

Optical Hardware Spending Grows in Europe, Asia Pacific in 1Q18, While North America Falls Flat

Cignal AI Enhances Quarterly Optical Hardware Reports with New Market Tracker Offering Real-Time Visibility into Individual Vendor Results

Cignal AI Increases 400G Forecast, Citing Flexibility of Technology and Expanding Applications

Compact Modular Optical Hardware Outpaces Projections as Adoption Extends Outside Cloud and Colo Customers

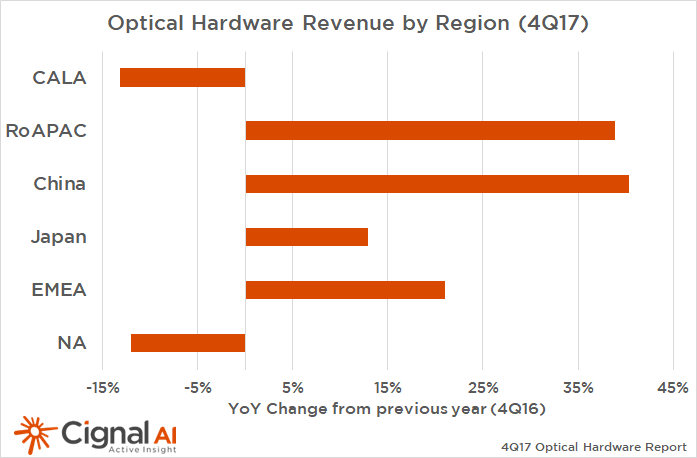

2017 Optical Hardware Spending Ends on High Note in APAC and EMEA

Cignal AI Quarterly Optical Hardware Report Also Reveals Lower-than-Anticipated North American Sales

Cignal AI Cuts 2018 EMEA Forecasts in Optical Hardware Report

Quarterly Shipments of Coherent 100G+ Ports Exceed 100,000 Units for the First Time

Cignal AI Reports Unexpected Drop in Cloud and Colo Provider Spending

Optical Customer Market Report Finds Ciena and Cisco Outperforming Peers in Cloud & Colo Market