Acacia Unveils 1.2T Multi-Haul Pluggable Module

Mentioned: Scott Wilkinson on Acacia’s new product announcement

OFC 2021: 400ZR/ZR+ Coherent Pluggables

After years of anticipation, 400G pluggable digital coherent optics (DCO) will finally achieve general availability and initial deployment in 2021.

1Q21 Transport Applications Report

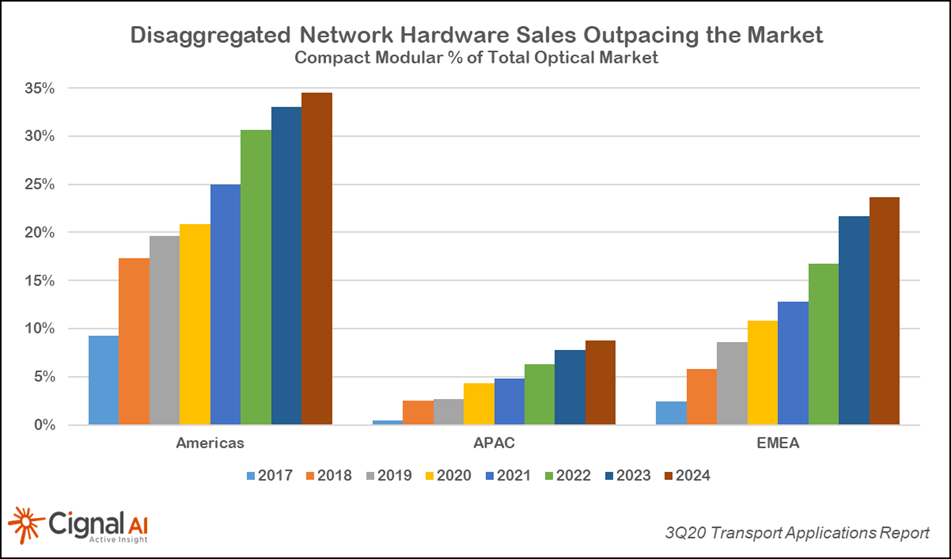

400Gbps+ port shipments doubled YoY, 400ZR ports started to ship, and compact modular sales significantly outperformed the overall optical hardware market this quarter.

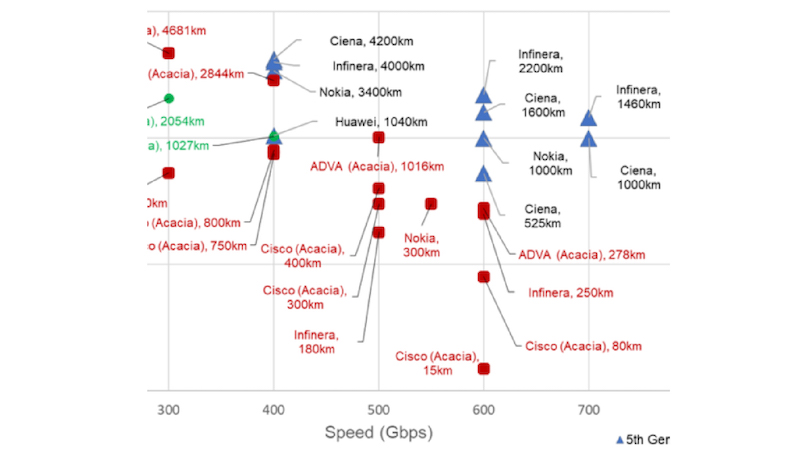

GEN90P Coherent Trials and Deployments

Cignal AI continues to track announcements of 5th generation (800Gbps-capable, 90+ GBaud) optical trials and deployments.

650K Coherent Ports Shipped by Cisco and Acacia

In conjunction with OFC, Cisco published a note quantifying the total volume of coherent ports shipped with Acacia and Cisco technologies combined.

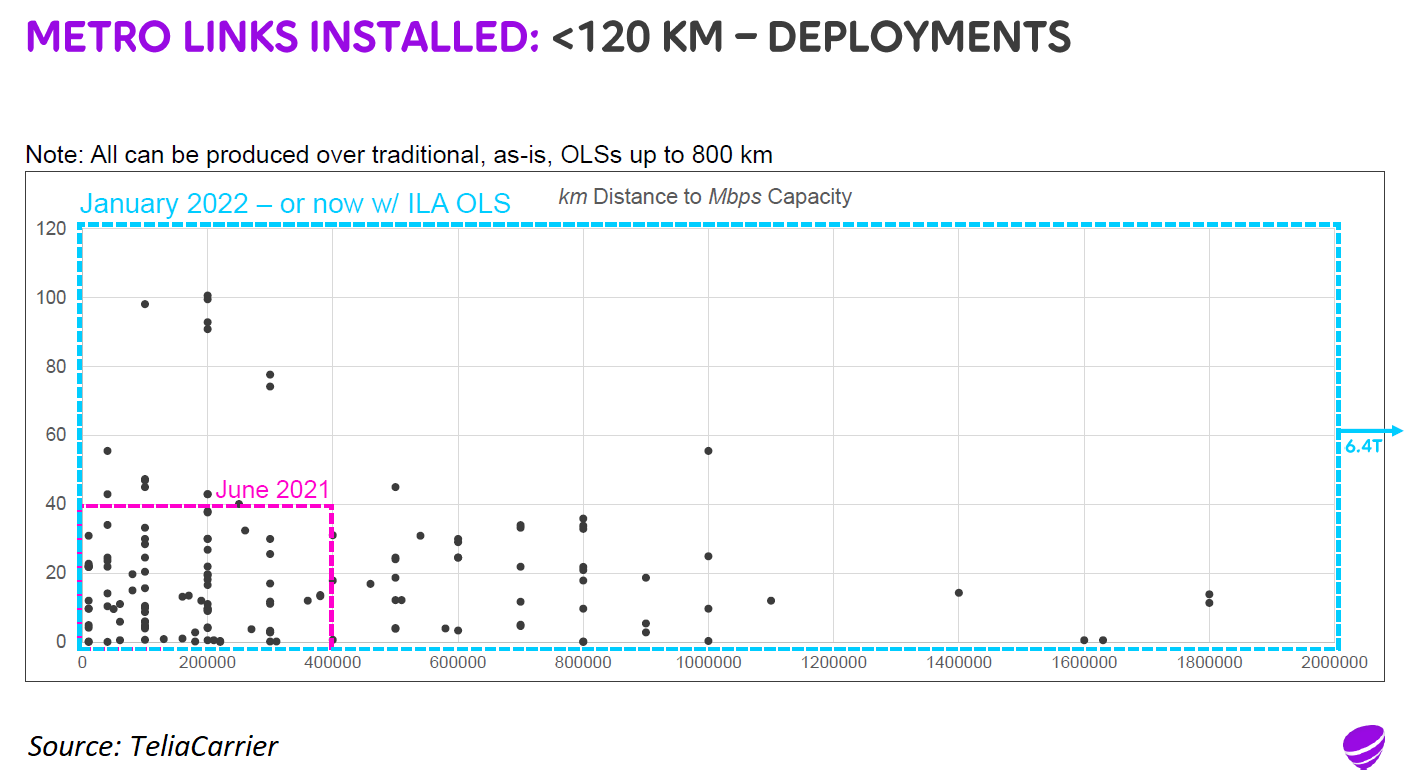

Telia Carrier – Open Optical Networks and 400ZR

TeliaCarrier’s plans for deploying 400ZR and growing its network post-COVID

Tencent, Coherent CFP2 ZR+ and Optical White Boxes

Chinese webscale operator Tencent has been developing its own white box for optical transport. In this report we provide more details of Tencent’s work, including its adoption of CFP2 400Gbps optics.

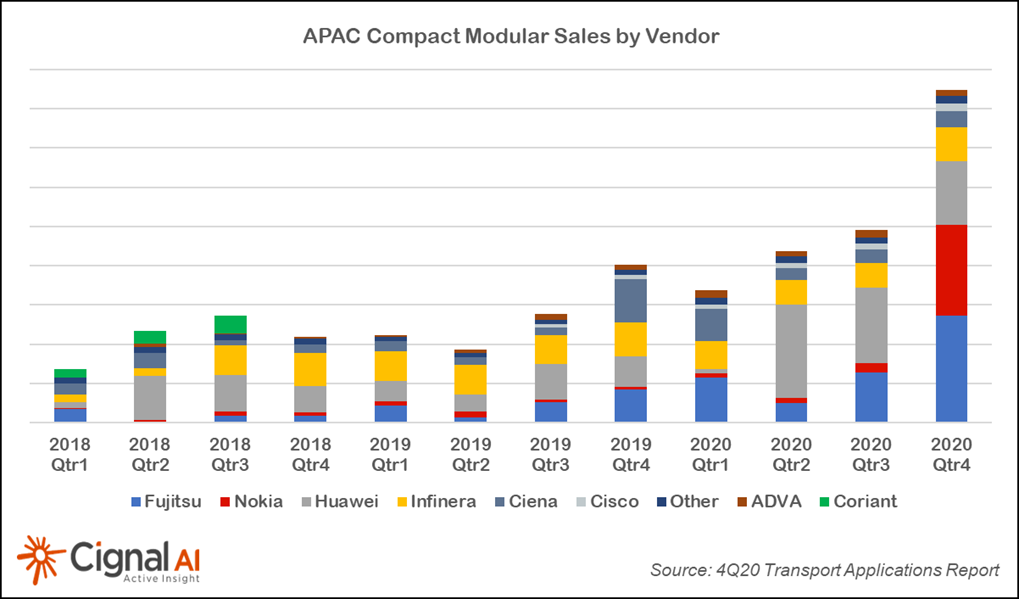

The Growth of Compact Modular in APAC

Compact Modular sales (and hence disaggregation) have historically lagged in APAC versus the rest of the world, so APAC’s sudden and extraordinary growth over the past few quarters means that something has changed and deserves a closer look.

4Q20 Transport Applications Report

4Q20 Compact Modular sales significantly outperformed the overall optical market, as APAC sales more than doubled and surpassed EMEA sales for the first time. 400ZR forecasts for 2022 and beyond were increased based on growing operator interest.

400ZR+ First Field Trial

Windstream announced it performed a field trial of Acacia 400ZR+ modules in Cisco compact modular equipment. This is a notable event because it is the first public trial of extended reach 4th gen pluggable coherent 400ZR+ modules and the first demonstration of 400ZR+ modules using the larger CFP2 format.

2021 Outlook: Optical & Packet Transport

This report provides a summary of Cignal AI’s current outlook for the year. Creating forecasts for 2020 was uniquely challenging and forecasting the expected return to normal by the end of 2021 is also very complex.

Telia Carrier Leans on Pluggable Optics for a Simpler Network

Lightreading covered an announcement by Telia Carrier that it was one of the first major network operators to use pluggable 400ZR and OpenZR+ coherent modules.

3Q20 Transport Applications Report

Compact modular sales grew much faster than the optical market overall, with significant growth in APAC this quarter. 400ZR and ZR+ modules began sampling with several hundred modules shipped for evaluation.

Acacia Strengthens Portfolio with New Coherent Bi-Directional Pluggables

Acacia announced further enhancements to its 100G coherent pluggable product line targetted at edge and access applications.

2Q20 Transport Applications Report

This report includes our initial forecasts of the 100ZR and 400ZR+ markets.. Compact Modular sales grew much faster than the overall market this quarter as disaggregation continues to gain traction in networks outside of Cloud & Colo.

1Q20 Transport Applications Report

Packet-OTN sales doubled in NA as carriers responded to COVID-19, and shipments of 400Gbps+ ports doubled YoY as Chinese equipment companies entered production.

Nokia PSE-V Coherent Chipset

Overview and analysis of Nokia’s fifth generation of coherent DSPs, the PSE-Vs, and PSE-Vc.

Acacia 1Q20 Vendor Summary Report

Acacia’s results are a bellwether to the industry. This report looks at the most recent results for the company and examines them in the context of historical trends.

OFC2020 Optical Hardware Review

Major optical transport equipment vendors did not present at OFC in March due to COVID-19 concerns, but that did not stop announcements of products and online updates to customers and analysts.

4Q19 Transport Applications Report

Compact Modular sales growth slowed in North America in the 4th quarter, but sales growth outside of NA was exceptionally strong and total worldwide sales grew nearly 50% year-over-year.