OCP25 EMEA Summit Report

1MW racks, 200G LRO, and 100G LRO VCSELs

The Optical Circuit Switching Market – 1Q25

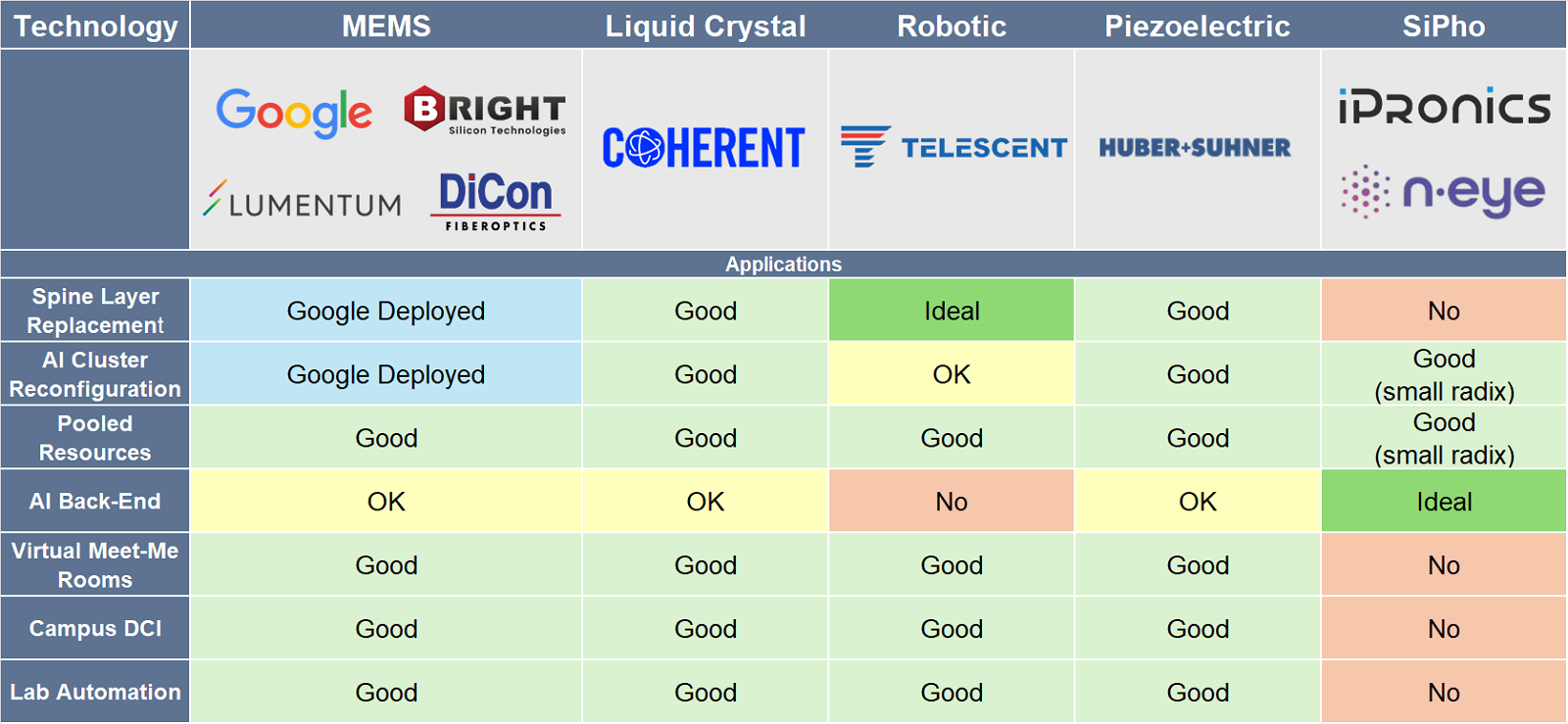

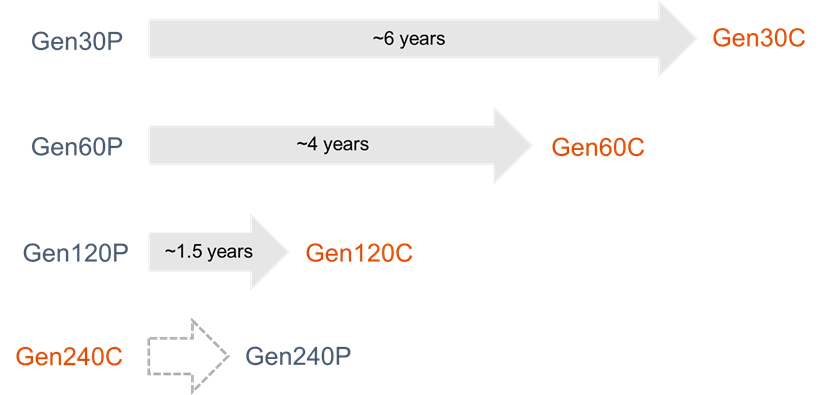

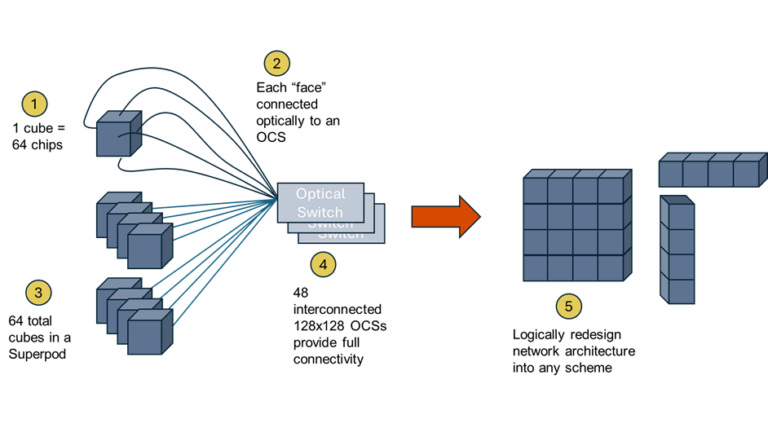

In this update to our OCS report we cover more vendors and technologies, investigate more applications, and introduce a forecasting model.

800ZR/ZR+: Expanding the Pluggable Coherent Market

Join Google, Ciena, and Marvell to learn how pluggable coherent will play an even larger role with the introduction of 800ZR/ZR+ and how its improved performance enables both new service provider applications and a superior DCI solution.

IP-over-DWDM Pluggables Forecast

IP-over-DWDM deployments of 400/800/1600ZRx optics and adoption across market segments

The Optical Circuit Switching Market

The current state of the art in OCSs, the players, why it matters today, and forecasts for the future.

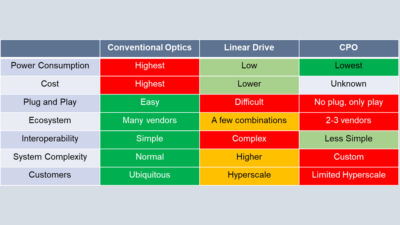

The Linear Drive Market Opportunity

Examines the benefits and challenges of Linear Drive and provides a preliminary assessment of its impact.

4Q22 Weekly Earnings – META GOOG AMZN GLW JNPR MTSI

Cloud capex outlook for 2023 summarized

Acacia 1Q20 Vendor Summary Report

Acacia’s results are a bellwether to the industry. This report looks at the most recent results for the company and examines them in the context of historical trends.

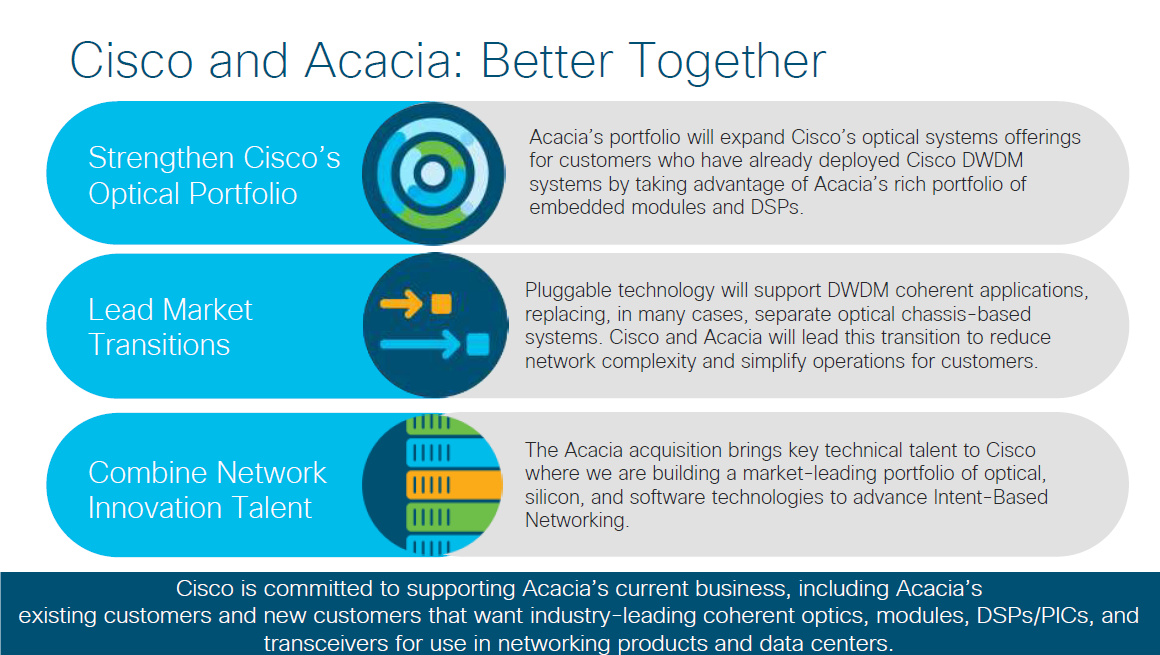

Cisco Buys Acacia

Acacia is a transformational acquisition that can vault Cisco into a market leadership position as the world transitions to disaggregated network design and pluggable, interoperable coherent optics.

OFC2019 – Inside the Datacenter

The next major stop on the road to faster speeds in the datacenter is 400Gbps Ethernet, and activity at OFC2019 centered on making this speed a feasible commercial option.

OFC2019 – Open and Disaggregated Networks

Open and disaggregated network equipment, software, and standards were a common theme on the floor and in presentations at OFC this year.

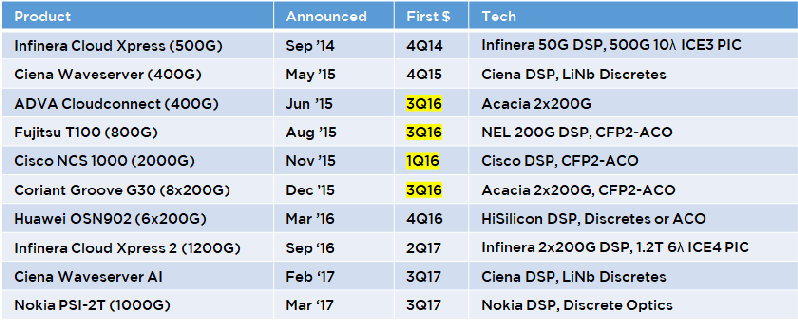

OFC2019 – Compact Modular

The compact modular format continues to be the fastest growing segment of the optical hardware market. In this section, the announcements and demonstrations at OFC are detailed.

OFC2019 – Coherent Technology

Coherent announcements and roadmaps at the show focused on two themes: lowering the power of coherent technology for use in pluggable applications and increasing baud rates to raise the maximum capacity of a single wavelength beyond 600Gbps. And despite few new ROADM announcements, there was a spirited debate about future ROADM architectures.

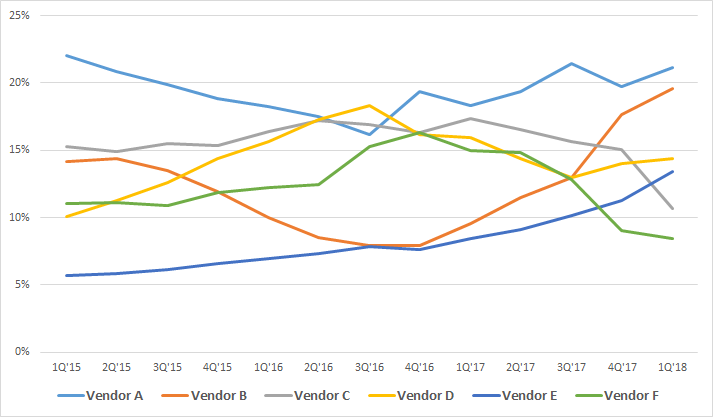

Cloud Spending on Optical Hardware – 1Q18 Update

In October 2017, Cignal AI analyzed the occurrence of a slowdown in spending by cloud & colo operators and quantified the magnitude of its impact (see Analysis: 1H17 Cloud and Colo Spending Slowdown).

OFC 2018 – Operator Perspectives

Each year at OFC, we have the valuable opportunity to hear from the network operators themselves to better understand their vision for the future network. This year, there were some…

OFC 2018 – Compact Modular Equipment

Compact Modular Equipment took center stage at OFC 2018

Analysis: 1H17 Cloud and Colo Spending Slowdown

Cignal AI’s recent Optical Customer Markets Report discovered an unexpected weakness in 2017 optical transport equipment spending from cloud & colo operators (see Cignal AI Reports Unexpected Drop in Cloud and Colo Spending). This surprising trend was then further supported by public comments later made by Juniper and Applied Optoelectronics, prompting us to examine the situation in greater detail.

OFC 2017 – Inside the Datacenter

100G and the Road to 400G

The transition to 100G network speeds inside the data center is underway at every major hyperscale operator simultaneously, creating major industry bottlenecks. Despite QSFP28…

Intel 4Q15 Earnings Call

Virtually all of the CPUs used in data centers come from Intel, therefore the Data Center group sales are a useful macro barometer for the growth and outlook of data…