Optical Applications Report Provides In-Depth Analysis of Coherent Port Shipments by Speed

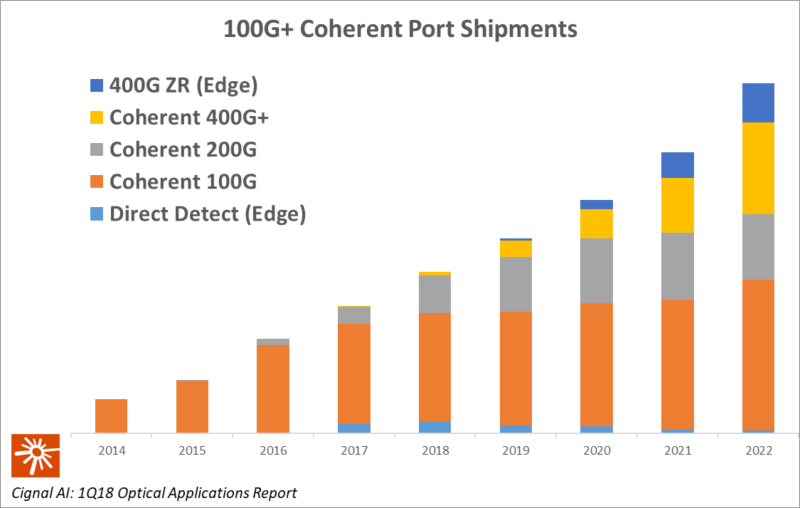

BOSTON (July 10, 2018) – Networking component and equipment market research firm Cignal AI has increased its coherent 100G market forecast for 2021 and 2022. The recently released 1Q18 Optical Applications Report noted that the uptick results from vigorous demand for low-cost 100G pluggable coherent modules as operators seek an affordable upgrade path for 10G WDM in the metro network edge.

New applications, such as 5G fronthaul/backhaul and Cable remote PHY will catalyze this demand. Also, compact modular equipment will account for half of all metro WDM spending in North America by 2021. The report underscores the importance of this product category as an enabler for network operators to implement more flexible, disaggregated network architectures.

1Q18 Optical Applications Report Press Release

New in the Optical Applications Report is a deeper analysis of coherent port shipments, with a detailed break out of equipment vendor market share by speed (100G, 200G and 400G). This follows recent enhancements to the forecasts for these speeds, including projected 400G ZR shipments.

“Starting this year, 400G speeds will be the primary source of growth in the optical equipment market,” said Andrew Schmitt, lead analyst for Cignal AI. “However, there will be a significant turning point in 2021/2022, when new, low-cost 100G pluggables open up markets for coherent technology at the edge of the network.”

These findings, and more, are detailed in Cignal AI’s Optical Applications Report, which is released quarterly. The latest edition updates market share for the first quarter of 2018 and provides forecasts in three key markets: 100G+ coherent WDM port shipments, compact modular equipment and advanced packet-OTN switching hardware.

Other key findings in the 1Q18 report include:

- Compact Modular Hardware Forecast Rises – Initially used by cloud vendors such as Google, Microsoft and Amazon, compact modular hardware is increasingly being adopted outside of that sector. Cignal AI raised this forecast in the past, but accelerating demand, even by traditional operators like NTT, has required yet another recasting of this segment.

- Ciena and Cisco Lead Market – Ciena emerged as the leader in the compact modular segment for the first time in 1Q18, and is expected to remain at the top because of its strong position in 400G. Cisco was the leader in 200G coherent shipments for 2017.

- Reduced 400G ZR Forecast – The forecast for 400G ZR modules in 2020-2021 was slightly reduced because the product’s performance will limit adoption outside of the three large cloud vendors during the first two years of availability.

- North America Packet-OTN Losing Share – Cignal AI cut long-term forecasts for packet-OTN switching in North America, while increasing it in EMEA. The incumbent operator market vertical in EMEA continues to adopt these systems. However, interest in North America is scarce, as evident in the lack of design wins in the region for newer advanced systems, such as Cisco’s NCS4000, Nokia’s PSS-24x and Coriant’s mTera.

About the Optical Applications Report

The Cignal AI Optical Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, and compact modular and advanced packet-OTN switching hardware. Deliverables include Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report features revenue-based market size and share for the hardware categories, and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Inphi, Juniper Networks, NEC, Nokia, NTT Electronics (NEL), Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details are available, and active clients who register an account can download articles and presentations.

About Cignal AI

Cignal AI provides active and insightful research for the networking component and equipment market and its end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us