Huawei Reports Record Revenue in China During ZTE Shutdown

BOSTON (August 23, 2018) – Research firm Cignal AI released its second quarter 2018 (2Q18) Optical Hardware Report, which identified sustained spending growth in the EMEA region despite the absence of major supplier ZTE. EMEA operators increased optical hardware spending 6 percent year-over-year (YoY), but a soft market persisted in North America, where slow spending by incumbent operators has not been offset by the spending of cloud operators, which remains flat.

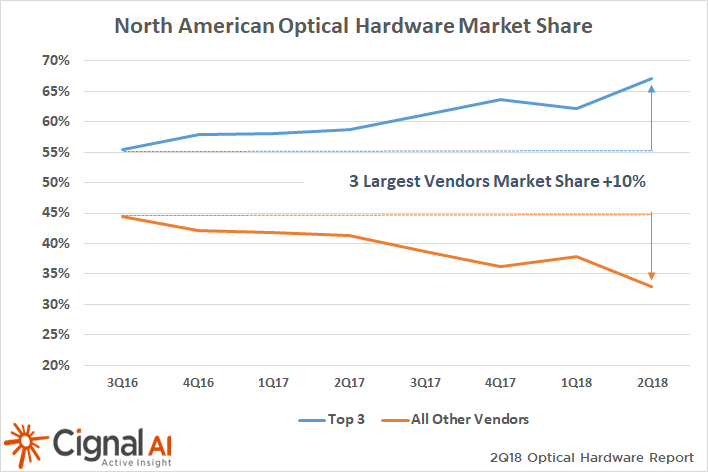

“Spending on optical hardware in North America declined again in 2Q18, but the trend of big vendors performing relatively better continued,” said Andrew Schmitt, lead analyst for Cignal AI. “During the past two years, the top 3 optical equipment vendors in the region consolidated 10 percent of the market at the expense of smaller competitors. It’s becoming a much tougher fight for smaller optical equipment vendors in North America.”

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. Shipment information and guidance from individual equipment companies are included, and forecasts are based on spending trends in each region and the equipment types within those regions.

Key Findings In 2Q18 Optical Hardware Report:

- EMEA spending rose as almost all vendors reported growth in the region. Vendors continue to be optimistic on large incumbent operator spending. Ciena reached record high revenue in EMEA during the quarter, while Nokia also notably increased revenue, excluding SLTE equipment.

- There was no return to growth for North America, as optical hardware spending continued its decline. Weakness is deeply concentrated among the smaller vendors, who experienced double digit YoY revenue declines, while the largest vendors all grew revenue.

- With the absence of ZTE in the market this quarter, China had a sharp drop in revenue. Yet Huawei reported all-time record high revenue in China. Carriers did not curb market activity until ZTE’s return contrary to our assumptions.

- Japanese spending was very strong. Ciena and Nokia both performed well in Japan and offset revenue declines experienced by traditional Japanese equipment vendors Fujitsu and NEC.

- Excluding ZTE, revenue in RoAPAC grew, though both Ciena and Nokia saw their revenue decline YoY for the first time in two years. Huawei reported strong growth in the market.

Optical Hardware Report Enhancements

Last quarter, Cignal AI launched its Optical Hardware Market Share Tracker. The Tracker captured this quarter’s most up to date market data, providing real-time visibility on individual vendors’ results as soon as they are reported to enable well-informed market analysis.

All Cignal AI reports use Excel-based pivot tables which enable clients to quickly and easily view specific market segments. These features are particularly useful this quarter as it allows YoY results for regions to be viewed with ZTE excluded from the calculation. The reports now include rolling 4 quarter analysis and allow clients to see vendor results in this format as well.

About the Optical Hardware Report

The Cignal AI Optical Hardware Report includes market share and forecasts for optical transport hardware used in optical networks worldwide. Analysis includes an Excel database and PowerPoint summaries, plus Cignal AI’s real-time news briefs on current market events, Active Insight.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details, as well as articles and presentations, are available to clients who register an account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us

Link to Release