Compact Modular Equipment took center stage at OFC 2018. News included speed upgrades to existing systems, the emergence of new switch/router variants, and open line systems designed to address the growing interest in optical hardware disaggregation.

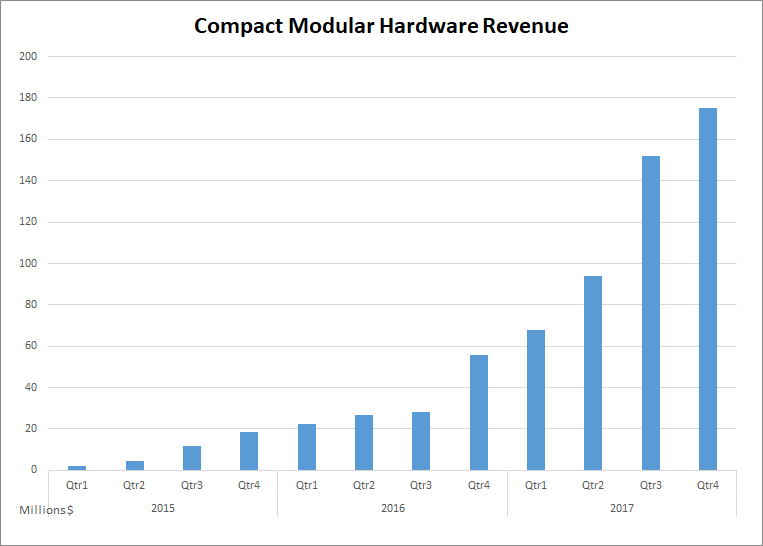

2017 was a period of exponential revenue growth for compact modular optical hardware. Products in this category include the well-recognized Infinera CX, Cisco NCS1000, and the Ciena Waveserver. All three of these hardware products were originally built for DCI applications, and as a result, some refer to these systems as ‘DCI hardware’. To do so is inaccurate; DCI is not a type of equipment but an application. Cignal AI prefers the term ‘Compact Modular’ to describe these small 1 or 2 RU chassis systems that allow operators to build networks in a modular way.

Compact Modular systems are now breaking out of DCI applications in cloud networks and finding new roles in Cable MSO and Incumbent networks around the world. Operators across all applications and regions are keenly interested in these systems, especially operators seeking a more disaggregated hardware design approach.

Key Takeaways

- Compact modular systems are the fastest growing segment of the optical market, as growth extends beyond the initial cloud and colo customers who used these systems for DCI.

- These systems form the building blocks for operators with unique requirements who seek to build an application-specific optical network.

- Cisco, Coriant, and Fujitsu announced systems which do not have much hardware differentiation between them, but they do take different architectural and software approaches. These three systems join those already announced previously by ADVA, Infinera, and Ciena.

- Ciena and Juniper announced combined Ethernet/IP platforms with coherent interfaces. Cable MSOs and 5G networks are the target applications for these systems.

- Ciena and Cisco announced open line systems which are impressive but costly. Large operators with big networks are likely to constrain the requirements of their line system in order to cut costs. These new open line systems are likely to evolve further to meet these needs.

Compact Modular Defined

The Compact Modular segment is the fastest growing part of the optical hardware market and was a prominent focus of OFC2018. Most of the major equipment companies in attendance showcased their compact modular systems in Market Watch presentations or through new product announcements. Cloud and colo, Incumbent, and Cable MSOs all identified these systems as a crucial technology for future network deployments.

Compact Modular Systems

| ADVA | Cloudconnect Teraflex |

||

| Ciena | Waveserver | ||

| Cisco | NCS1000 | ||

| Coriant | Groove G30 | ||

| Fujitsu | 1Finity (T-Series, L-series) | ||

| Huawei | OSN 902 | ||

| Infinera | Cloud Xpress XT-500/XT-3300 |

||

| Nokia | 1830 PSI | ||

| ZTE | ZXONE 7000 |

One factor driving the popularity of the Compact Modular system is that the needs of network operators are currently diverging. Twenty years ago, a company such as AT&T would outline its requirements and most other operators would model their deployments accordingly. This is not the case today. The equipment and software requirements of AT&T are radically different from those of Google, Comcast, or even distant cousin Verizon. It is therefore difficult for OEMs to economically build systems that are designed just for one network operator segment.

This situation is where compact modular systems shine. Operators are moving toward a model where they can build a network tailored to its needs out of modular pieces from several vendors. The compact modular approach allows operators to mix and match components as needed to meet their application requirements.

The software to stitch these systems together will initially be built in-house. Going forward, groups like the Open Networking Foundation (ONF) are working to develop standardized APIs and software models for specific network functions.

Hardware adoption is white hot in this segment, and 2018 revenue tripled year over year to nearly $500M. Companies are driving investment to capitalize on the compact modular trend. We forecast that revenue in this segment will nearly double in 2018 – yet even with this growth compact modular remains a small part of overall optical hardware spending.

Source: Cignal AI Optical Applications Report (2H17)

OFC 2018 Product Announcements

Cisco, Coriant, and Fujitsu each chose OFC to announce new 600G capable compact modular platforms. These announcements follow those made last year by ADVA, Ciena, and Infinera regarding higher speed platforms.

Each of these systems now supports multi-haul operation; the ability for a single coherent port to operate at varying baud rates and modulations to maximize capacity on links spanning from 100km to 4000km+. Multi-haul operation is in almost all new coherent systems that reached the market in 2017. All three of these newly announced 600G capable systems are slated to be in production by the end of 2018.

Cisco ncS1004

Cisco announced a new member of the very successful NCS1000 series; the NCS1004. The NCS1000 family of systems only began shipping in late 2016, but it has been quite successful and earned the number two spot in compact modular market share in 2017. The NCS1000 provides a combination of CFP2-ACO design, 250G per lambda operation, and a flexible software model that appeals to cloud and colo operators.

Cisco’s new NCS1004 builds upon takes the 1000 concept and adds in flex-coherent operation up to 600Gb/s per wavelength. Recognizing the industry-wide move away from CFP2-ACO as part of a transition to 400G speeds, the NCS1004 can use both silicon photonics and indium phosphide based discrete optics. Cisco is confident both technologies will work equally well.

Coriant

Coriant introduced a follow-on module (CHM2T) to the Groove G30 platform which added 600G operation. The Groove was the first system to feature ‘sleds’, effectively cards that can be customized with certain features and allow the network operator to personalize any given system. The Groove’s sleds allow the entire installed base to make the jump to 600G operation, where products from Cisco, Ciena, and others require users to install new chassis to support higher speeds. Users can purchase a CHM2T and deploy it in an existing G30 chassis – something no other vendor can do. It also gives the Groove a leg up in 2018 as its customers can deploy 200G coherent now and know the upgrade path is future proofed.

Coriant also offers a range of amplifiers, filters, and optical functions that can occupy the sleds – and the company is developing more. While the Groove hasn’t had the same commercial success as the Ciena, Cisco, and Infinera platforms, it did pioneer features now being adopted by systems like Cisco’S NCS1000.

Fujitsu T500, T600

Fujitsu announced new generations of its 1FINITYcompact modular product line – the T500 and T600. Like the Cisco and Coriant, Fujitsu increases coherent wavelength speeds to 600G and uses the latest in DSP and discrete InP optical technology.

Fujitsu has made incumbent and cable MSO operators customers a central focus, which is not surprising considering its long relationships with AT&T and Verizon. The 1FINITY is designed to meet the needs of AT&T’s network hardware disaggregation efforts, including Open ROADM hardware and CORD software architecture.

ADVA, Infinera, and Ciena

All three of these vendors announced new compact modular systems prior to OFC 2018 and they had live demonstrations or mock-ups of the new hardware on site. Ciena is already in production with its Wavelogic-based Waveserver Ai, capable of multi-haul 400G operation. Waveserver Ai will be the only 400G system to ship in volume during 2018, and it will be exciting to see what sort of market prominence this affords Ciena.

Infinera is in production with its 4th generation coherent optical engine and uses it in its CloudXpress 2. The engine (ICE4) is capable of 200G per wavelength operation but the company claims that it has a structural cost advantage when competing against other 200G solutions because of its vertical integration and use of photonic integration. Infinera also announced its technology roadmap which we discuss in our report on coherent technology.

ADVA announced its 600G system – Teraflex – at OFC2017, and it is based on much of the same technology as other 600G systems.

Coherent + Ethernet & IP

Ciena and Juniper announced new compact modular products that combine both coherent optical transport with data inter-networking.

Ciena’s new product is the 8180 coherent networking platform, a 6.4 Tb/s packet fabric based on off-the-shelf Ethernet switching silicon. Half of the switch bandwidth can be dedicated to four ‘sleds’ with coherent optics, each of which can currently operate up to 400Gb/s using Ciena’s Wavelogic AI. The other 3.2 Tb/s of switch bandwidth is dedicated to 32 100GbE QSFP ports.

The 8180 is designed with a number of new applications. The first is the densification of future 5G mobile networks and the convergence of both mobile fronthaul and backhaul traffic into a common Ethernet interface. The second is fiber deep – the deeper penetration of Ethernet interfaces into Cable MSO access networks. Cable operators are moving from analog DOCSIS based interfaces to Ethernet and increasing the number of total interfaces by an order of magnitude. Both 5G and fiber deep require lots of Ethernet switching and low-cost coherent backhaul, which the 8180 is designed to meet head-on.

Juniper announced the ACX6360, which is a derivative of its much larger carrier-class PTX router. The 6360 is essentially a single blade of the PTX, complete with its extensive L3 routing capabilities, paired with 8 x 200G coherent interfaces and 16 100GbE QSFP clients. Juniper plans to offer the hardware with a limited Ethernet switching feature set, and then sell additional software licenses that can leverage the extensive packet capabilities of the blade. The licenses could be application specific and include features specifically needed for Cable MSOs, content distribution networks, or wireless.

Open Line Systems

For some time now, companies have claimed to offer open line systems, but they have been quick to gloss over inherent limitations. Some systems required custom pilot tones or placed performance restrictions on the wavelengths from other vendors. All of them failed to operate with maximum spectral efficiency.

Now, there is a new class of optical common equipment coming to market with the goal of eliminating those issues and building truly open optical line systems. Ciena announced the 6500 RLS (Reconfigurable Line System) while Cisco presented the NCS1010. Both are designed to have the hardware flexibility (flexible-grid ROADMs, independent closed loop subsystems) and the software interfaces (North/Southbound NETCONF/YANG data models) needed to adapt to disaggregated hardware environments. Ciena and Cisco’s hardware is even capable of running 3rd party applications written by the network operator itself.

All of this flexibility comes at a premium cost. If one were to tear down the hardware of the 6500 RLS, NCS1010 (or any of the other systems that follow) you’ll find top-of-the-line components end-to-end. Users who expect open hardware and open line systems to be cheap will be in for a shock.

In order to accommodate a range of potential transponder vendors and network designs, the equipment must be designed to handle every possible situation. This necessitates the elimination of fixed grid AWGs and replacing them with flex-grid ROADMs. It requires sophisticated amplifier power balancing techniques and embedding OTDR testing hardware in each node. The result is a Ferrari, not a Ford, and the price tag shows it.

But here lies the dirty little secret of these new open systems: They are not meant to save money. And to be fair, the operators who are moving towards open systems have not signaled that lower cost is their objective. They want the flexibility to build application-specific networks and solve the problems unique to their business. Maximum flexibility comes at a price.

The open systems announced by Cisco and Ciena are just a first step to trying to meet these needs. Large network operators seeking open line systems will find ways to constrain their network architectures to avoid needing maximum flexibility. They will then seek out the lowest cost modular equipment to build these line systems – a vision that Google clearly outlined during its Market Watch presentation.