Almost 2M 400GbE Transceivers Shipped for Datacenter Applications

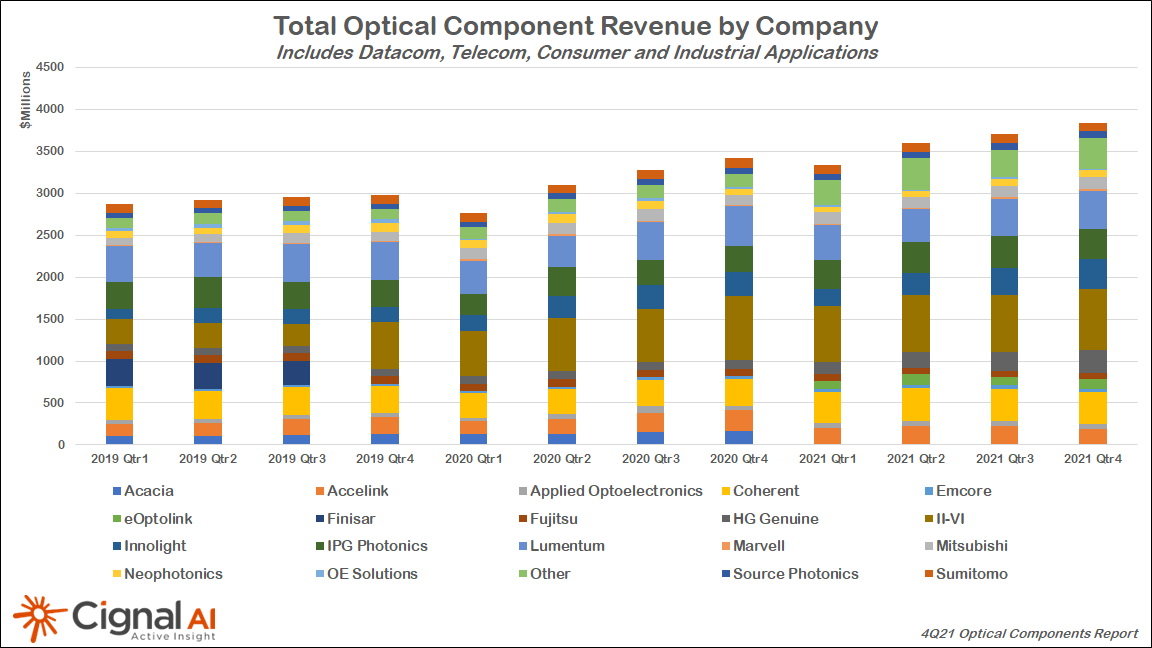

BOSTON (April 13, 2022) – Cloud operator capex for hyperscale datacenter expansion drove Datacom optical component revenue growth by 27% to reach $4.7B in 2021, as reported in Cignal AI’s new Optical Components Report. This growth outstripped component revenue growth from Telecom, Consumer, and Industrial optical component applications. Total revenue for optical components across all four segments grew 15% to reach $14.5B in 2021.

The Optical Components Report also tracks detailed unit shipments of Datacom and Telecom transceivers across multiple module types and reaches. Shipments of 400GbE Datacom modules doubled and reached record levels in 2021, as large cloud operators and select enterprise customers transitioned from 100G to this new speed.

“The transition to 400GbE is well underway, and pluggable coherent 400Gbps technology is revolutionizing the design of the optical networks that connect datacenters,” said Scott Wilkinson, Lead Optical Component Analyst at Cignal AI. “400Gbps speeds will drive spending and bandwidth growth both inside and outside the datacenter in 2022.”

More Key Findings from the 4Q21 Optical Components Report:

- Supply chain difficulties limited Telecom optical components market growth the most in 2021. However, the segment is forecast to grow more than 8% in 2022.

- Consumer component revenue for 3D sensing applications was flat YoY as lower-cost components offset higher unit shipments.

- Industrial optical components used for welding and medical applications grew 18% in 2021, following a weak 2020. Following the acquisition of Coherent, II-VI is poised to control over 50% of this market.

- 1.8M QSFP-DD Datacom modules shipped during 2021, most of which were DR4 format. The report also tracks SR4, FR4, and LR4 Datacom transceivers.

- Over 60k 400Gbps pluggable coherent modules shipped last year, the majority of which were QSFP-DD ZR. The report captures the shipment details of all the emerging derivatives of this format, including ZR, ZR+, 0dB ZR+, and CFP2 based ZR+.

- Shipments of 200Gbps coherent CFP2 modules grew 17% to just over 200k units during 2021 as Chinese OEMs ramp this speed (which is less dependent on western technology) for longer distance metro and long haul applications.

About the Optical Components Report

Cignal AI’s Optical Components Report is published quarterly and provides revenue-based market share of company sales into four optical component markets – Datacom, Telecom, Industrial, and Consumer. The report also tracks detailed unit shipments of Datacom and Telecom components, including Datacom transceivers used for short-reach applications and pluggable and embedded transceivers for Telecom applications. Five-year forecasts are also provided for all segments.

Included in the report are data from Accelink, ADVA, Applied Optoelectronics, Ciena, Cisco, Coherent, Emcore, eOptolink, Fiberhome, Fujitsu, HG Genuine, Huawei, II-VI, Infinera, Innolight, Intel, IPG Photonics, Lumentum, Marvell, Mitsubishi, Molex, NEC, Neophotonics, Nokia, OE Solutions, Packetlight, Source Photonics, Sumitomo, and ZTE. A full description of the report including an up-to-date listing of all product categories, as well as reports and presentations, are available on the Cignal AI website.

This is the final Beta release of the report and follows nine months of development and feedback from optical component companies seeking a comprehensive picture of the optical component market. Access to this report is free during the Beta period for all companies that contributed to its development, and it will join Cignal AI’s quarterly reporting services going forward.

Clients and development partners can join a live presentation of the report results Thursday, April 14th at 11 AM ET by registering at the website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and its end customers. Our work blends expertise from various disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us