Optical and Packet Transport Spending Weaker in EMEA and Asia

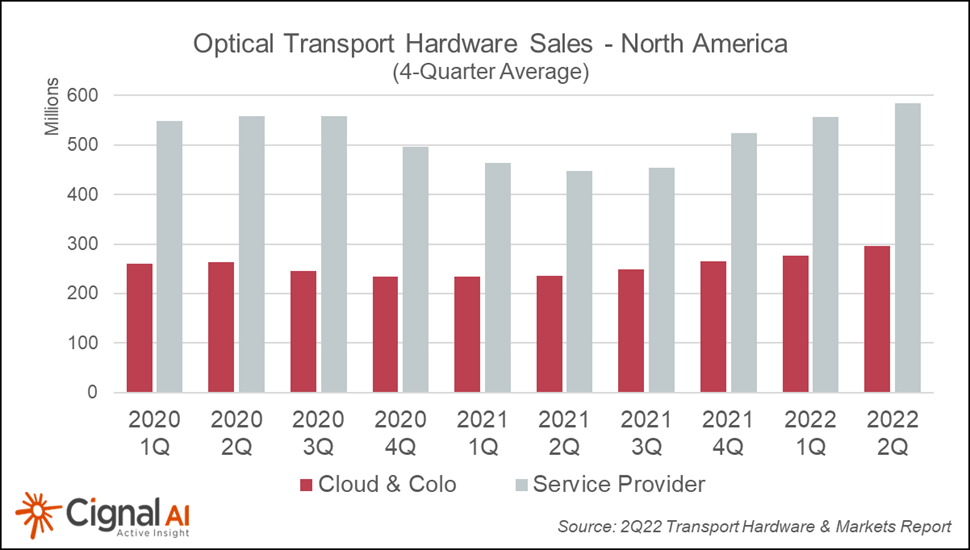

BOSTON (August 24, 2022) – Spending on optical transport hardware by North American network operators grew more than 20% in 2Q22 compared with the year before. Equipment capex by traditional network operators as well as large cloud operators has now surpassed pre-Covid levels, according to the most recent Transport Hardware Report from research firm Cignal AI. Spending by European and Asian operators remains low by comparison.

“Funding for broadband infrastructure, continuing 5G rollouts, and pent-up demand because of supply chain disruptions have catalyzed growth in North American transport spending,” said Kyle Hollasch, Lead Analyst for Transport Hardware at Cignal AI. “Massive order backlogs and an anticipated easing of supply issues point to a period of rapid spending growth for Service Providers and Cloud operators in the region.”

Bookings remain exceptionally strong, with large vendors universally reporting orders exceeding revenue resulting in record backlogs. Equipment vendors indicate that supply chain difficulties affected their ability to ship products and delayed network deployment and acceptance, postponing recognition of some revenue.

Additional 2Q22 Transport Hardware Report Findings:

- Second quarter 2022 worldwide optical hardware spending grew 3%. Revenue grew in North America and China while all other regions declined.

- Worldwide Cloud and Colo spending grew over 10%, compared to roughly flat spending by traditional service providers. Enterprise and Government sales declined YoY for the fifth consecutive quarter as the heightened spending levels during the pandemic reverted to normal.

- Cisco, Infinera, and ADVA benefited the most from an increase in spending by Cloud Operators in North America

- Results varied widely by region; North American optical revenue grew to the highest second-quarter level on record, while European spending declined. EMEA’s decline is due to a shift from transport to RAN spending, combined with a disadvantageous dollar exchange rate.

- Worldwide packet transport sales grew 6%, driven by Cloud and Colo packet spending, which grew 16%.

- North American packet transport sales climbed in tandem with optical and grew over 30%, with Cisco, Nokia, and Juniper all participating. EMEA packet sales fell.

Live Presentation Available

Results from Cignal AI’s Transport Hardware Report are presented live each quarter by Lead Analyst Kyle Hollasch. Clients are welcome to register for a presentation on September 7th at 11 AM ET.

About the Transport Hardware Report

Cignal AI’s Transport Hardware & Markets Report is issued each quarter and examines optical and packet transport equipment revenue across all regions, customers, and equipment types. The initial analysis is based on financial results, independent research, and guidance from individual equipment companies. Hardware forecasts are reviewed and updated in the following weeks, along with spending trends by operator type.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. It also tracks equipment spending by end-customer market type, including traditional service provider, cloud/hyperscale, and enterprise/government network operators. Vendors in the report include Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Ribbon, Tejas, Xtera, ZTE as well as other vendors. A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us