Optical Customer Market Report Finds Ciena and Cisco Outperforming Peers in Cloud & Colo Market

BOSTON – October 12, 2017 – Spending on optical transport equipment by cloud and colocation providers dropped unexpectedly year-over-year, according to the most recent Optical Customer Markets Report issued by networking component and equipment market research firm Cignal AI. The surprising reversal in spending by Amazon, Facebook and Google is a result of aggressive price declines in the equipment market, the deflationary effects of 200G technology and more focus by cloud/colo providers on building inside the data center rather than between locations.

“The slow down in cloud and colo provider spending has been a surprise to equipment and component manufacturers, particularly since all forecasts for this market had anticipated continued growth,” said Andrew Schmitt, lead analyst at Cignal AI. “The supply chain is feeling an impact already, but once these 200G pricing reductions are digested in the market, spending will again be on the rise.”

Produced twice a year, Cignal AI’s Optical Customer Markets Report quantifies optical equipment spending by five key customer markets – incumbent, wholesale, cable MSO, cloud and colo, and enterprise and government. The current report covers spending through 1H17 and includes forecasts based on expected spending trends by customer market on a regional basis. The report also details equipment vendor market share for sales directly to the cloud and colo market.

Additional key findings in the 1H17 Optical Customer Markets Report include:

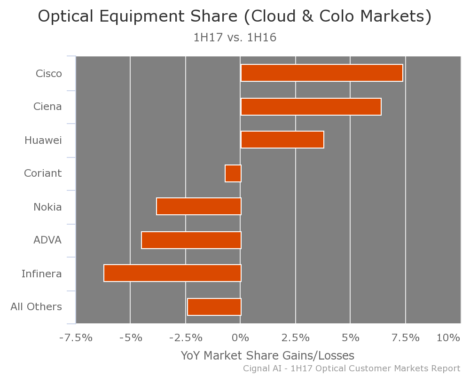

- Ciena and Cisco are significantly outperforming their peers in sales to the cloud and colo market, even in the current challenging environment. Their gains reflect losses at ADVA, Infinera and Nokia.

- Spending by incumbent operators in North America is durable and has remained consistent year-over-year.

- Chinese cloud and colo spending is still very low as a percentage of total sales. This is attributable to regulatory issues, which prevent companies like Baidu, Alibaba and Tencent from building their own networks.

About the Optical Customer Markets Report

The Cignal AI Optical Customer Markets Report tracks optical equipment spending by end customer market type and provides forecasts based on expected spending trends by customer market on a regional basis. Deliverables include Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report includes revenue-based market size for all end customer markets across all regions, with market share for the cloud and colo segment broken out on a worldwide basis. Vendors examined include Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu Networks, Huawei, Infinera, Juniper Networks, NEC, Nokia, Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details, as well as other articles and presentations, are available to users who register for a free account on the Cignal AI website. If you have questions or are interested in purchasing the report, please contact us.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us

Link to press release