Cignal AI Vendor Summary Reports examine recent quarterly results and items of interest about key vendors in the optical market. This report highlights Lumentum’s calendar 3Q23 (Fiscal 1Q24) results as reported on November 8, 2023.

Quarterly Results

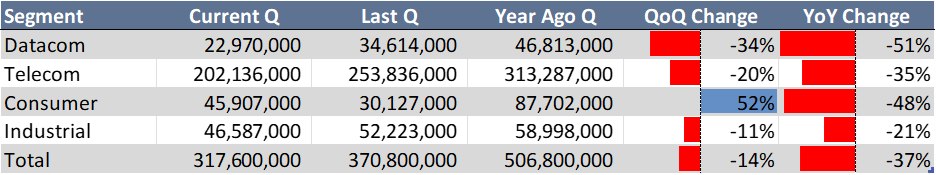

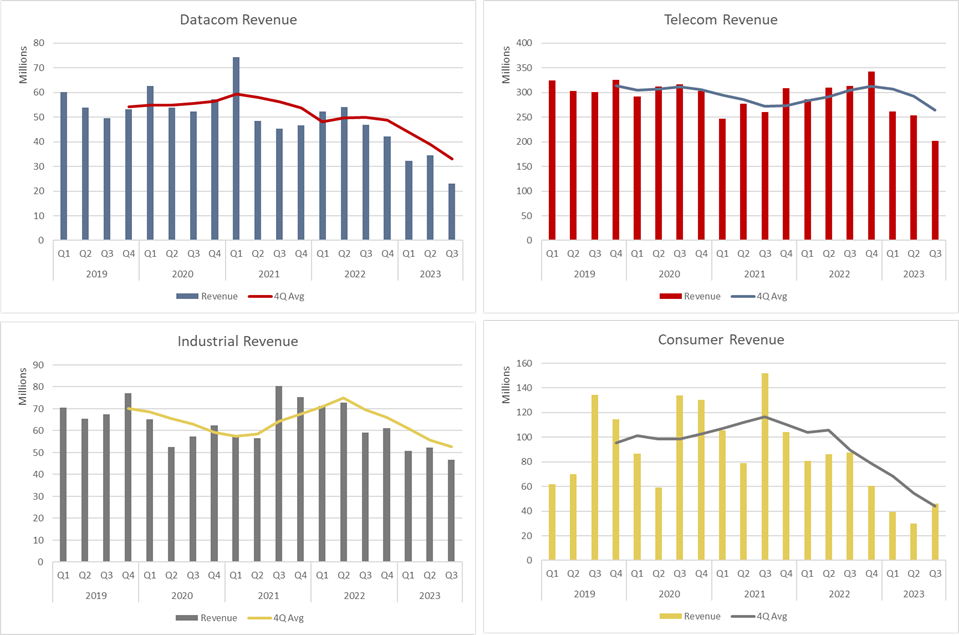

* Graphs and Results Table include historical Telecom revenue from Neophotonics and IPG Photonics, prior to their acquisition in 3Q22.

- The big news from Lumentum this quarter was its acquisition of datacom transceiver company Cloud Light. For more on that acquisition, see the separate Active Insight Report, Lumentum Buys Cloud Light.

- Lumentum’s revenue declined sharply across all segments and was down -37% YoY overall. As with last quarter, the company placed the blame on an inventory correction as customers continued to deplete inventory accumulated during supply chain challenges at the end of 2022 and the beginning of 2023. The process is expected to continue for 1-2 more quarters, as CEO Alan Lowe said, “there’s probably still some inventory consumption going on even into early parts of calendar ’24.”

- The company reported broad-based softness in networking (Datacom and Telecom) with some points of strength in intra-datacenter lasers (EMLs, DMLs) and tunable access modules (10G DWDM).

- Lumentum forecasts revenue for next quarter (calendar Q4, fiscal Q2) to be $350 million to $380 million, including a partial quarter (7½ weeks) of Cloud Light revenue. 7½ weeks of Cloud Light revenue, assuming the growth rates quoted (around 30% annually) and current quarter Cloud Light revenue (around $60.5 million) comes to $35.4 million. This implies that the core Lumentum business will be flat to up about 8% next quarter, which is not the strong recovery the industry hoped for in Q4 as inventories are exhausted.

- The company expects a return to growth in the Cloud & Networking segments (Telecom and Datacom) in calendar Q4 as inventories are finally reduced. Growth in that segment will be dominated by Cloud Light, which is expected to grow revenue by 30% or more over the next year due to strong 800GbE demand. If Cloud Light grows at 30%, Cloud & Networking will grow at around 6% even without contributions from the existing business.

Clients log in to access full report