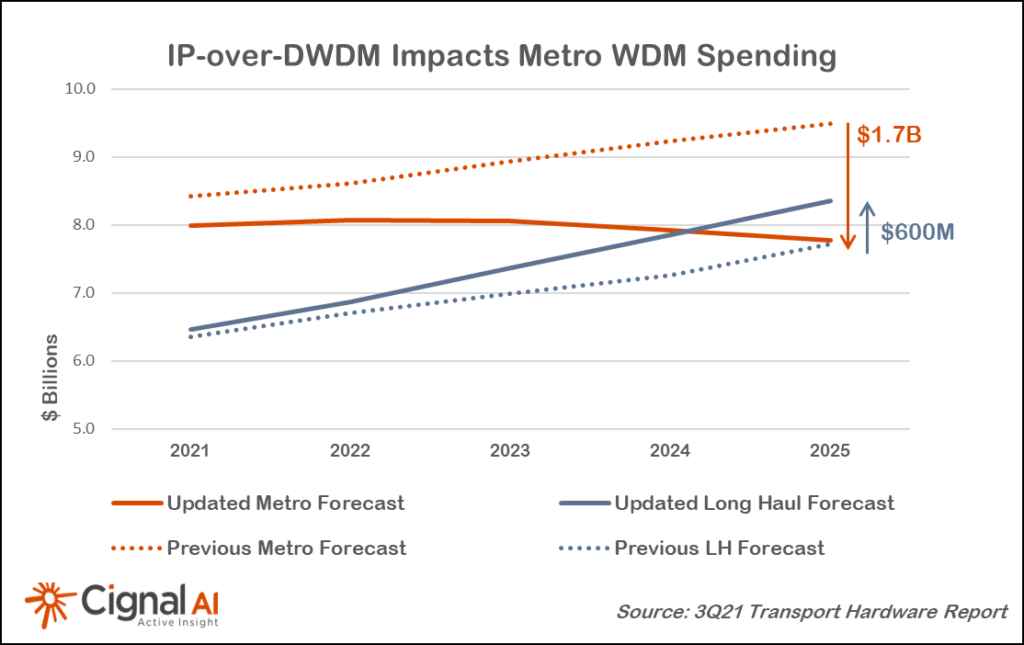

Metro forecasts cut as historical growth rate of 6% is expected to flatten by 2023

BOSTON (December 10, 2021) – Optical transport equipment deployment faces increasing headwinds as a broad number of network operators embrace IP-over-DWDM in Metro WDM applications, according to the most recent Transport Hardware Report from research firm Cignal AI. The impact of IP-over-DWDM on capex is expected to be moderate until 2023 when implementation of the new approach gathers momentum.

“IP-over-DWDM is a concept two decades old, but technical compromises, operational challenges, and high cost have prevented its widespread adoption. Gen60C 400ZR/ZR+ pluggable optics can solve these problems with availability well-timed to the 400 Gigabit Ethernet investment cycle,” said Kyle Hollasch, Lead Analyst for Transport Hardware at Cignal AI. “Hyperscale data center interconnect will drive early volumes, but service providers – who are responsible for 75% of optical CAPEX – should get on board in 2023 as the cost savings of IP-over-DWDM becomes impossible to ignore.”

Cignal AI has cut forecasted spending on standalone optical transport hardware by $1.1B in 2025 as operators introduce pluggable coherent optics into routing and switching equipment to replace standalone traditional and compact modular equipment. This decline will be partially offset by greater sales of IP Routing and Switching hardware, open line systems, and long haul WDM, as well as direct sales of coherent optics to hyperscale operators. Clients can read 400ZR IPoDWDM Market Impact and Forecast for more detail.

Additional 3Q21 Transport Hardware Report Findings:

- Total transport hardware (Optical and IP Switching & Routing) revenue declined -2.5%, with sales in China declining double digits for the second consecutive quarter.

- North American optical revenue grew for the 4th consecutive quarter and registered its first quarter of YoY growth since COVID impacted 2Q20. Fujitsu and Cisco led in revenue growth.

- Sales of optical hardware in EMEA increased YoY as the region registered its 6th consecutive quarter of growth. Regional market leaders Huawei and Nokia declined while ADVA, Infinera, and ZTE grew double digits.

- North American packet transport sales grew 6%, its third straight quarter of growth. Nokia and Cisco led this growth.

- Japanese packet sales continued to grow, up nearly 10% YoY. Cisco increased its lead in the region, with YoY sales growth of 42%.

Live Presentation Available

Results from Cignal AI’s Transport Hardware Report are presented live each quarter by Lead Analyst Kyle Hollasch. Clients are welcome to view a replay and download the PowerPoint slides.

About the Transport Hardware Report

Cignal AI’s Transport Hardware Report is issued each quarter and examines optical and packet transport equipment revenue across all regions and equipment types. The initial analysis is based on financial results, independent research, and guidance from individual equipment companies. Hardware forecasts are reviewed and updated in the following weeks, along with spending trends by operator type.

The Transport Hardware Report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. Vendors in the report include Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Ribbon, Tejas, Xtera, ZTE as well as other vendors. A full report description, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us