400ZR vs 800G – Classifying Coherent Technology

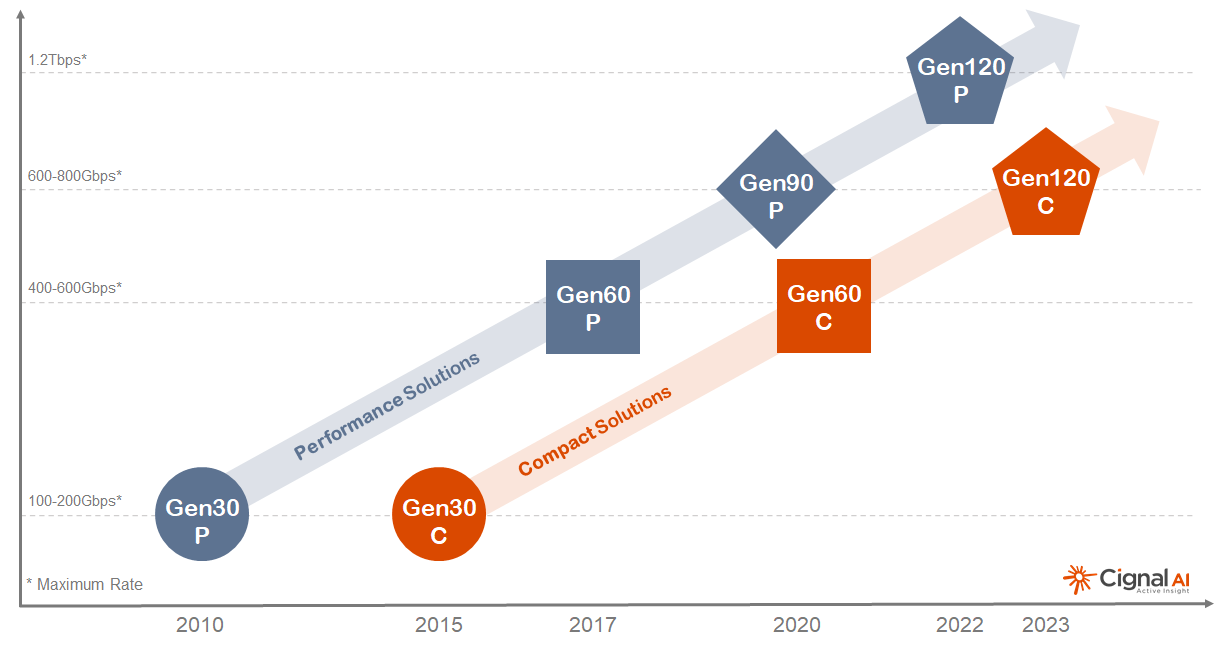

The historical classification of coherent optical technology (Gen1, Gen2, etc.) is no longer sufficient. Therefore, Cignal AI will now recognize and classify coherent DSP technology by its maximum baud rate and whether the DSP is optimized for Performance or Compact applications.

2Q21 Transport Applications Report

Compact modular sales again outperformed the overall optical hardware market while Packet-OTN sales declined. 400ZR is shipping but is supply limited.

Cisco/Acacia Announces 1.2Tbps DSP and Coherent Module

Development moves past 90+ GBaud directly to 120+

Ciena 3Q21 Vendor Summary Report

Ciena starts out the second half of 2021 strong, but supply chain headwinds threaten further growth.

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

2Q21 Transport Hardware Report

First-quarter 2021 worldwide optical hardware spending was down slightly YoY, Chinese optical hardware spending was down significantly.

OpenROADM Update

Nearly 5 years after the project’s inception, AT&T disclosed it has deployed OpenROADM-based networks across a dozen US metros.

OFC 2021: 400ZR/ZR+ Coherent Pluggables

After years of anticipation, 400G pluggable digital coherent optics (DCO) will finally achieve general availability and initial deployment in 2021.

1Q21 Transport Applications Report

400Gbps+ port shipments doubled YoY, 400ZR ports started to ship, and compact modular sales significantly outperformed the overall optical hardware market this quarter.

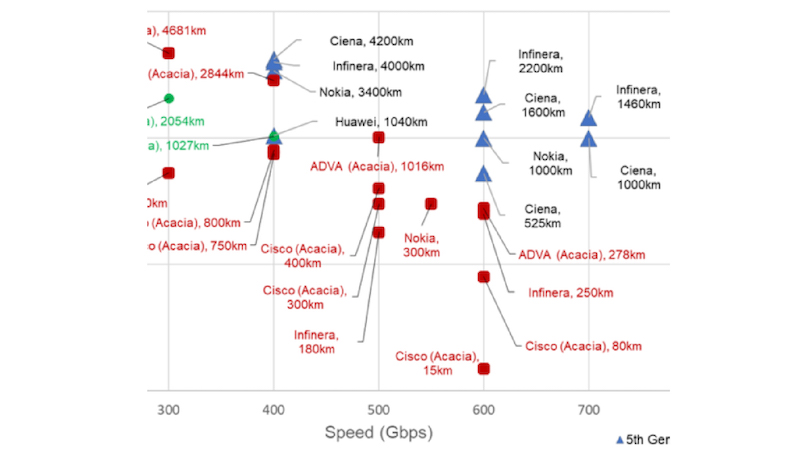

OFC21: 800G Coherent and Beyond

Several vendors are shipping 800Gbps capable coherent optical solutions, and now the industry must consider the next steps in development.

Ciena 2Q21 Vendor Summary Report

Ciena is well-positioned to return to growth in the second half of 2021 as multiple factors align in its favor.

OFC21: Co-packaged Optics

Co-packaged optics (CPO) moved from hero experiments to discussions of commercial roadmaps this year. In this update from OFC21, we cover the key points about CPO discussed at the show.

GEN90P Coherent Trials and Deployments

Cignal AI continues to track announcements of 5th generation (800Gbps-capable, 90+ GBaud) optical trials and deployments.

1Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined steeply YoY compared to a heavily frontloaded 1Q20, but show signs of longer term recovery. Cloud & Colo optical spending worldwide slowed as NA spending stalled in 2020 and APAC is just beginning to take off.

1Q21 Transport Hardware Report

First quarter optical spending was down compared to the Covid-impacted 1Q20. Packet transport sales, which suffered a year ago from operational issues, increased sharply.

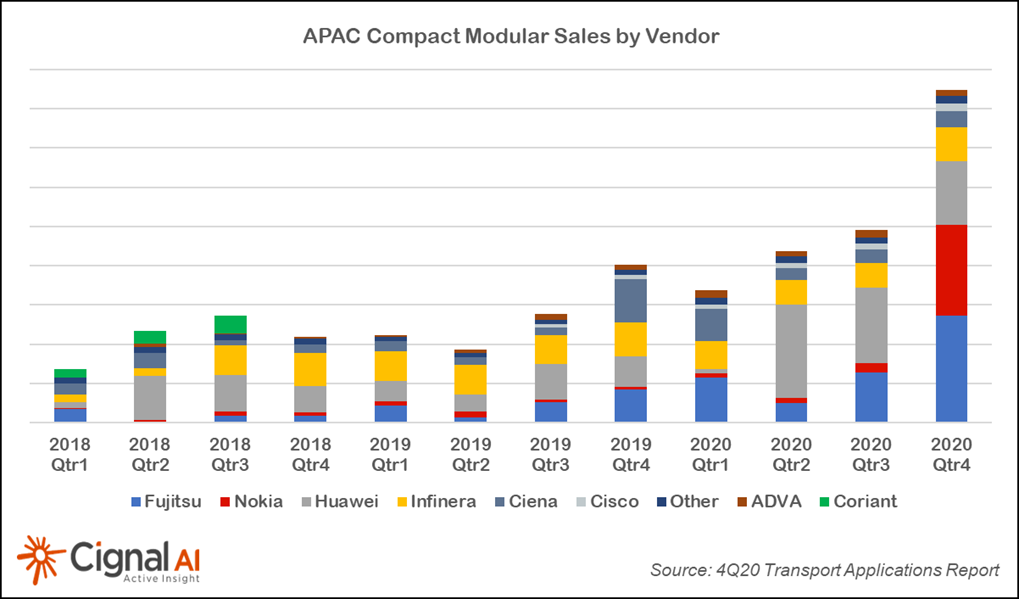

The Growth of Compact Modular in APAC

Compact Modular sales (and hence disaggregation) have historically lagged in APAC versus the rest of the world, so APAC’s sudden and extraordinary growth over the past few quarters means that something has changed and deserves a closer look.

4Q20 Transport Applications Report

4Q20 Compact Modular sales significantly outperformed the overall optical market, as APAC sales more than doubled and surpassed EMEA sales for the first time. 400ZR forecasts for 2022 and beyond were increased based on growing operator interest.

Ciena 1Q21 Vendor Summary Report

Ciena’s revenue decline this quarter was steeper than our forecast, but the company is poised to grow revenues based on the success of its WaveLogic 5e 5th generation coherent technology.

4Q20 Transport Customer Markets Report

North American Traditional Telco spending on optical and packet hardware declined significantly in the 4th quarter, due to a dramatic reshuffling of capex spurred by the pandemic during the first half of 2020. Meanwhile, APAC Cloud & Colo spending exploded. Long term, hardware sales in all markets are predicted to return to growth in the second half of 2021.

4Q20 Transport Hardware Report

North American optical and packet transport spending plummeted in North America as Tier 1s concentrated COVID-related capex in the first half of the year.