4Q22 Preliminary Transport Hardware & Markets Report

Optical and routing sales declined on weakness in Europe and China.

3Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales, supply chains remained strained.

3Q22 Transport Hardware & Markets Report

Optical sales declined due to supply chain and currency effects, while routing hardware sales continue to grow.

2Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales, supply chains remained strained.

2Q22 Transport Hardware & Markets Report

North American Cloud operators were again the growth engine for optical and packet transport sales

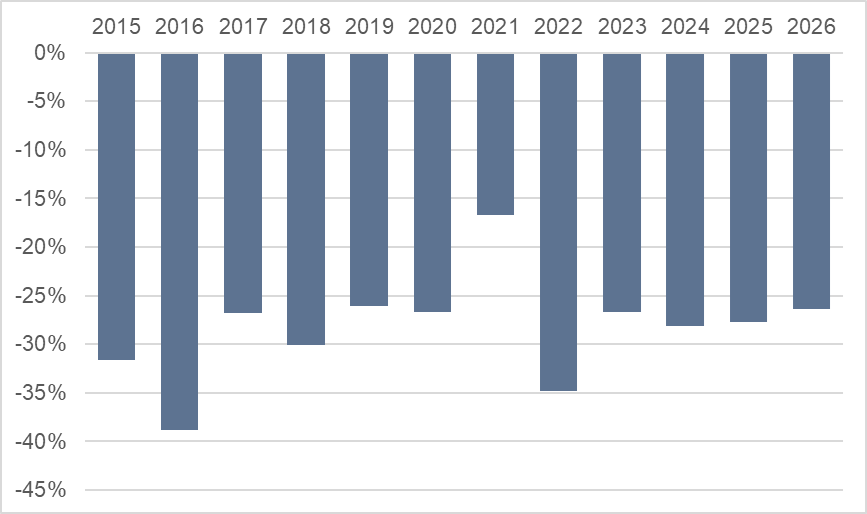

Coherent Port Pricing Trends (1Q22)

Cignal AI revisits our Coherent Pricing Trends report from 2019 and provides an update based on recent technology advances.

1Q22 Transport Hardware & Markets Report

First-quarter 2022 worldwide optical hardware spending increased 2.5% YoY, while packet gained 2%. North America led growth in both categories.

1Q22 Transport Hardware & Markets Report

First-quarter 2022 North American optical and packet sales continue to rebound despite supply-chain constraints. Excluding NA, both hardware categories declined in 1Q22.

4Q21 Transport Hardware & Markets Report

Fourth-quarter 2021 worldwide optical hardware spending increased 3.5% YoY. Declines centered in APAC for the second consecutive quarter, while all other regions grew YoY.

3Q21 Transport Hardware Report

Optical forecasts were reduced by $1.1B worldwide in 2025 due to a shift of coherent optics into router-based DCO’s.

2Q21 Transport Hardware Report

First-quarter 2021 worldwide optical hardware spending was down slightly YoY, Chinese optical hardware spending was down significantly.

1Q21 Transport Hardware Report

First quarter optical spending was down compared to the Covid-impacted 1Q20. Packet transport sales, which suffered a year ago from operational issues, increased sharply.

4Q20 Transport Hardware Report

North American optical and packet transport spending plummeted in North America as Tier 1s concentrated COVID-related capex in the first half of the year.

3Q20 Transport Hardware Report

Third quarter results were better than forecast, especially in EMEA where both optical and packet hardware spending increased. North America spending declined while China spending was flat and Japan spending growth continued unabated.

2Q20 Transport Hardware Report

Second quarter results were mixed. Forecasted growth in Q2 from sales pushed out of Q1 did not materialize as anticipated and carriers indicated that annual CapEx will not be increased – suggesting a flat to down second half of the year.

Coherent Port Pricing Trends (1Q20)

Our 3Q18 report showed coherent optical port pricing dropping at 26% per year. This report examines the stability of that trend over the last 12 months as new coherent systems entered the market.

1Q20 Transport Hardware Report

Vendors generally claimed a 5-10% reduction in sales due to COVID-19 operational issues this quarter. While demand increased, the inability to get parts, manufacture equipment, and deliver to end customers reduced sales in all areas.

4Q19 Transport Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2024.

3Q19 Optical Hardware Report

This report finalizes our full optical equipment market share analysis and includes updated forecasts for the industry through 2023.

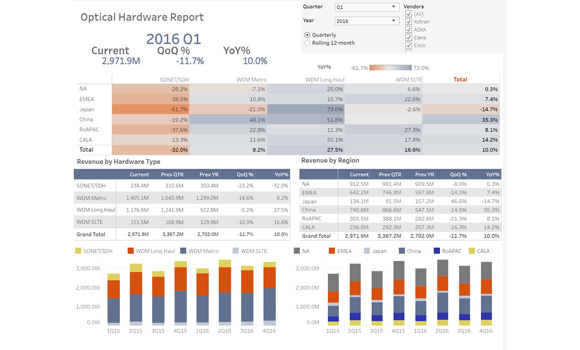

3Q19 Optical Hardware Tracker

The Cignal AI 3rd quarter 2019 (3Q19) Optical Hardware market share tracker is now active. The tracker gives clients a real-time view of market results as they are released.