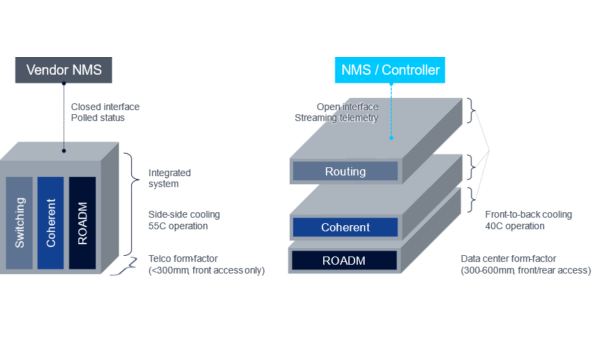

Compact Modular Hardware

This report provides historical information, industry context, and product examples of our classification of Compact Modular systems.

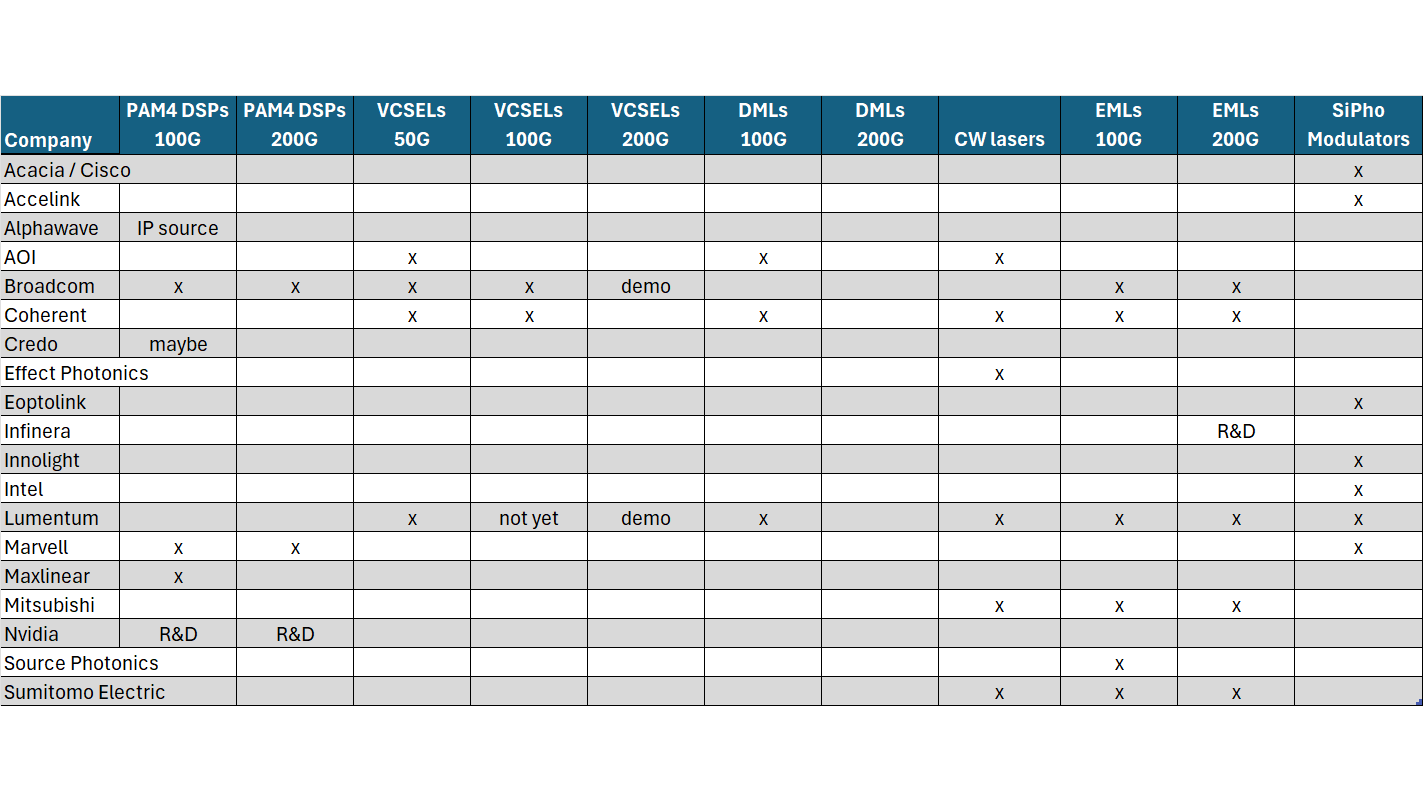

Datacom Optical Industry Tracker

This report tracks the component suppliers that enable the 400GbE+ Datacom Transceiver ecosystem. It includes an overview of the types of transceivers employed, the key components that are used in those transceivers, and which vendors supply those components.

OFC 2024 – What We Learned

This is a summary of how OFC 2024 and the conversations we had there shaped our thoughts.

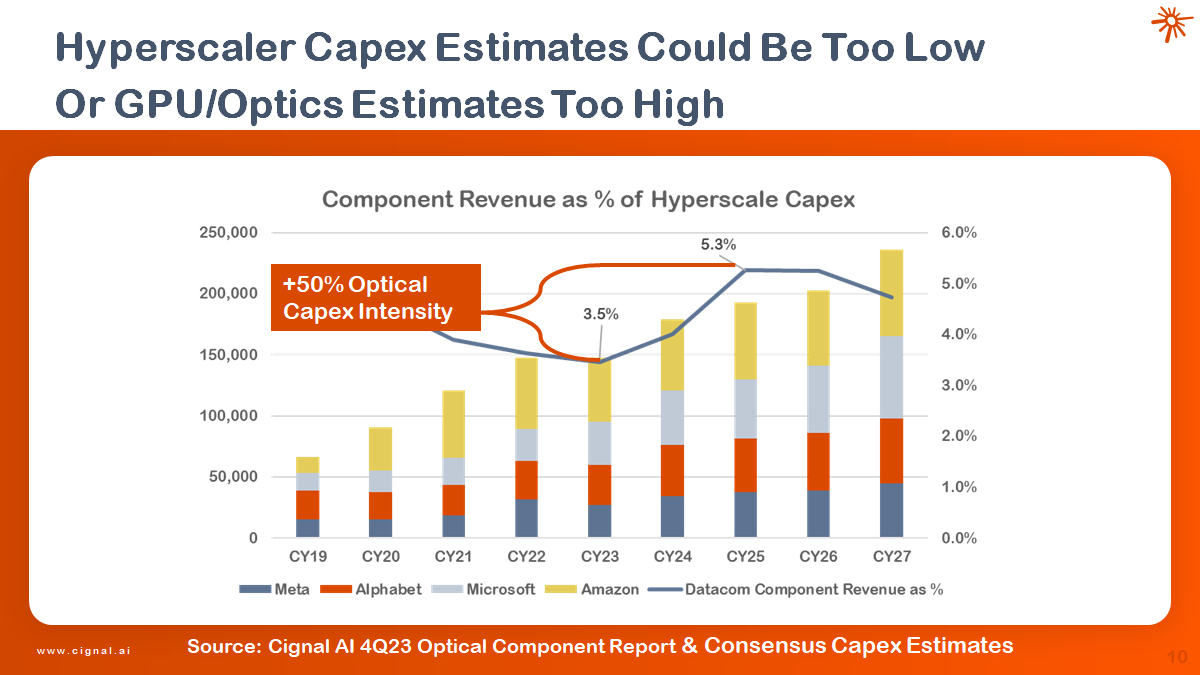

OFC 2024 Marketwatch Presentations

Trends in operator spending, datacenter optics, and sanity checking the optics forecast for AI applications.

Infinera 4Q23 Vendor Summary Report

Driven by sales to Cloud operators, full year 2023 revenue came in at a record $1.3B.

Applied Optoelectronics 4Q23 Vendor Summary Report

Providing an update to our 1Q23 vendor summary and updating AOI’s quarterly results for 4Q23.

OFC 2024 Preview

Key themes to watch – AI, 800G, and everything else

Lumentum 4Q23 Vendor Summary Report

Revenues continue to be in the doldrums and the slowdown is expected to continue for a couple of quarters before growth returns.

Coherent 4Q23 Vendor Summary Report

Coherent calls the bottom in the Telecom optical components market while capitalizing on the AI-fueled Datacom boom.

Nokia 4Q23 Vendor Summary Report

Optical and routing results point to growing weakness in North American carrier capex.

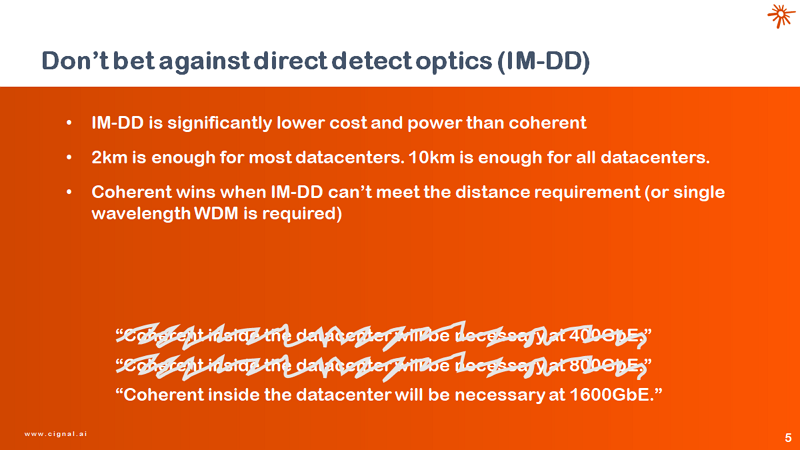

The Move to Coherent Inside the Datacenter

Does the higher performance offered by coherent optics offer a compelling use case inside the datacenter?

Ciena 4Q23 Vendor Summary Report

Sales to Cloud operators powered $3B in optical revenue for 2023.

Coherent Port Pricing Trends (1Q24)

The price of bandwidth ($/Gbps) has declined consistently every year except 2021. In this updated report, we analyze the most recent data to determine if the trend is continuing.

Coherent 3Q23 Vendor Summary Report

Coherent’s revenue declined in all segments, but the company’s forecast for a return to growth in 2024 remains unchanged.

Lumentum 3Q23 Vendor Summary Report

It’s all about the future for Lumentum, with a strong backlog and the incorporation of Cloud Light expected to drive increased revenues into 2024.

Lumentum Buys Cloud Light

On November 7, Lumentum announced its acquisition of optical component manufacturer Cloud Light for approximately $750 million. This move marked an unexpected return to the datacom transceiver market for Lumentum, which sold its business in 2019 to CIG.

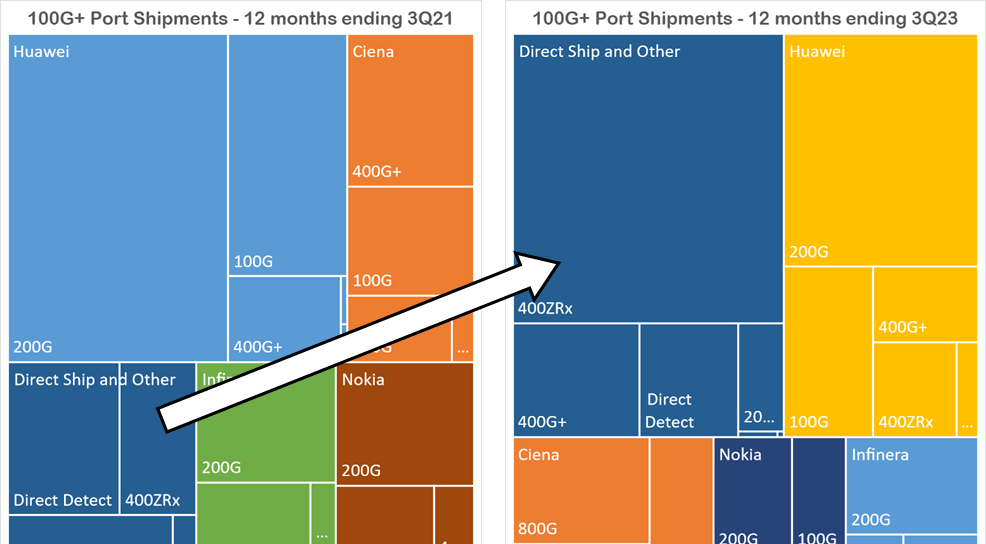

Fujitsu 3Q23 Vendor Summary Report

Fujitsu faces headwinds as weakness in Japan combines with the end of fronthaul sales in NA. Can the 1FINITY Ultra Optical System help it break into new markets?

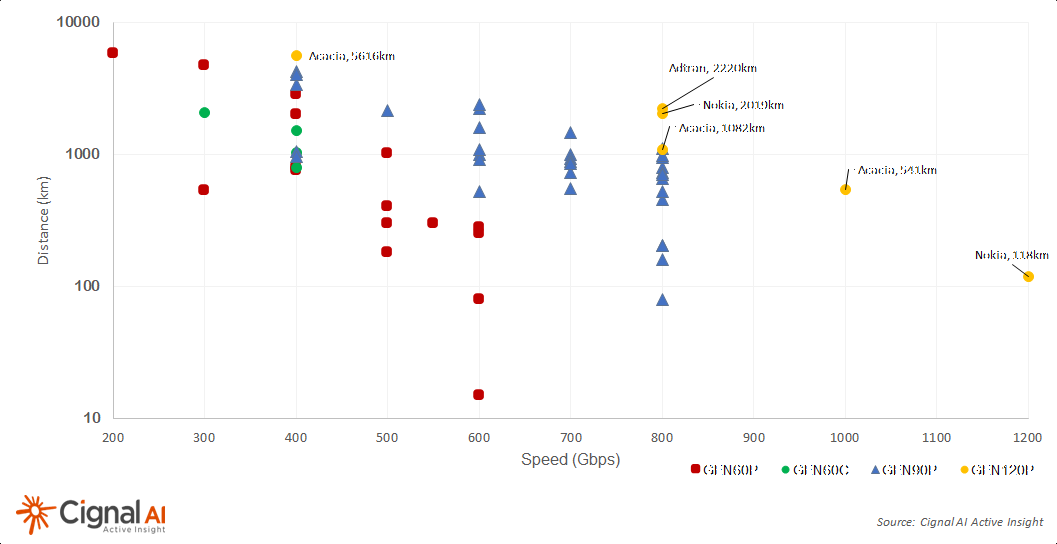

GEN120+ Coherent Trials and Deployments

Cignal AI is tracking announcements of Gen120 (120+ GBaud, 1+Tbps) optical trials and deployments.

Nokia 3Q23 Vendor Summary Report

Optical and routing point to growing weakness in North American carrier Capex.

2023 OCP Global Summit Report

The “AI Emergency”, LPO vs. CPO optics, and pushing the scaling limits of AI computing.