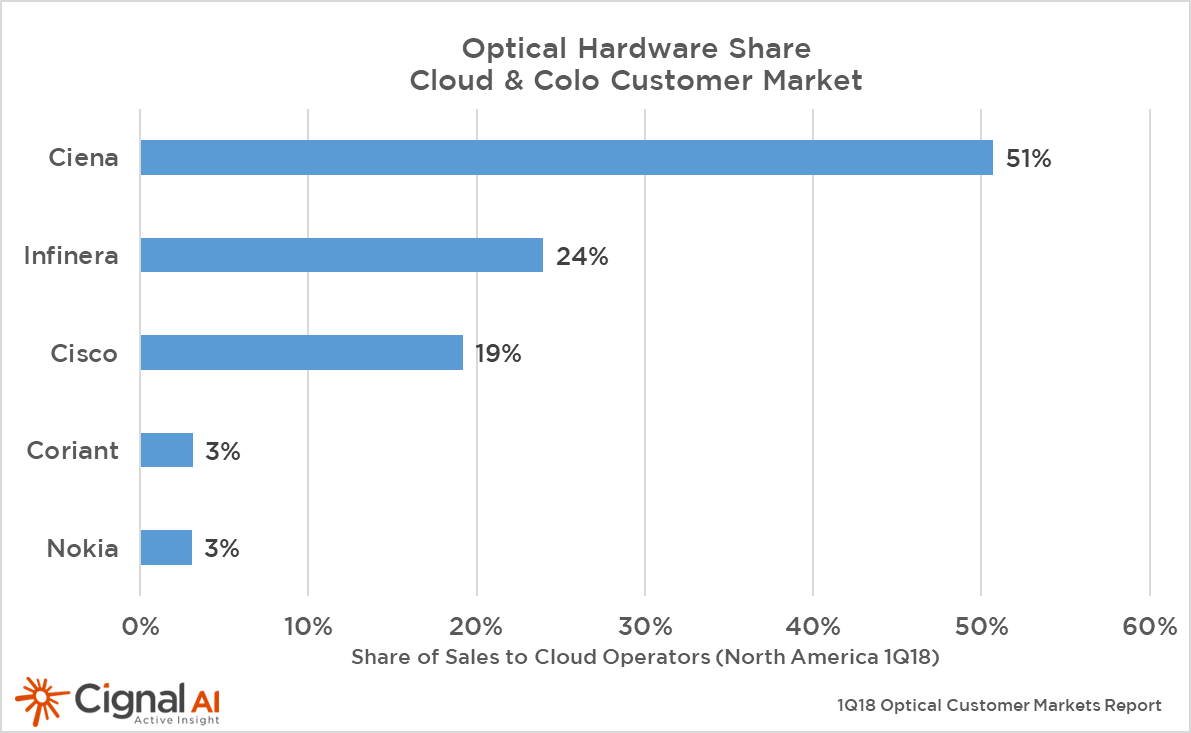

Ciena and Infinera Continue to Take Share in Cloud Market

BOSTON – August 9, 2018 – Spending growth by cable MSOs in North America outpaced all other customer verticals during 1Q18, including cloud operators, according to the latest Optical Customer Markets Report issued by networking component and equipment market research firm Cignal AI. Contrary to the continued increase in China, spending by incumbent network operators in North America and EMEA on optical transport equipment continues to decline.

The conclusions in the 1Q18 Customer Market Report contradict the common, but inaccurate, perception that optical transport equipment spending by cloud operators such as Amazon, Google, and Microsoft is growing at a rapid rate. Rather, optical equipment spending by cloud operators has stalled; inhibited by rapidly declining prices and the use of IP over WDM as a substitute.

“In North America, cable MSOs were the strongest performing customer market during the first quarter of 2018,” said Andrew Schmitt, lead analyst at Cignal AI. “Cloud operators are not increasing purchases of optical equipment, though common belief right now is just the opposite. The revenue growth from cloud operators experienced by Ciena and Infinera came at the expense of other vendors’ sales.”

Cignal AI’s Optical Customer Markets Report is issued quarterly and quantifies optical equipment sales to five key customer markets – incumbent, wholesale, cable MSO, cloud and colo, and enterprise and government. The current report includes results through 1Q18 and equipment vendor market share for sales to cloud operators. Regional forecasts, based on expected spending trends by customer market, are also included.

Additional key findings in the 1Q18 Optical Customer Markets Report include:

- Ciena and Infinera sales growth in the cloud and colo market came during a period of overall spending decline among these customers.

- Incumbent spending in China is the largest source of optical hardware market growth; one-third of global spending is in Asia, almost all coming from Chinese incumbent operators. This growth in APAC offsets declines in incumbent operator spending in North America and EMEA, a trend that is expected to continue.

- Global spending by cable MSOs grew 5 percent year-over-year in the first quarter, with North America increasing 30 percent. Spending from Cable MSOs increased the most among all customer markets in the region.

- Cloud operator spending on optical equipment is not accelerating. Cignal AI updated its analysis of spending trends (see Cloud Spending on Optical Hardware) in this market and found no evidence of spending increases; instead these operators are using lower prices and IPoDWDM to meet rapidly growing bandwidth needs. The relative spending strength of cloud operators when compared to other operators is misinterpreted as growth by many industry observers.

About the Optical Customer Markets Report

The Cignal AI Optical Customer Markets Report tracks optical equipment spending by end customer market type and provides forecasts based on expected spending trends by customer market on a regional basis. Deliverables include an Excel file with a complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report includes revenue-based market size for all end customer markets across all regions, with market share for the cloud and colo segment broken out on a worldwide basis. Vendors examined include Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu Networks, Huawei, Infinera, Juniper Networks, NEC, Nokia, Padtec, TE Conn, Transmode, Xtera, and ZTE.

Full report details, as well as other articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us