Ciena Leads Sales to North American Cloud/Colo Operators; Huawei Sees Strong Demand from Chinese Cloud Giants

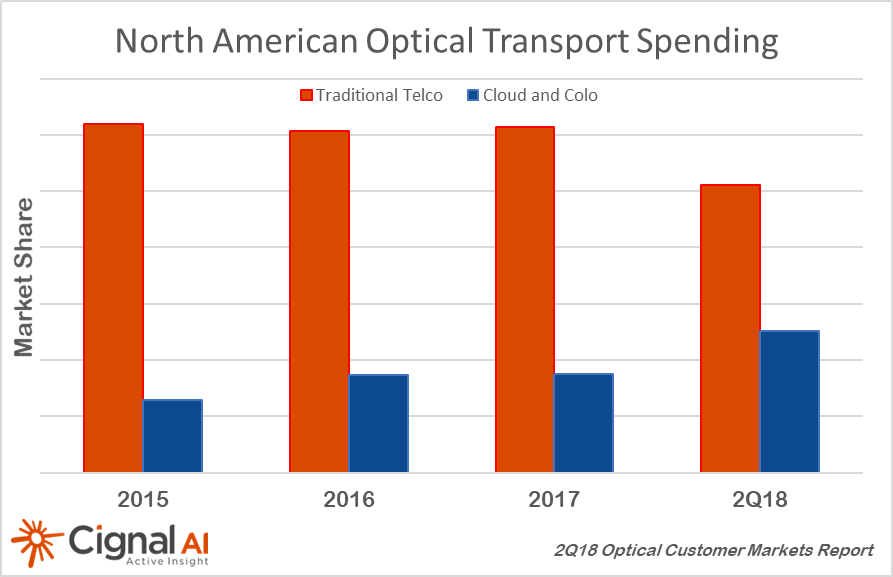

BOSTON (October 16, 2018) – Sales of optical equipment to the cloud and colo market grew rapidly, reaching record levels in 2Q18, according to the most recent Optical Customer Markets Report issued by networking component and equipment market research firm Cignal AI. Cloud and colo operators such as Google, Microsoft, and Amazon still account for only a fraction of global optical equipment spending but were nearly a quarter of all North American operator purchases during 2Q18.

“While cloud and colo spending is still not near traditional telco demand for optical transport equipment, the balance is shifting. This is particularly true in North America, where cloud and colo operators now provide both technical and financial leadership to the supply chain,” said Andrew Schmitt, Directing Analyst at Cignal AI.

Released quarterly, the Optical Customer Markets Report quantifies optical equipment sales to five key customer markets – incumbent, wholesale, cable MSO, cloud and colo, and enterprise and government. The current report includes results through the 2Q18 and details equipment vendor market share for sales to cloud operators. Regional forecasts, based on expected spending trends by customer market, are also updated.

Additional key findings in the 2Q18 Optical Customer Markets Report include:

- Incumbent spending accounts for the largest share of all optical spending in the market. In fact, incumbent spending in China is as much as all spending by other incumbent operators worldwide, combined. Outlays by EMEA incumbents increased again in the most recent quarter.

- Cable MSO spending in North America continues to be very strong and grew both quarter-over-quarter and year-over-year.

- Ciena led other vendors in direct sales to the cloud/colo market led by strength from the WaveServer platform. Also, newly-combined Infinera and Coriant became the second largest supplier of optical equipment to these customers. Huawei also continues to grow its market share as a result of growing demand from Baidu, Alibaba, and Tencent.

About the Optical Customer Markets Report

The Optical Customer Markets Report tracks optical equipment spending by end customer market type and provides forecasts based on expected spending trends on a regional basis. Deliverables include an Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report includes revenue-based market size for all end customer markets across all regions, with market share for sales to the cloud and colo segment broken out on a worldwide basis. Vendors examined include Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu Networks, Huawei, Infinera, Juniper Networks, NEC, Nokia, Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details, as well as other articles and presentations, are available to users who register for a free account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us