Google’s AI Buildout Drives Higher Optical Circuit Switching Forecast

Updated outlook lifts 2029 forecast over 40 percent

800ZRx Growth to Surpass All Earlier Coherent Generations

Coherent pluggable performance is comparable to embedded solutions at 400G and closing the gap with 800G.

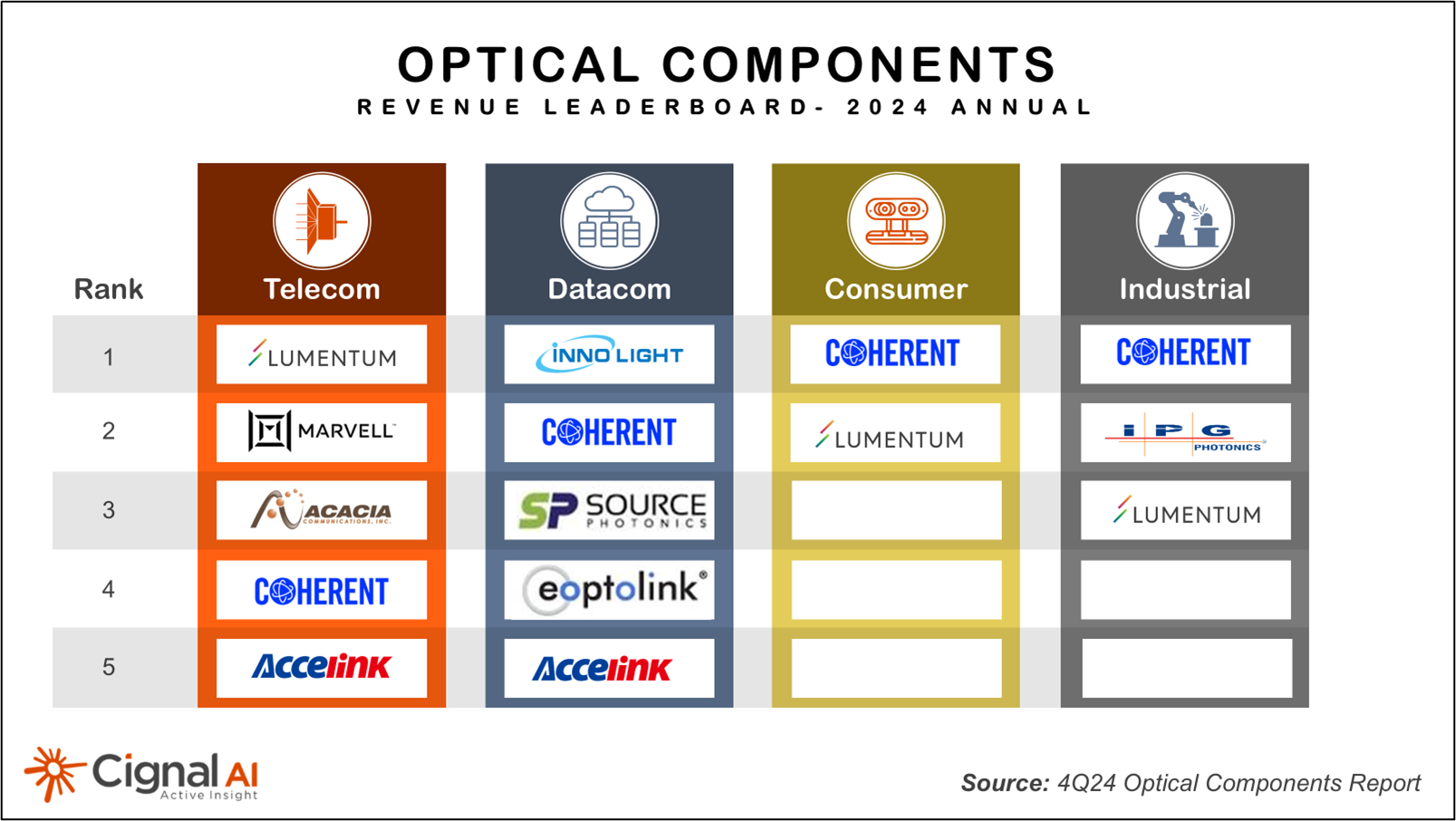

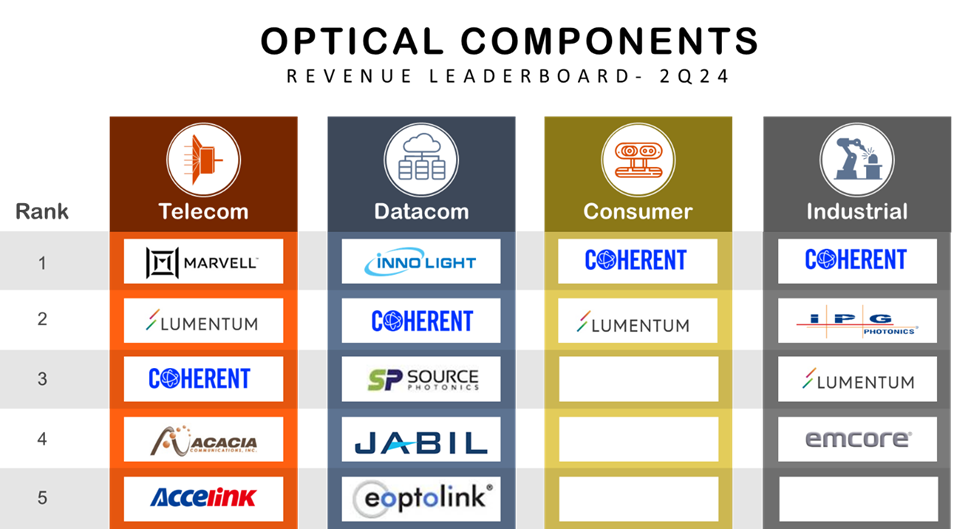

Optical Component Revenue Reaches Nearly $25B in 2025

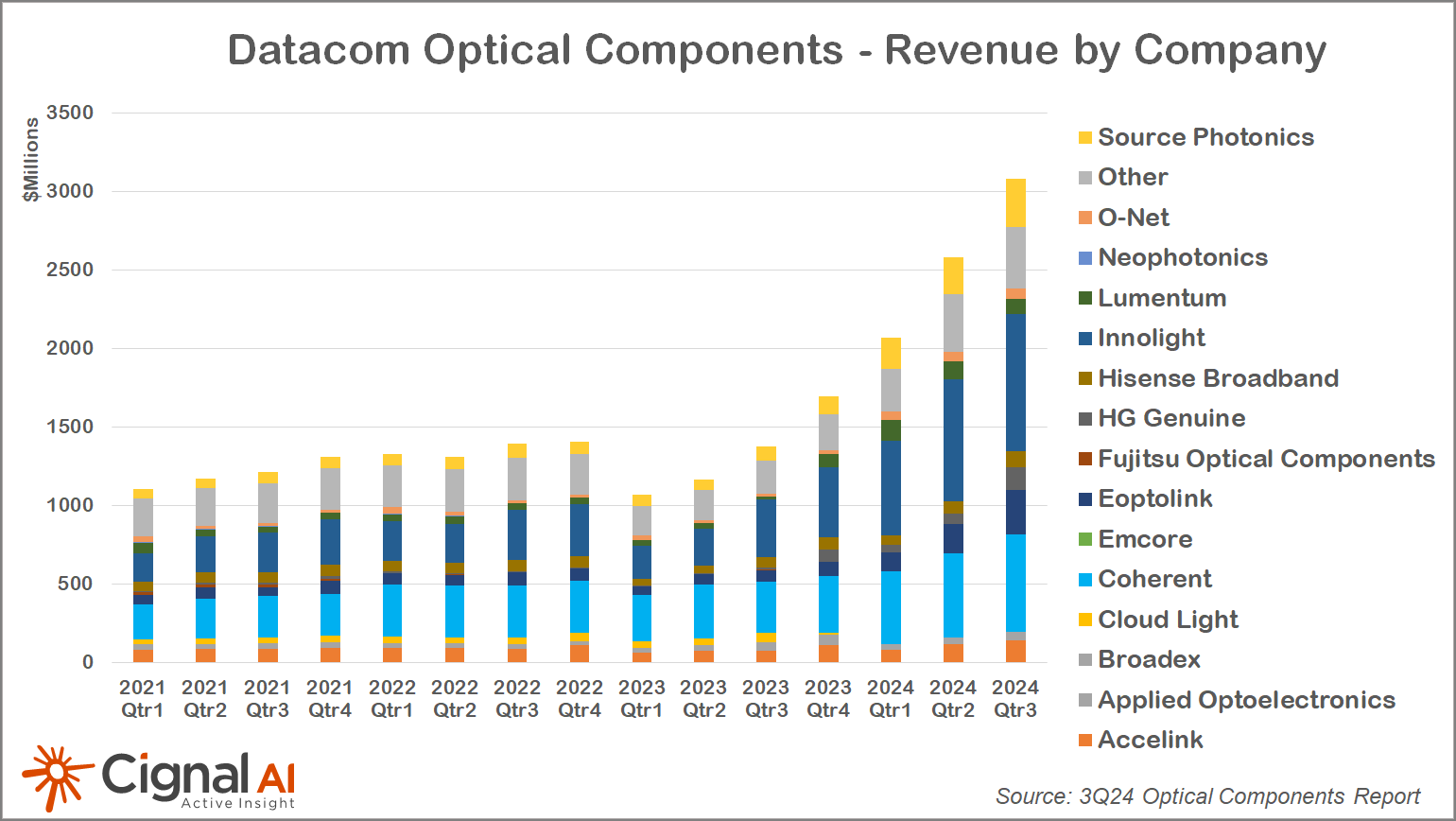

Datacom component revenue growth to exceed 20% through 2029.

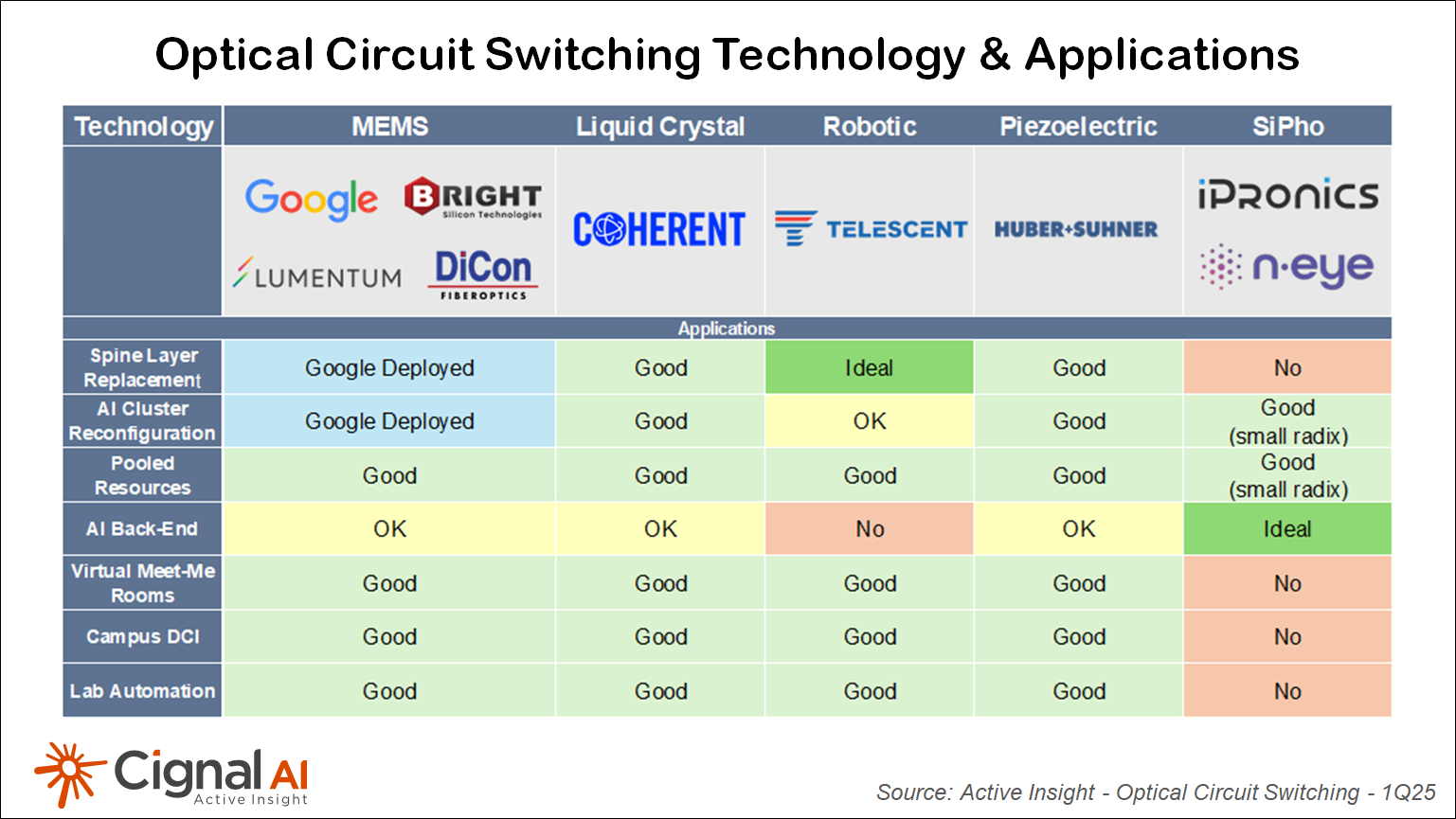

Optical Circuit Switching Market to Exceed $2.5B in 2029

OCS Becoming a Foundational Technology for Datacenters

Optical Transport Market Rebounds in 2Q25 as Hyperscalers Ignite Recovery

North America Up Over 40% as AI Long-Haul Builds Begin

800G Coherent Pluggable Shipments to Exceed $1B Revenue in 2026

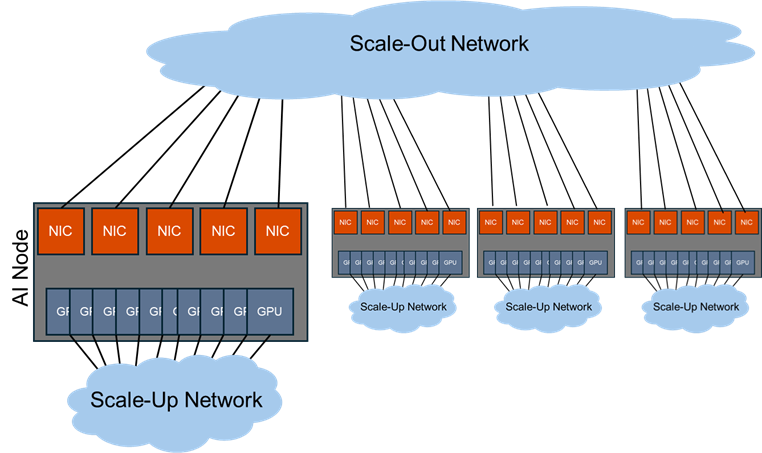

Hyperscaler AI Architectures Drive Increased Demand for Long-Reach Coherent Pluggables

800GbE Optics Shipments to Grow 60% in 2025

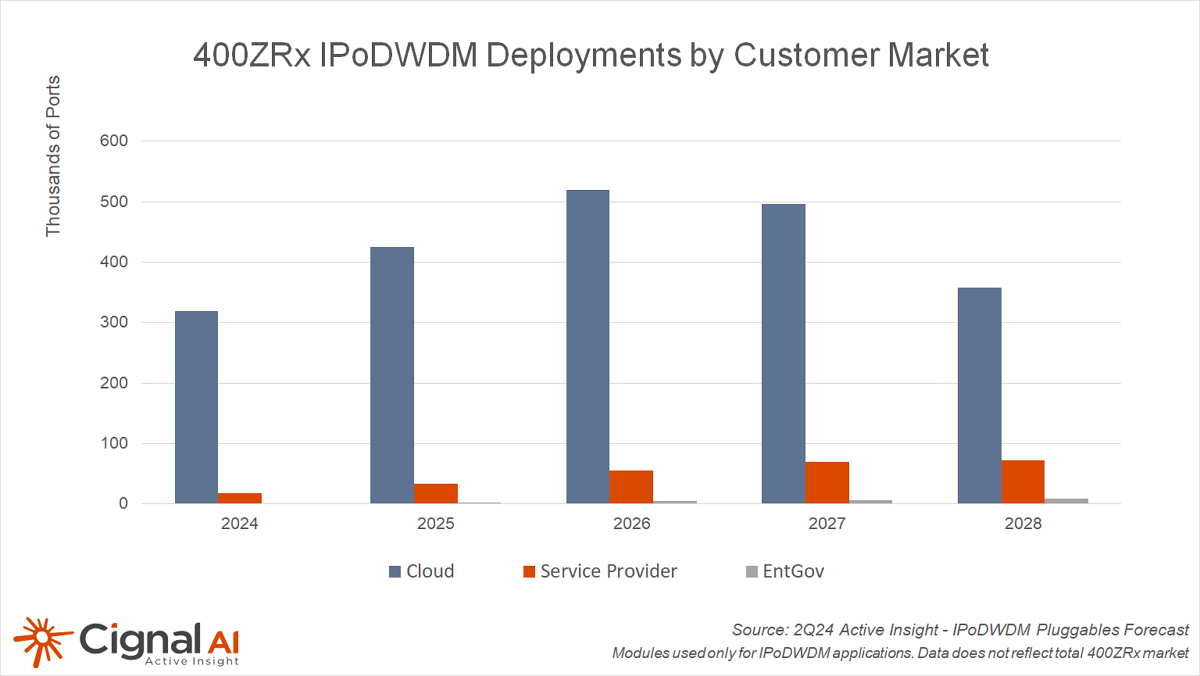

400/800ZRx Shipments Expected to Surpass 600k Units

Co-Packaged Optics: Inevitable but Not Imminent

Copper Replacement Remains the Killer Application

Optical Circuit Switching Market to Exceed $1B by 2028

Compelling Usage in AI Applications Driving Widespread Adoption

Over 20 Million 400G & 800G Datacom Optical Module Shipments Expected for 2024

AI Deployments Create Unprecedented Ramp in Datacom Optics

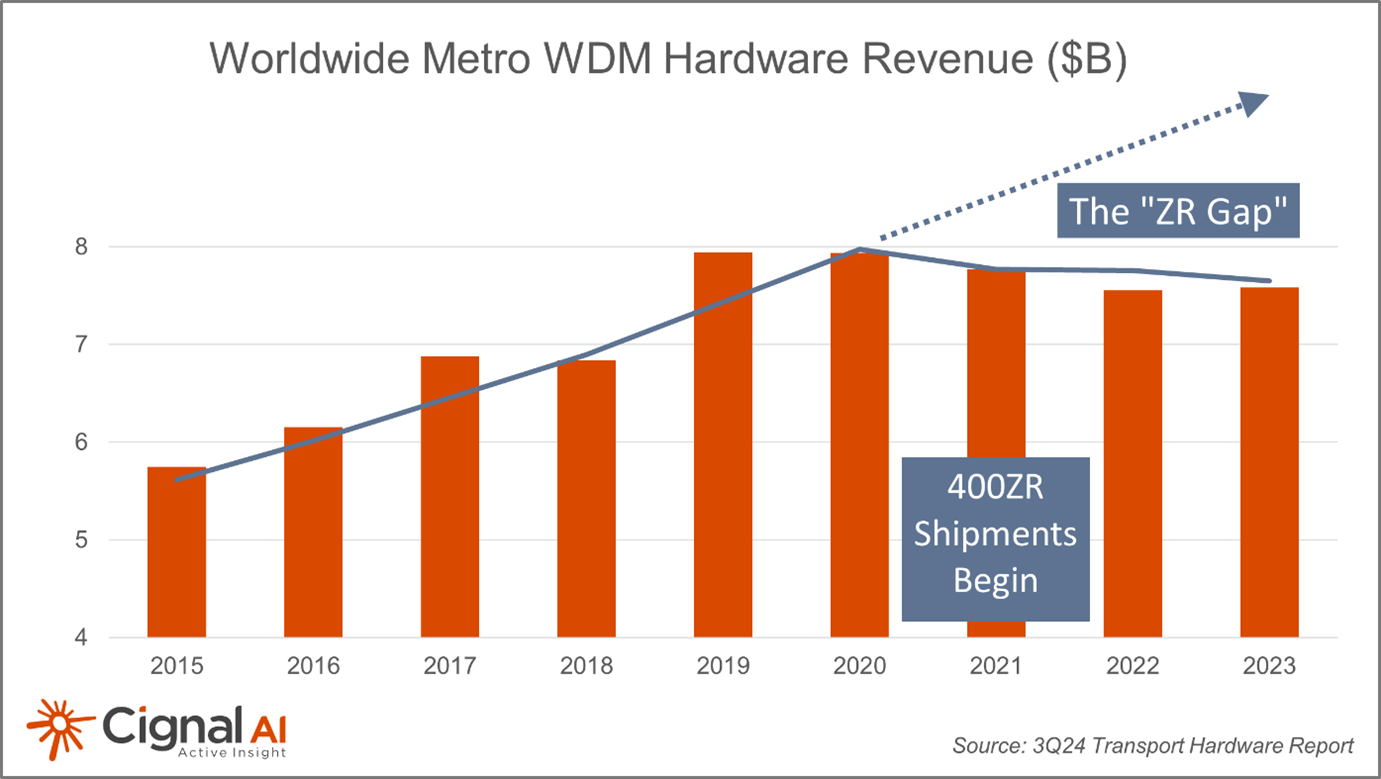

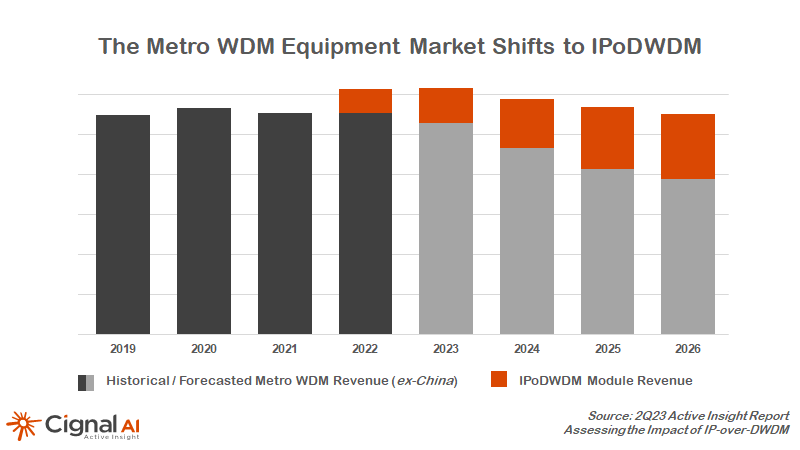

Metro WDM Market Faces Shift as Operators Move to Pluggable Coherent Optics

Hyperscale Operators Grow Hardware Spending 7%

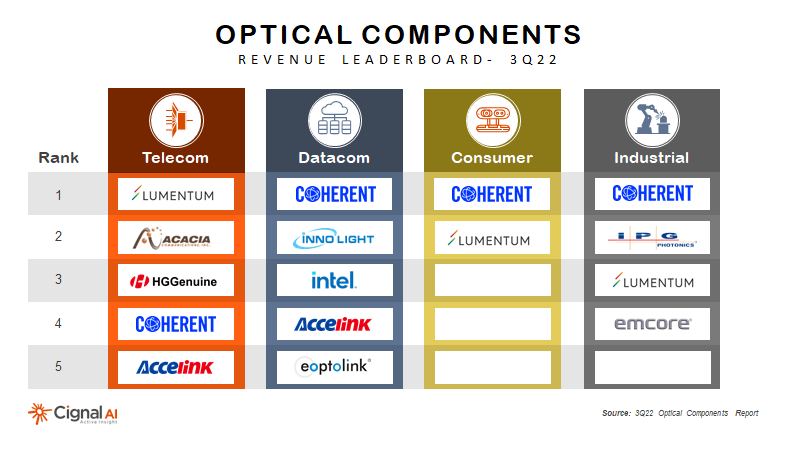

Datacom Optical Component Revenue Doubles in 2Q24

Record pluggable coherent shipments are not enough to reverse Telecom revenue weakness

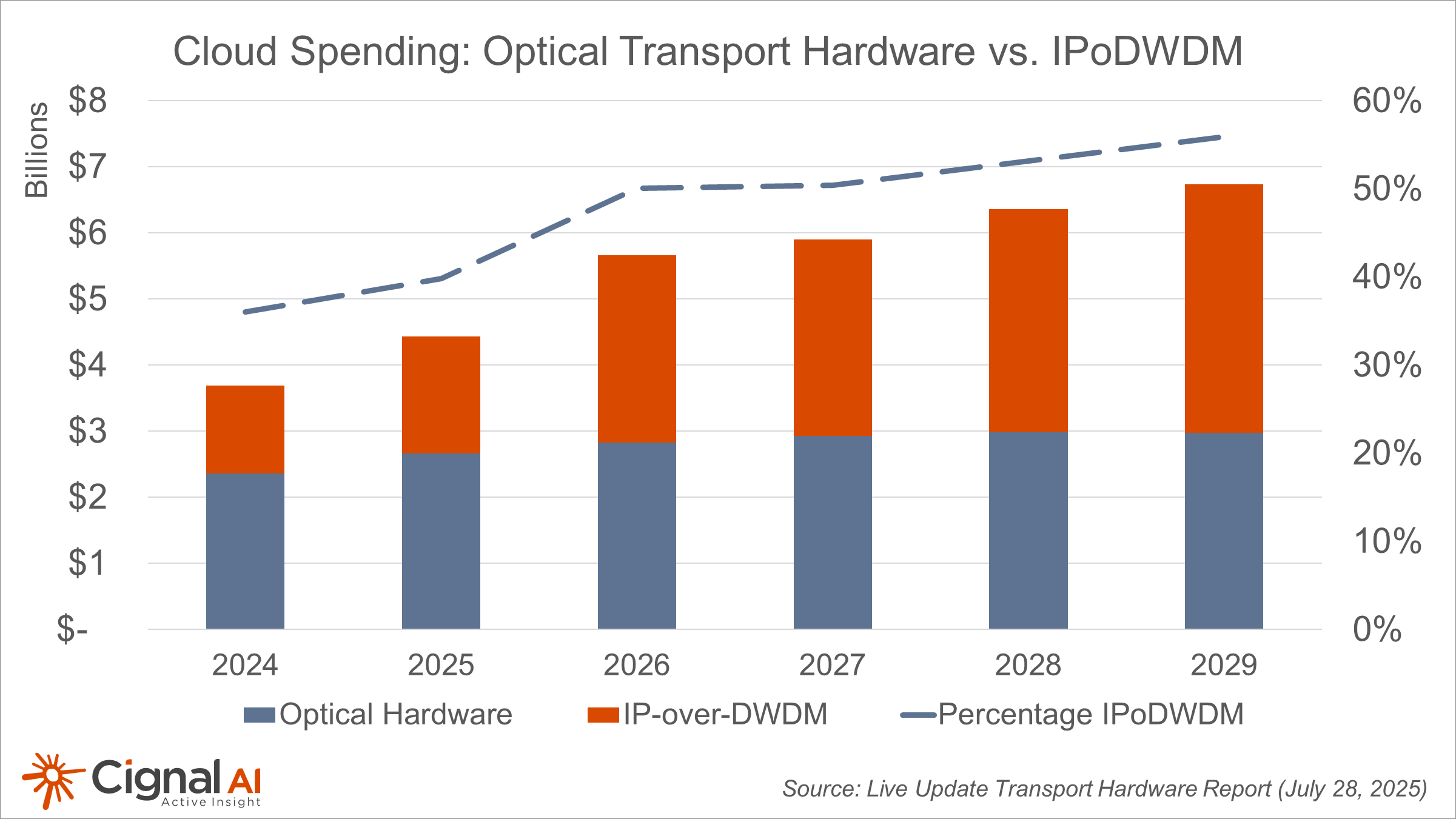

IP-over-DWDM Port Deployments to Top 700k in 2027

Cloud Operators Drive Adoption of Converged Architecture

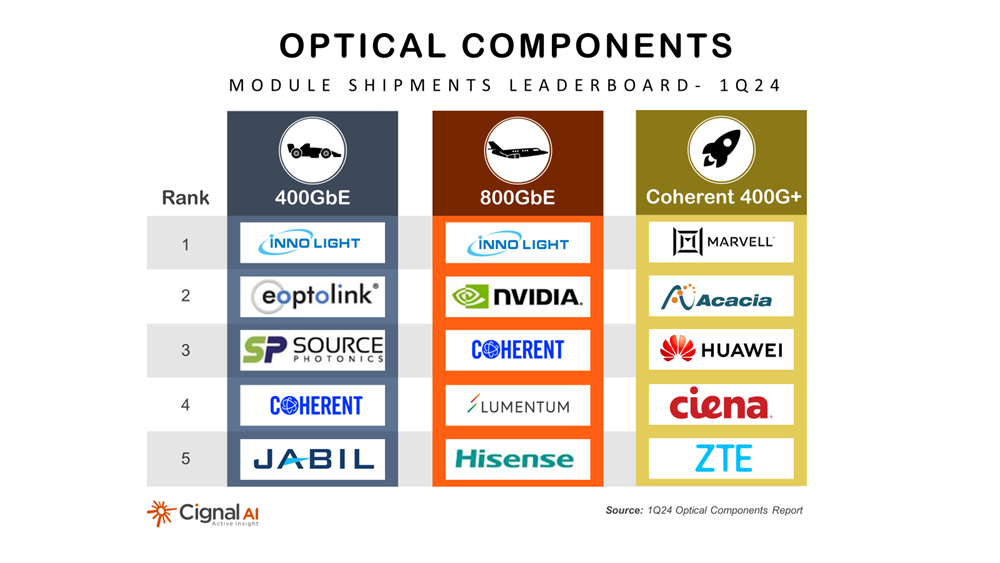

Demand for Datacom Optical Modules Reaches Record Levels in 1Q24

400 and 800GbE module shipments jump more than 25% QoQ

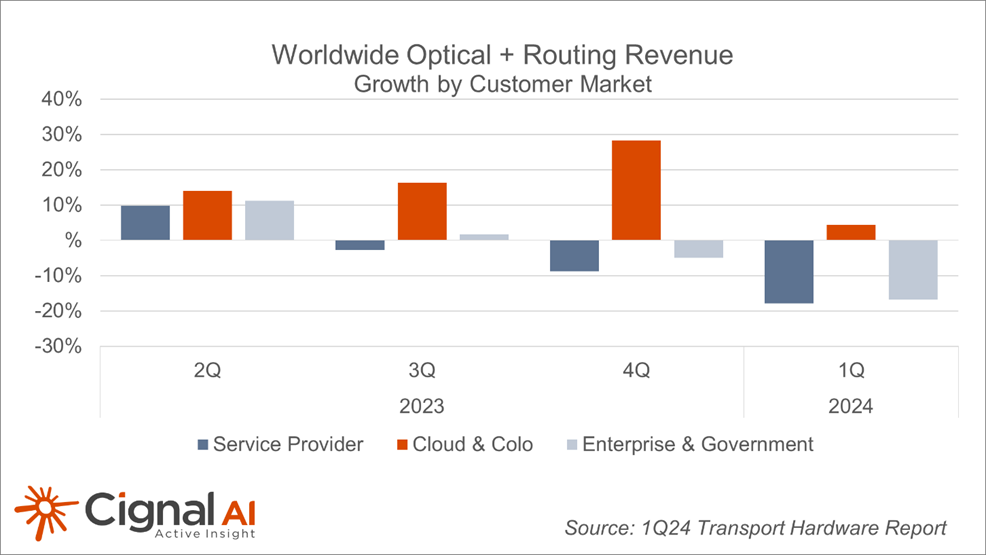

Optical and Routing Hardware Spending Drops 15% in 1Q24

Excluding Growth in China, Sales Declined 21%

AI Deployment Accelerates 800GbE Optical Growth

Coherent optics growth is healthy but Telecom component market remains in doldrums

Cloud Spending on Optical Transport Jumps 46% in 4Q23

Traditional Service Provider Spending Remains Weak

30% of Metro WDM Hardware Spending to Shift to Router-hosted Coherent Pluggables

IPoDWDM represents a $1.6B Opportunity by 2026

WDM Transport Spending Weakens During 2Q23

Network Operators Absorb Inventory and Pause Orders

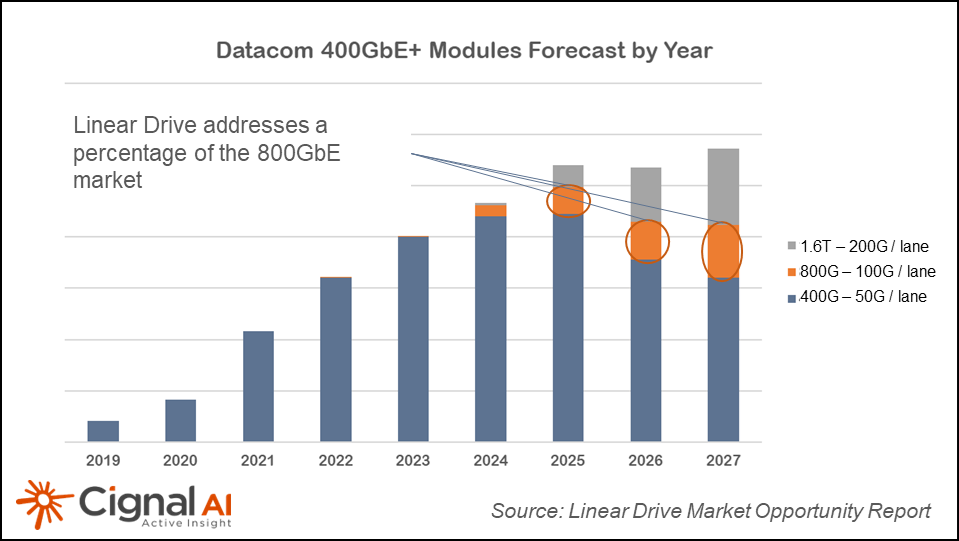

Linear Drive will be a Small Fraction of 800GbE Market

Promise of Power Reduction but Challenges Will Limit Deployment