Cignal AI Quarterly Optical Hardware Report Also Reveals Lower-than-Anticipated North American Sales

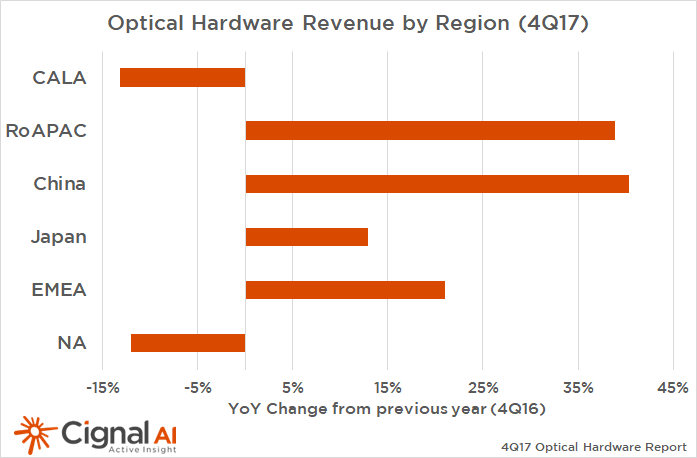

BOSTON (February 15, 2018) – Asia and the EMEA region were the bright spots in the optical hardware market during 2017 as spending grew and larger equipment vendors gained traction. The Optical Hardware Report from Cignal AI, a market research firm specializing in optical network components and equipment, analyzed fourth quarter results and also noted North American optical capex was much weaker than expected because of lower spending by incumbent operators.

“One of the biggest surprises in 2017 was massive spending growth in China. Despite slumping purchases from component manufacturers, Chinese optical vendors Huawei and ZTE reported record levels of revenue. A strong component sales rebound should be expected if this divergence was a result of excess inventory,” said Andrew Schmitt, lead analyst for Cignal AI. “Also, the sustained weakness in the North American market should reverse in 2018 as pricing pressure stabilizes.”

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. The report includes shipment information and guidance from individual equipment companies and forecasts spending trends in each region and for each equipment type.

Key findings from the 4Q17 Optical Hardware Report include:

- Chinese metro WDM spending surged in 2017. Chinese optical spending grew despite concerns of market saturation for coherent 100G ports. 2017 marked a transition in spending from long-haul to metro WDM equipment in all regions, but China played a predominant role in all spending. Global metro WDM spending grew 11 percent but only at a more modest 3 percent excluding China.

- North American optical capex was weaker than expected. Anemic cloud and colo optical capex – combined with brutal 200G pricing, weak deployments by incumbent and wholesale vendors, and a decline in long-haul WDM purchases – resulted in lower overall spending during 2017. In fact, cloud and colo was the weakest North American customer market for the year; a counterintuitive development considering the priority equipment companies place on it. A general slowdown in spending by both AT&T and Level 3/CenturyLink exacerbated the North American decline.

- EMEA spending stabilizes with significant year-end sales. This region had significant quarterly growth in optical hardware sales to a wider array of vendors. While Huawei benefited from strong end-of-year purchases in EMEA, Nokia, Ciena, Cisco, and Infinera increased their presence in this market.

- Nokia and Ciena were top vendors for best quarterly performance. Outside of vendors that sold into the hot Chinese market, Nokia and Ciena reported the best performance in the fourth quarter of 2017, and their success was driven by increased quarterly sales for metro WDM as well as submarine (SLTE).

About the Optical Hardware Report

The Cignal AI Optical Hardware Report includes market share and forecasts for optical transport hardware used in optical networks worldwide. The analysis includes an Excel database and PowerPoint summaries, plus Cignal AI’s real-time news briefs on current market events, Active Insight. The Hardware Report examines revenue for metro WDM, long-haul WDM, and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, Coriant, ECI Telecom, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper (BTI Systems), Mitsubishi, NEC, Nokia, Padtec, TE Connectivity, Xtera, and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us

Link to Release