Cignal AI provides active and insightful market research for the networking component and equipment market as well as its end customers.

Modern Market Research for Networking Communications

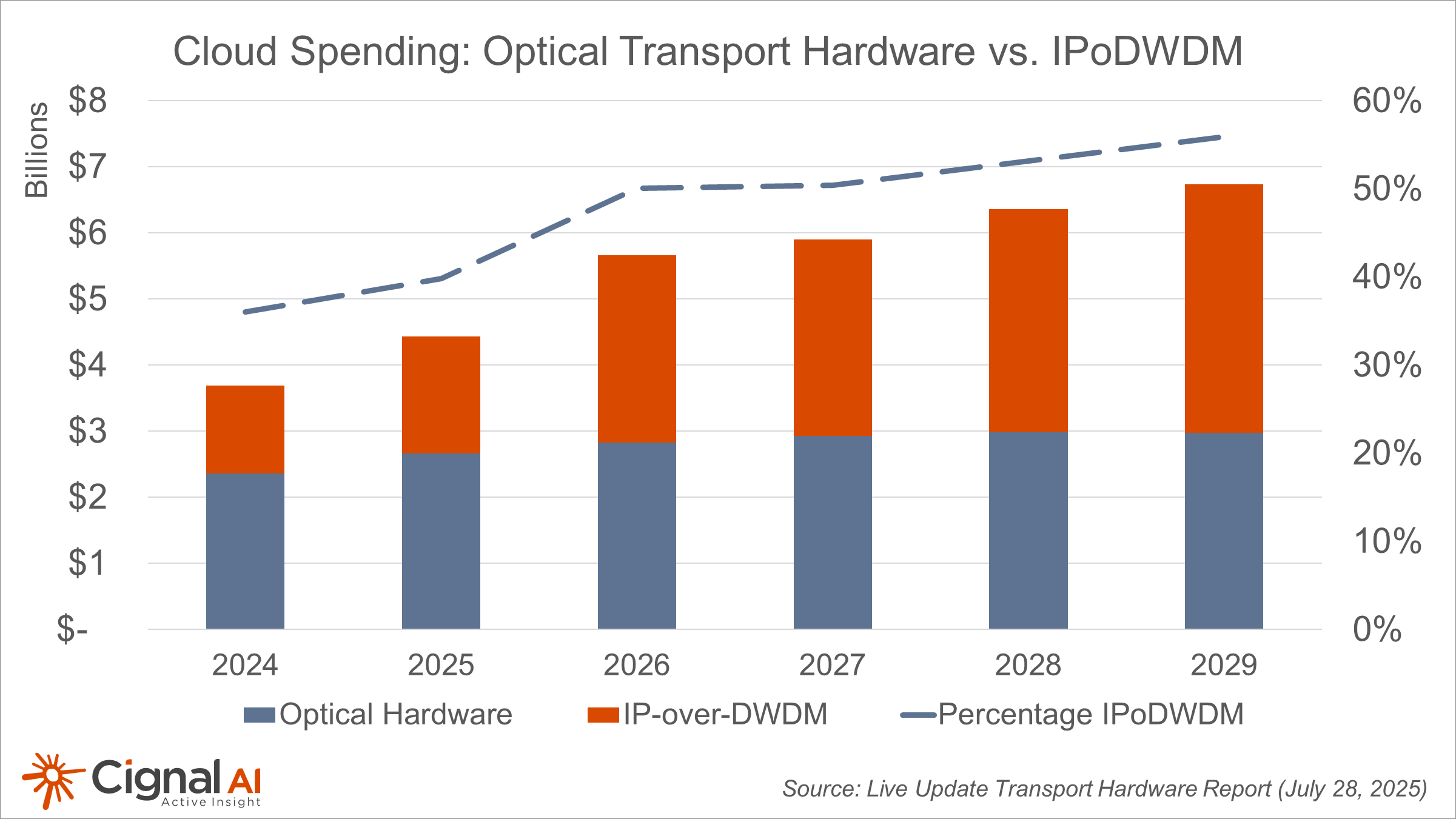

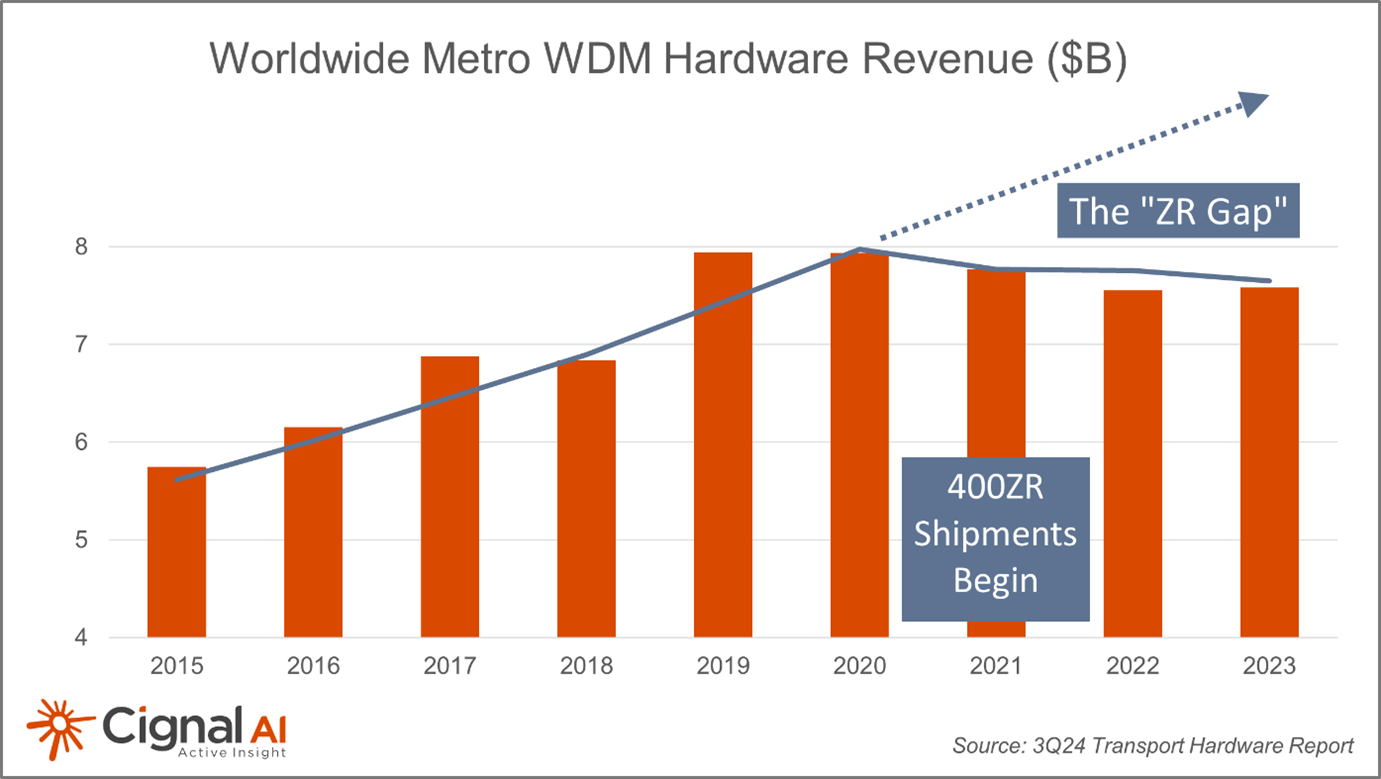

Transport Hardware & Markets Report

Comprehensive vendor market share and forecasts for optical and routing hardware, spanning global regions, equipment types, customer verticals, and hardware applications.

Active Insight

Stay informed with concise, real-time reports of company performance, product announcements, industry events, and in-depth explorations of critical technology and market developments.

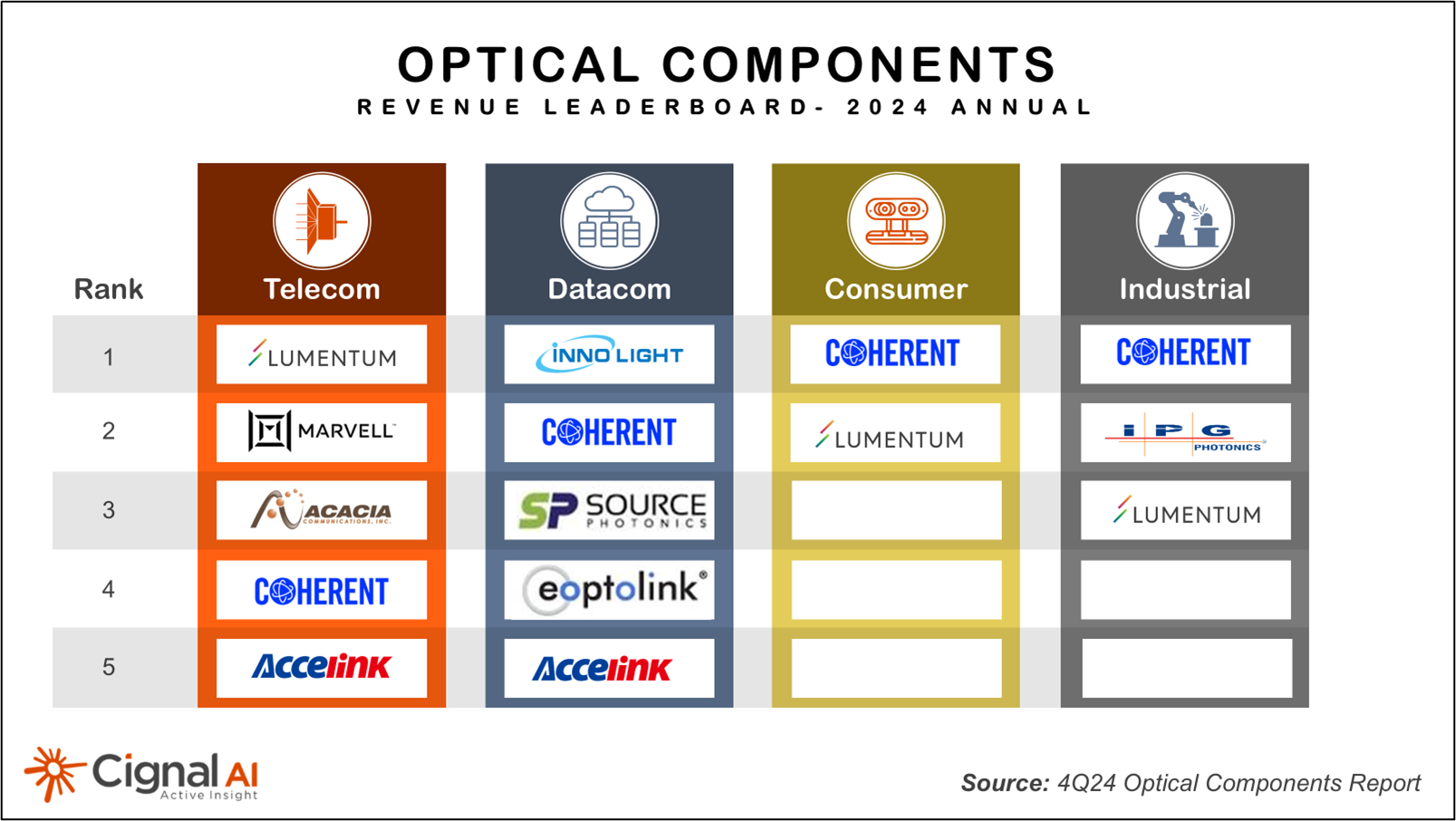

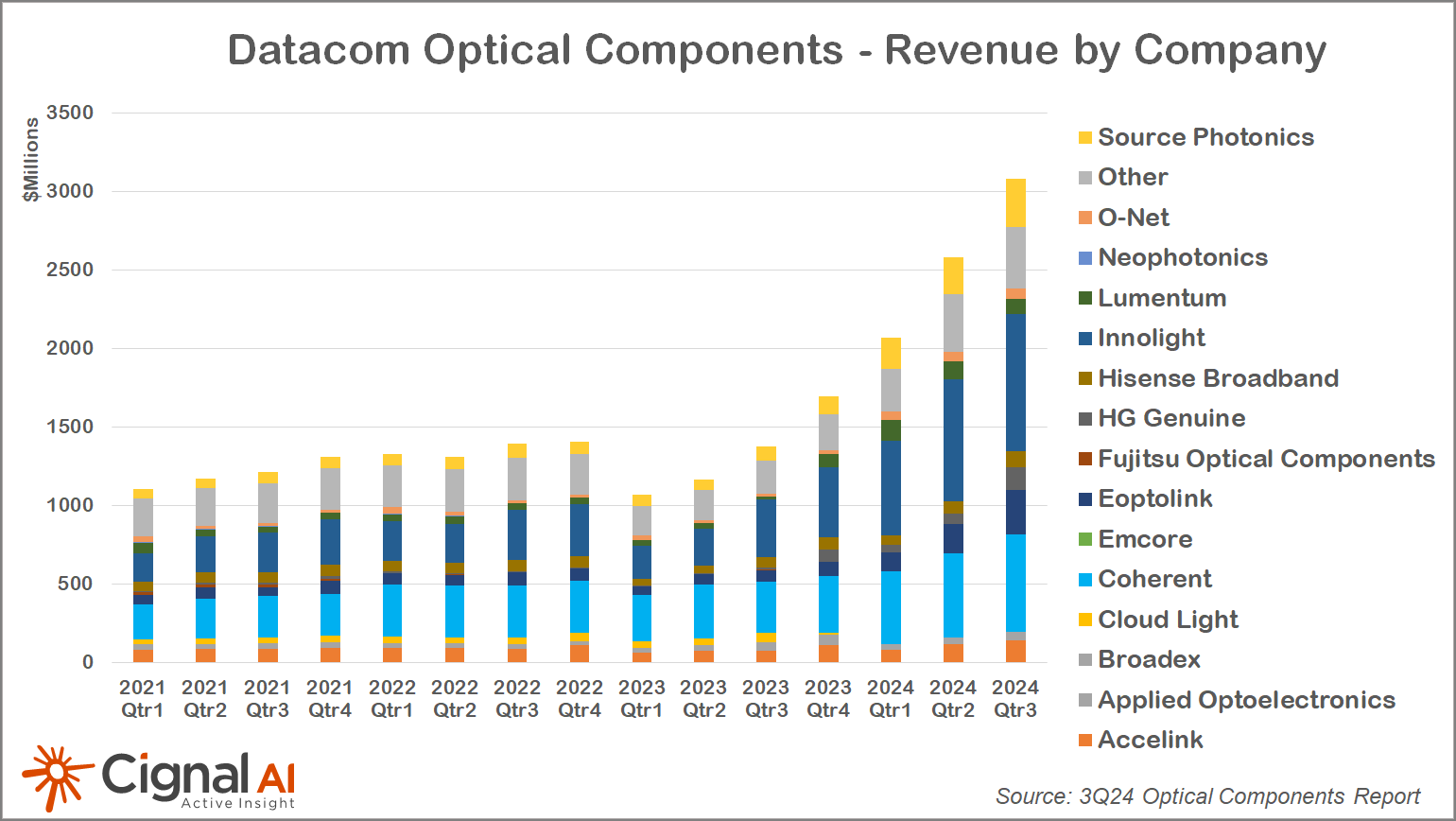

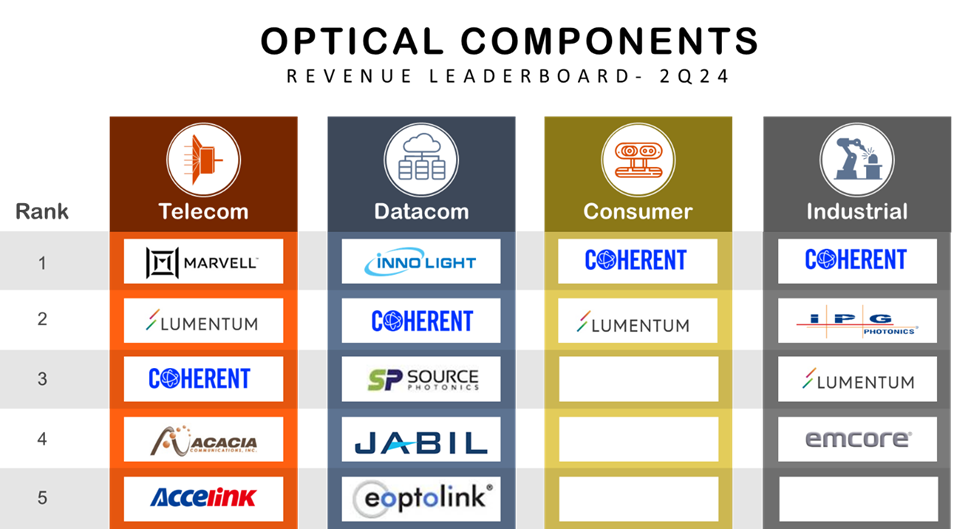

Optical Component Report

Exceptionally detailed shipment database for Datacom and Telecom optical modules and components as well as revenue based vendor performance and market analysis.