3Q22 Transport Applications Report

Gen60C modules drive coherent bandwidth growth this quarter while Compact Modular and ROADM equipment sales outperform.

3Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales, supply chains remained strained.

3Q22 Transport Hardware & Markets Report

Optical sales declined due to supply chain and currency effects, while routing hardware sales continue to grow.

Nokia 3Q22 Vendor Summary Report

Nokia’s routing and optical businesses are weathering a downturn in EMEA with increasing success in North America and RoAPAC.

2Q22 Optical Components Report

Pluggable 400Gbps optics continues to drive Telecom bandwidth as operators migrate away from lower speeds. Datacom component shipment growth slowed this quarter, but revenue for Datacom is still growing faster than in any other optical segment.

2Q22 Transport Applications Report

Coherent bandwidth growth remains muted outside of 400ZR

2Q22 Transport Hardware & Markets Report

North American Cloud operators were the growth engine for optical and packet transport sales, supply chains remained strained.

2Q22 Transport Hardware & Markets Report

North American Cloud operators were again the growth engine for optical and packet transport sales

Nokia 2Q22 Vendor Summary Report

Battling supply chain constraints and currency fluctuations, Nokia’s optical and packet businesses maintain flat YoY growth.

Cisco PONC 2022 – Observations and Thoughts

Cisco Packet Optical Networking Conference advanced the RON strategy.

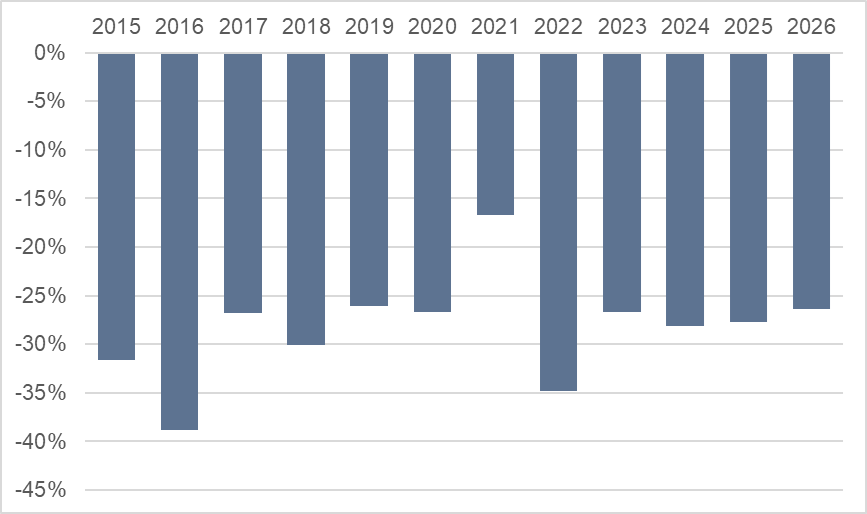

Coherent Port Pricing Trends (1Q22)

Cignal AI revisits our Coherent Pricing Trends report from 2019 and provides an update based on recent technology advances.

1Q22 Optical Components Report

It’s all about the supply chain again this quarter, but signs point to gains in the second half of the year. 400GbE datacenter optics and 400Gbps pluggable telecom optics are driving their respective segments.

1Q22 Transport Applications Report

Coherent bandwidth growth returns to historical levels & ROADM coverage initiated.

1Q22 Transport Hardware & Markets Report

First-quarter 2022 worldwide optical hardware spending increased 2.5% YoY, while packet gained 2%. North America led growth in both categories.

1Q22 Transport Hardware & Markets Report

First-quarter 2022 North American optical and packet sales continue to rebound despite supply-chain constraints. Excluding NA, both hardware categories declined in 1Q22.

Nokia 1Q22 Vendor Summary Report

Stung by supply chain difficulties, Nokia’s optical business declined, while packet continued to outperform.

4Q21 Transport Applications Report

400ZRx Pluggable shipments surge while lower cloud spending holds back Compact Modular in North America.

OFC 2022 Show Report

Key technology takeaways from OFC 2022.

4Q21 Transport Hardware & Markets Report

Fourth-quarter 2021 worldwide optical hardware spending increased 3.5% YoY. Declines centered in APAC for the second consecutive quarter, while all other regions grew YoY.

Nokia showcases Coherent Routing solution for IP-optical networks

Mentioned: Kyle Hollasch on Nokia IP over DWDM demo