1Q25 Optical Component Report

Datacom revenues and shipments slowed, 400ZRx shipments kept Telecom revenue growing for a fourth consecutive quarter.

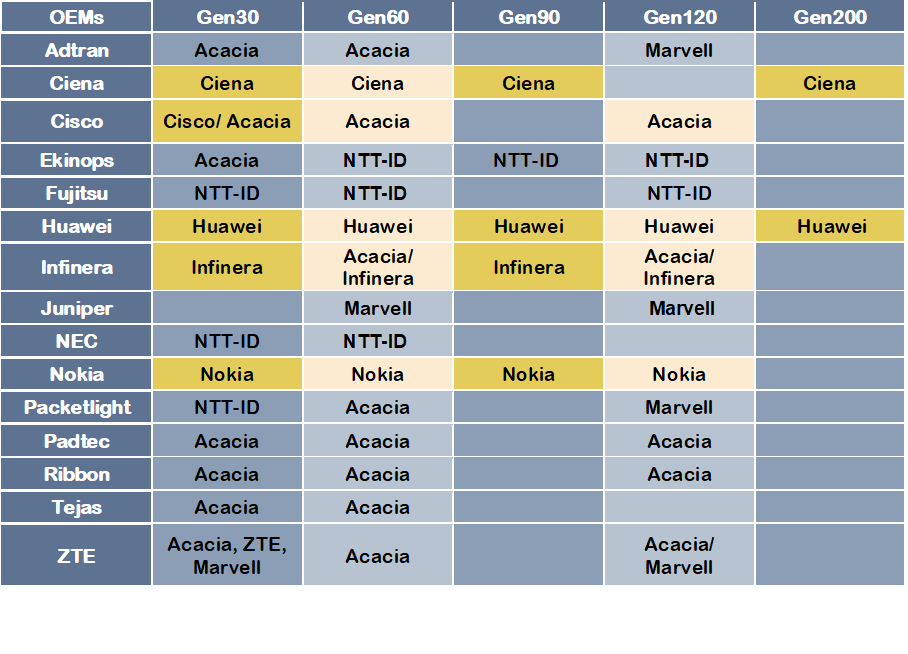

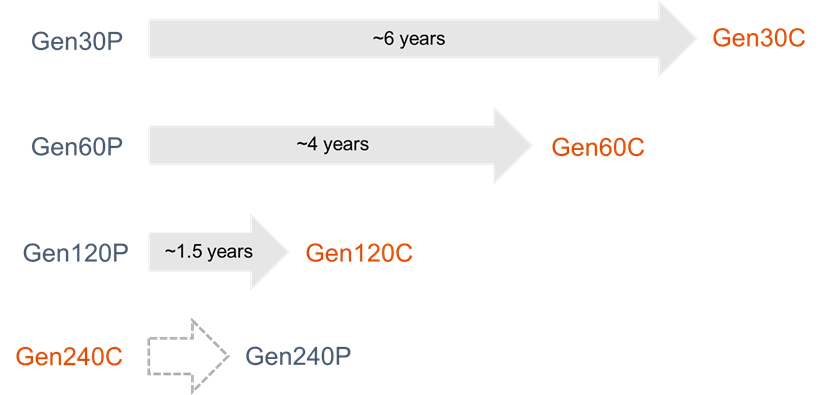

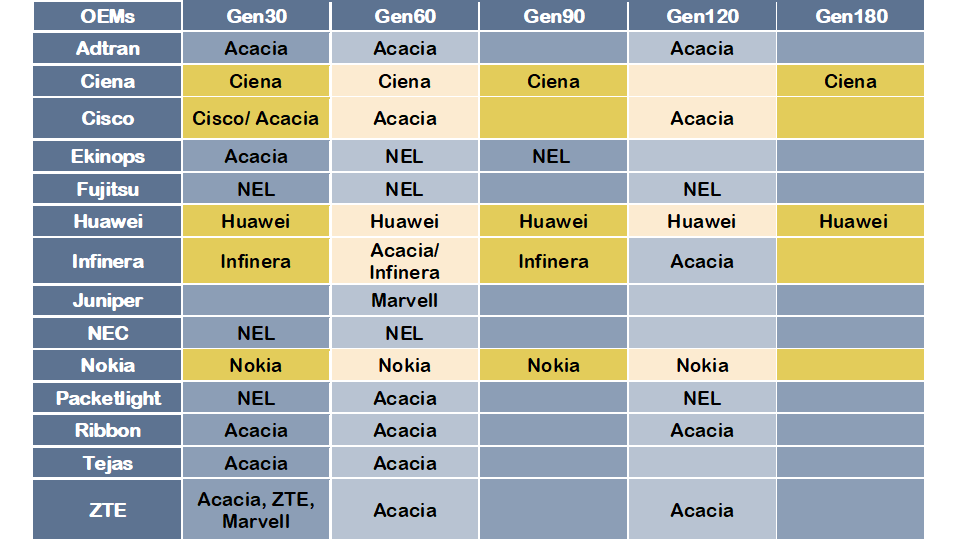

Tracking the Coherent DSP Supply Chain – 2025

Uncovering who uses which DSP, and which DSP vendors ship the most volume.

4Q24 Optical Component Report

Datacom revenue and port shipments stalled this quarter. Telecom revenue recovered from the doldrums based on 400G pluggables.

4Q24 Interim Optical Component Report

Final report will be issued once all Chinese companies complete 4Q24 reporting.

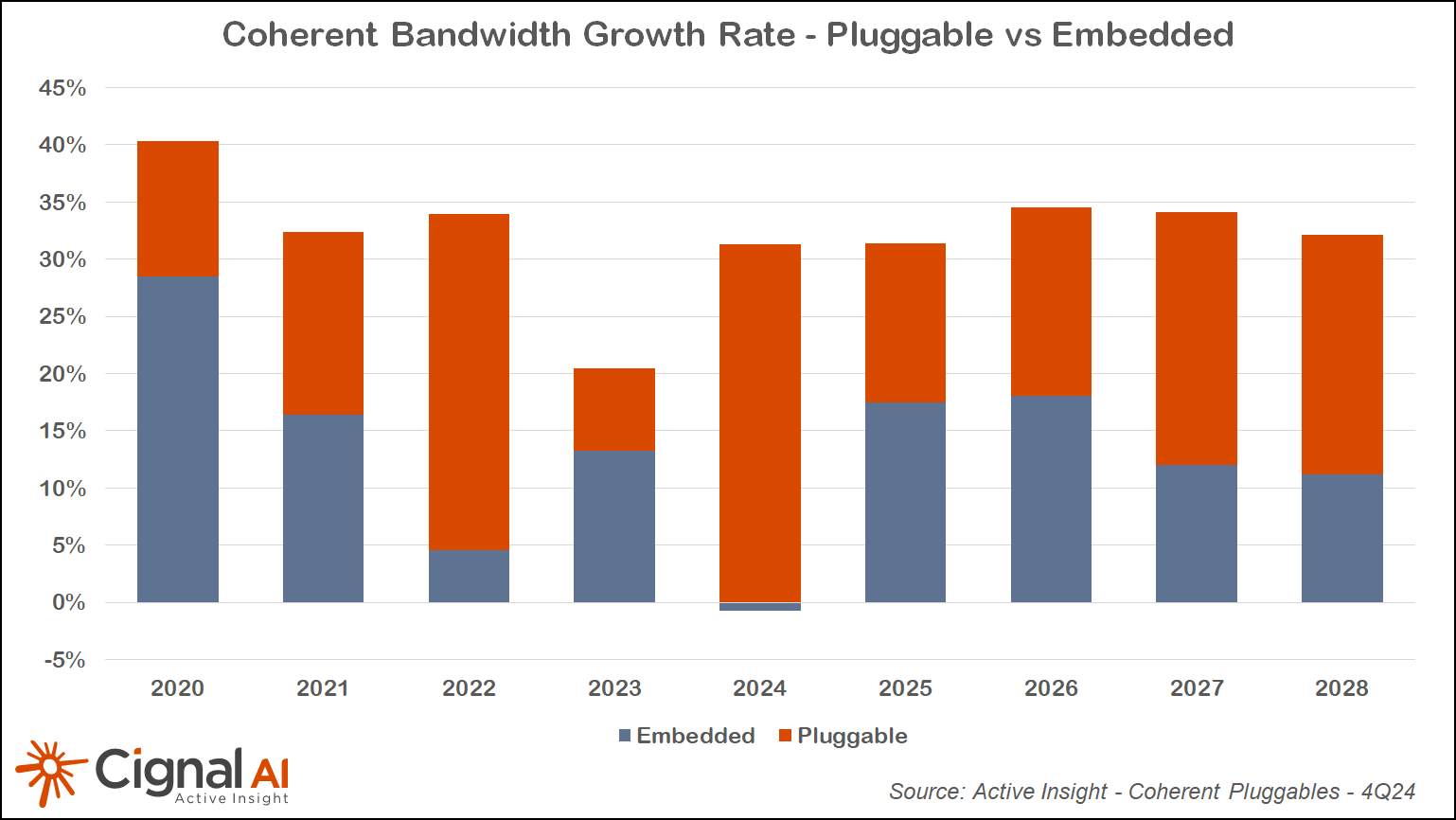

Coherent Optics: It’s a Pluggable World

Coherent pluggable optics were responsible for all the telecom bandwidth growth in 2024, and will account for most of the future growth.

3Q24 Optical Component Report

Datacom revenue more than doubled for the second quarter in a row as AI demand for 400GbE and 800GbE modules continued unabated. Telecom revenue has emerged from the depths of its recent decline.

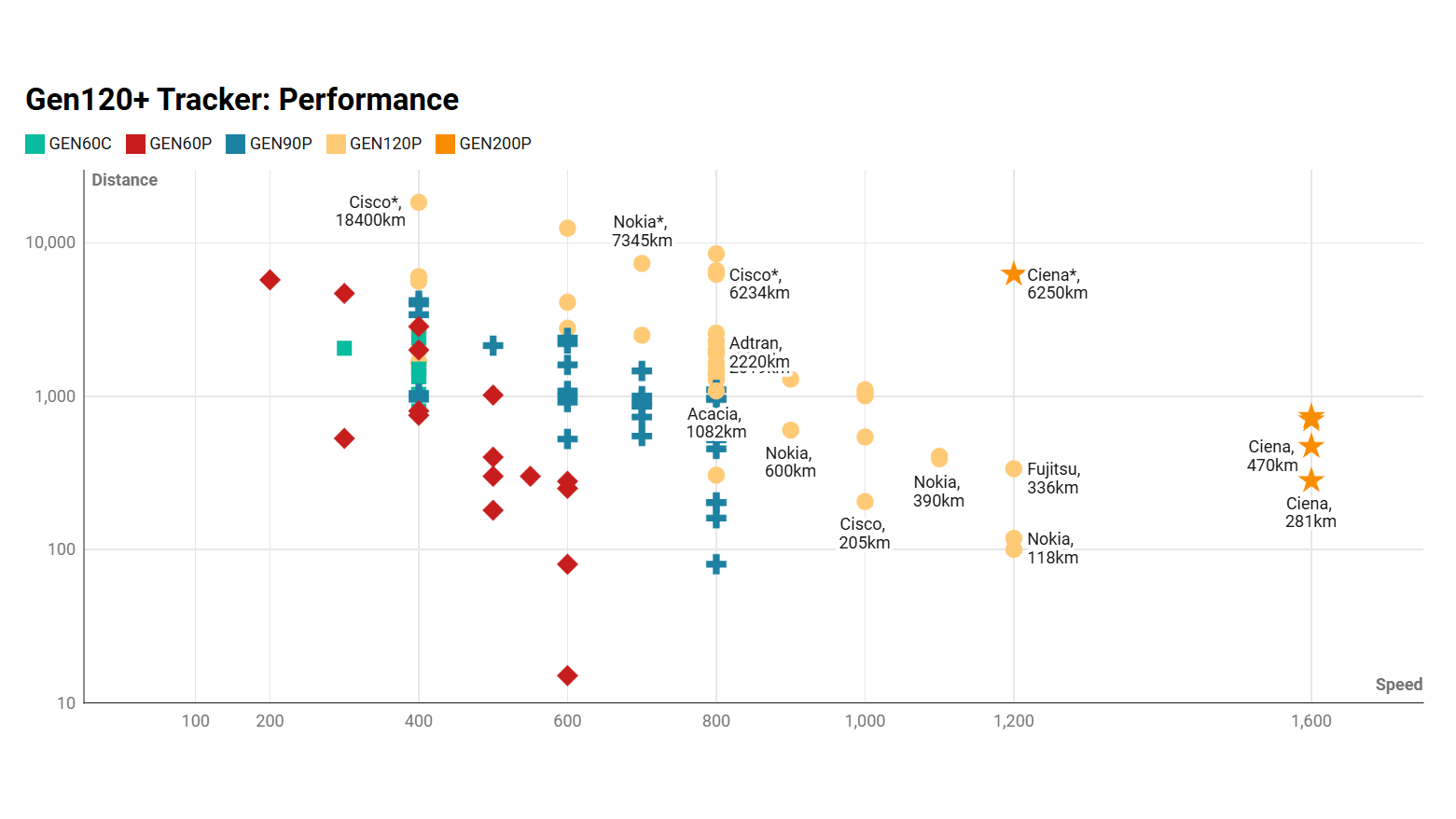

GEN120+ Coherent Trials and Deployments

Cignal AI is tracking announcements of Gen120 (120+ GBaud, 1+Tbps) optical trials and deployments.

ECOC 2024 Show Report

Nvidia PAM-4 DSP, Ciena 2x 800G-LR, LPO Lives, 1600ZR slipping, L-Band ramping.

Cisco Packet Optical Networking Conference 2024

Routed Optical Networking Goes Mainstream at Cisco’s PONC 2024. Our thoughts on the customer testimonials, product and technology updates, and live demonstrations.

CIOE24: Insights into China’s Market

Gathering the Chinese perspective on vendors and technologies.

2Q24 Optical Component Report

Datacom revenue hit new records with a surge in 400GbE shipments and continued growth in 800GbE. Telecom’s only growth area is 400G coherent pluggables.

IP-over-DWDM Pluggables Forecast

IP-over-DWDM deployments of 400/800/1600ZRx optics and adoption across market segments

Tracking the Coherent DSP Supply Chain

Uncovering who uses which DSP, and which DSP vendors ship the most volume.

1Q24 Optical Component Report

Datacom revenue and shipments of 400GbE & 800GbE modules hit new records as Telecom struggles to recover.

Cisco 1Q24 Vendor Summary Report

Optical hardware sales shake off a depressed 2023; Acacia 400ZR shipments resume growth

Unlocking the benefits of converged IP and Optical Transport

Join Cisco, Colt, and Telefonica to learn how operators can deliver more capacity from a smaller network footprint with reduced power consumption and operational complexity.

4Q23 Optical Component Report

Telecom revenue has hit the bottom as overwhelming 800GbE demand raises Datacom revenue and shipments.

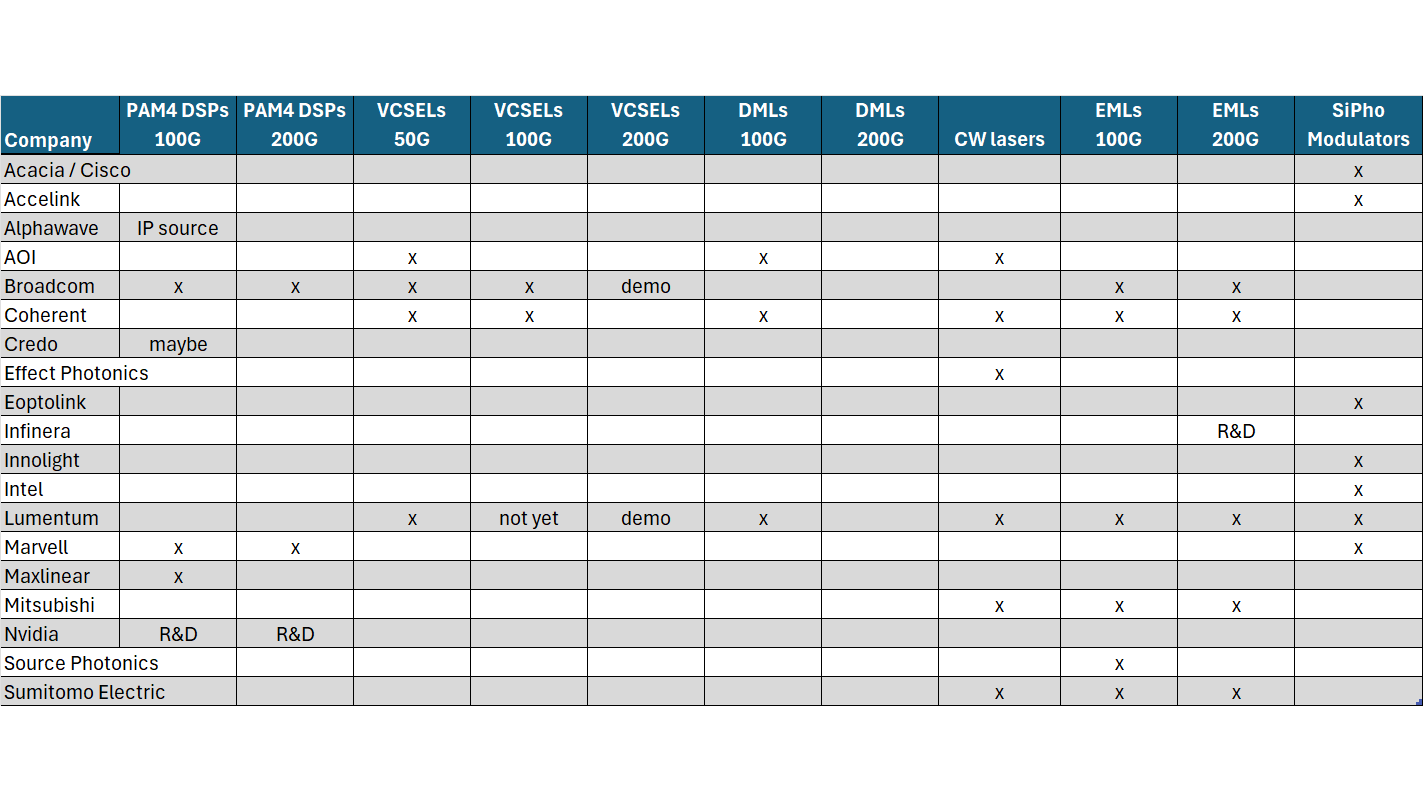

Datacom Optical Industry Tracker

This report tracks the component suppliers that enable the 400GbE+ Datacom Transceiver ecosystem. It includes an overview of the types of transceivers employed, the key components that are used in those transceivers, and which vendors supply those components.

Acacia Introduces 800G ZR+ with Interoperable PCS

Mentioned: Scott Wilkinson on interoperable PCS and 800ZR

3Q23 Optical Components Report

Datacom revenues are recovering from the Q1 drop and are poised to explode along with 800GbE shipments in 2024. Telecom revenue continues to lag, as deployed bandwidth declined YoY for the first time this quarter.