400GbE Optical Module Unit Shipments up 50%

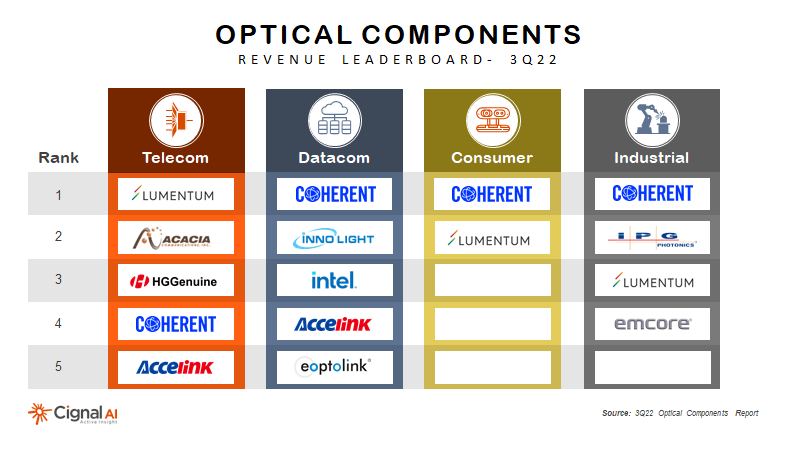

BOSTON (January 11, 2023) – Datacom optical component revenue recovered from two quarters of declines to post solid gains in Q3, led by 400GbE optical modules. Innolight and Coherent (formerly II-VI) drove growth with their expanded shipments into hyperscale applications, according to the most recent Optical Components Report from research firm Cignal AI. Lumentum remains the leading Telecom component supplier in this segment, in which overall revenue grew 6% YoY.

“400Gbps was the success story both inside and outside of the datacenter this quarter, as 400GbE datacenter optics shipments recovered from a weak Q2 and 400ZR/ZR+ drove telecom bandwidth growth for DCI applications,” said Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI. “Looking forward to upcoming Q4 results and into 2023, telecom component demand will continue its recovery, while near-term growth of datacom optics will soften as inventory is absorbed.”

More Key Findings from the 3Q22 Optical Component Report:

- 400GbE optical module shipments returned to high growth levels this quarter and were up +50% YoY, but lower demand from hyperscale operators resulted in forecast cuts.

- After a drop due to a slowdown in orders at Amazon, 400GbE-DR returned to almost half of total 400G unit shipments in 3Q22.

- The growth of Gen60C coherent modules (400ZR/ZR+ & variants) slowed as inventory was absorbed at major customers. Specifically, CFP2 versions grew sharply as traditional telco vendors ramped sales.

- 100Gbps and 200Gbps (Gen30) coherent module shipments dropped dramatically in the quarter, mostly due to declines in sales by Chinese vendors.

- Coherent was the primary beneficiary of Consumer 3D sensing revenue gains, claiming 2/3rd of sales in the segment.

Live Presentation Available

Results from Cignal AI’s Optical Component Report are presented live each quarter by Lead Analyst Scott Wilkinson. Clients are welcome to login and register for a presentation tomorrow, January 12th at 11 AM ET.

About the Report

Cignal AI’s Optical Components Report is published quarterly and provides revenue-based market share of company sales into four optical component markets – Datacom, Telecom, Industrial, and Consumer.

The report also tracks detailed unit shipments of Datacom and Telecom components, including 400Gbe/800GbE/1.6Tbe Datacom transceivers used for short-reach applications as well as pluggable and embedded transceivers for Telecom applications. Five-year forecasts are also provided for all revenue segments as well as unit shipments.

Companies included in the report are Acacia, Accelink, ADVA, Applied Optoelectronics, Broadex, Ciena, Cisco, Coherent, Emcore, Eoptolink, Fiberhome, Finisar, Fujitsu, Furukawa Electric, HG Genuine, Huawei, Infinera, Innolight, Inphi, Intel, IPG Photonics, Lumentum, Marvell, Mitsubishi, Molex, NEC, Neophotonics, Nokia, OE Solutions, Packetlight, SONT Technology, Source Photonics, Sumitomo Electric, Sumitomo Osaka Cement, and ZTE. A full description of the report including an up-to-date listing of all product categories, as well as reports and presentations, are available on the report page.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us