3Q23 Transport Applications Report

Worldwide DWDM deployed bandwidth declined YoY for the first time.

2Q23 Transport Applications Report

Bandwidth growth and compact modular sales slow as Hyperscalers take their foot off the gas.

1Q23 Transport Applications Report

The Bandwidth Must Flow: Up 39% YoY

4Q22 Transport Applications Report

Gen60C shipments slow, ROADM shipments in line with hardware as supply chain issues resolve

3Q22 Transport Applications Report

Gen60C modules drive coherent bandwidth growth this quarter while Compact Modular and ROADM equipment sales outperform.

2Q22 Transport Applications Report

Coherent bandwidth growth remains muted outside of 400ZR

1Q22 Transport Applications Report

Coherent bandwidth growth returns to historical levels & ROADM coverage initiated.

4Q21 Transport Applications Report

400ZRx Pluggable shipments surge while lower cloud spending holds back Compact Modular in North America.

3Q21 Transport Applications Report

Compact Modular equipment sales continued to surge while Chinese coherent port shipments stalled.

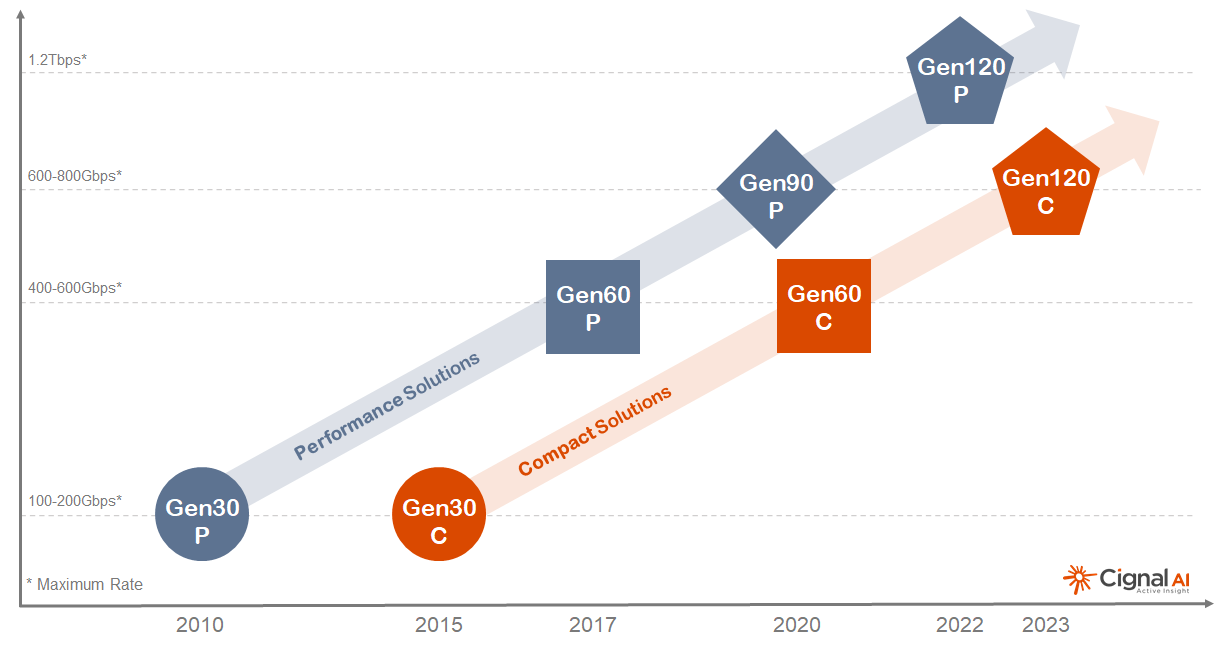

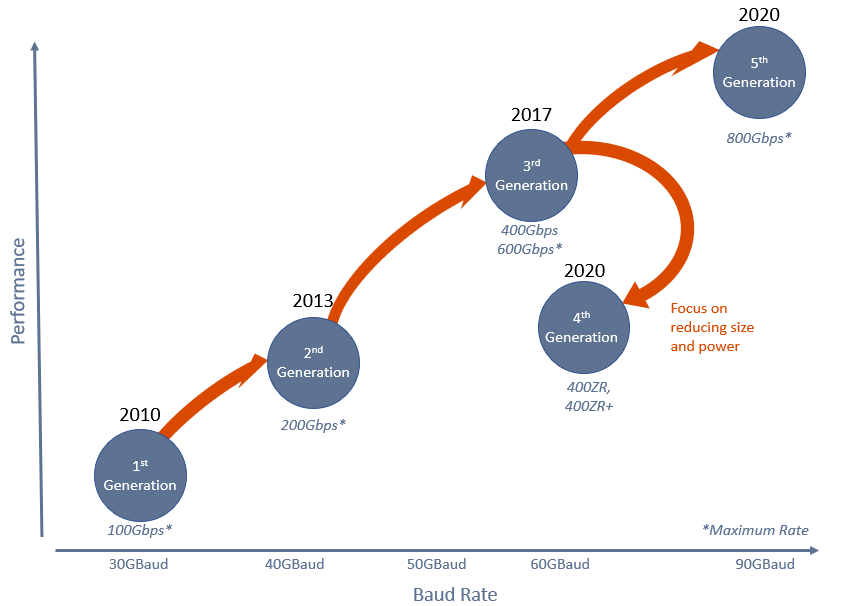

400ZR vs 800G – Classifying Coherent Technology

The historical classification of coherent optical technology (Gen1, Gen2, etc.) is no longer sufficient. Therefore, Cignal AI will now recognize and classify coherent DSP technology by its maximum baud rate and whether the DSP is optimized for Performance or Compact applications.

2Q21 Transport Applications Report

Compact modular sales again outperformed the overall optical hardware market while Packet-OTN sales declined. 400ZR is shipping but is supply limited.

1Q21 Transport Applications Report

400Gbps+ port shipments doubled YoY, 400ZR ports started to ship, and compact modular sales significantly outperformed the overall optical hardware market this quarter.

4Q20 Transport Applications Report

4Q20 Compact Modular sales significantly outperformed the overall optical market, as APAC sales more than doubled and surpassed EMEA sales for the first time. 400ZR forecasts for 2022 and beyond were increased based on growing operator interest.

3Q20 Transport Applications Report

Compact modular sales grew much faster than the optical market overall, with significant growth in APAC this quarter. 400ZR and ZR+ modules began sampling with several hundred modules shipped for evaluation.

2Q20 Transport Applications Report

This report includes our initial forecasts of the 100ZR and 400ZR+ markets.. Compact Modular sales grew much faster than the overall market this quarter as disaggregation continues to gain traction in networks outside of Cloud & Colo.

1Q20 Transport Applications Report

Packet-OTN sales doubled in NA as carriers responded to COVID-19, and shipments of 400Gbps+ ports doubled YoY as Chinese equipment companies entered production.

Nokia PSE-V Coherent Chipset

Overview and analysis of Nokia’s fifth generation of coherent DSPs, the PSE-Vs, and PSE-Vc.

4Q19 Transport Applications Report

Compact Modular sales growth slowed in North America in the 4th quarter, but sales growth outside of NA was exceptionally strong and total worldwide sales grew nearly 50% year-over-year.

5th Gen Coherent Optics – 4Q19 Update

An update to October’s State of 5th Generation Optics report based on recent developments at Ciena and Infinera.

3Q19 Optical Applications Report

200G coherent shipments from China exceeded forecasts, worldwide shipments of 100G coherent ports will now decline until lower-cost alternatives emerge.