Compact Modular Hardware

This report provides historical information, industry context, and product examples of our classification of Compact Modular systems.

4Q23 Optical Component Report

Telecom revenue has hit the bottom as overwhelming 800GbE demand raises Datacom revenue and shipments.

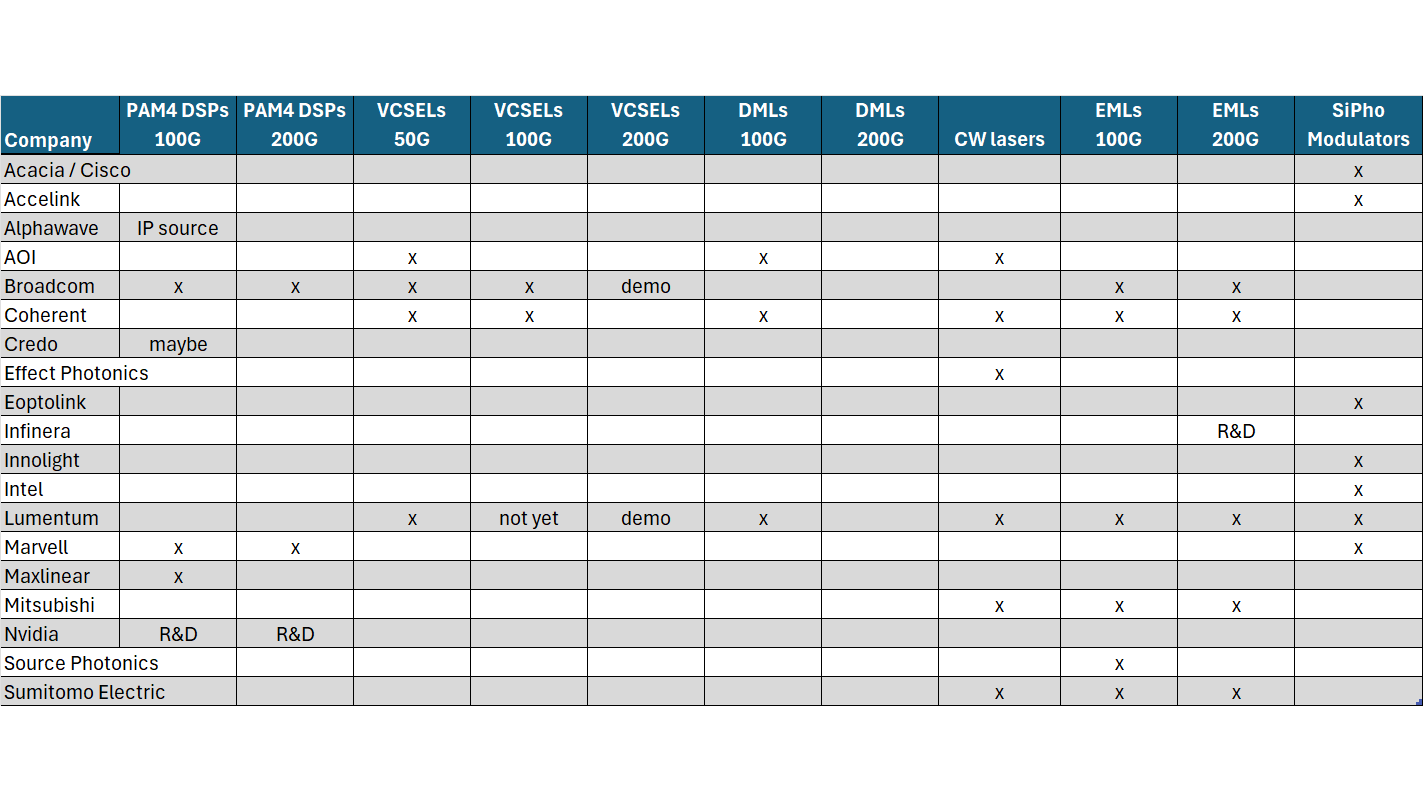

Datacom Optical Industry Tracker

This report tracks the component suppliers that enable the 400GbE+ Datacom Transceiver ecosystem. It includes an overview of the types of transceivers employed, the key components that are used in those transceivers, and which vendors supply those components.

Infinera 4Q23 Vendor Summary Report

Driven by sales to Cloud operators, full year 2023 revenue came in at a record $1.3B.

Infinera Announces Intra-Datacenter 1.6 Tb/s Optics

Mentioned: Scott Wilkinson on the 1.6Tbs client optics market.

4Q23 Transport Hardware & Markets Report

Cloud Spending on Optical Transport Jumps 46% in 4Q23, Traditional Service Provider Spending Remains Weak

3Q23 Transport Applications Report

Worldwide DWDM deployed bandwidth declined YoY for the first time.

3Q23 Optical Components Report

Datacom revenues are recovering from the Q1 drop and are poised to explode along with 800GbE shipments in 2024. Telecom revenue continues to lag, as deployed bandwidth declined YoY for the first time this quarter.

3Q23 Transport Hardware & Markets Report

The optical market grew 4% – cloud operators continue to invest in transport and vendors are still shipping against large backlogs.

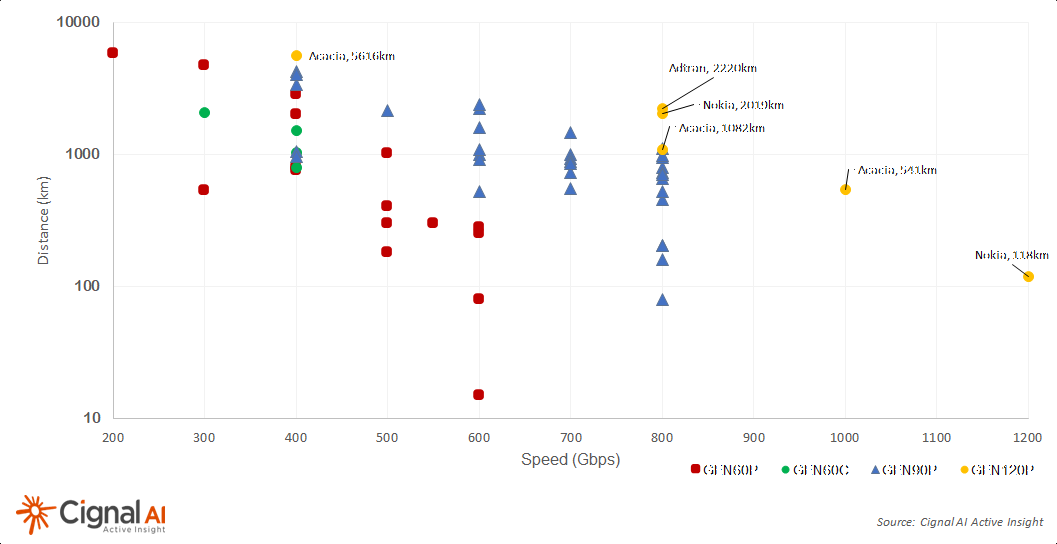

GEN120+ Coherent Trials and Deployments

Cignal AI is tracking announcements of Gen120 (120+ GBaud, 1+Tbps) optical trials and deployments.

ECOC 2023 Show Report

800ZR, debate on Linear Pluggable Optics and IPoDWDM, and progress in 200G/lane modules

2Q23 Optical Components Report

Datacom revenue and module shipments plummeted as inventory adjustment hit hard this quarter.

2Q23 Transport Applications Report

Bandwidth growth and compact modular sales slow as Hyperscalers take their foot off the gas.

2Q23 Transport Hardware & Markets Report

Optical sales slowed due to inventory absorption and macroeconomic concerns, but routing sales continued to grow.

2Q23 Takeaways – INFN ADTN VIAV

Infinera and Viavi think a turnaround in demand is imminent.

1Q23 Transport Applications Report

The Bandwidth Must Flow: Up 39% YoY

Five Themes from NGON 2023

Mentioned: Kyle Hollasch at NGON 2023

1Q23 Optical Components Report

Datacom revenue and module shipments plummeted as inventory adjustment hit hard this quarter.

1Q23 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales.

NGON 2023 Show Report

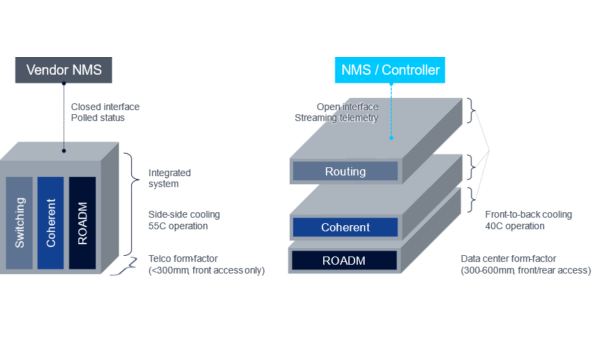

Observations on IP over DWDM and the Optical Edge