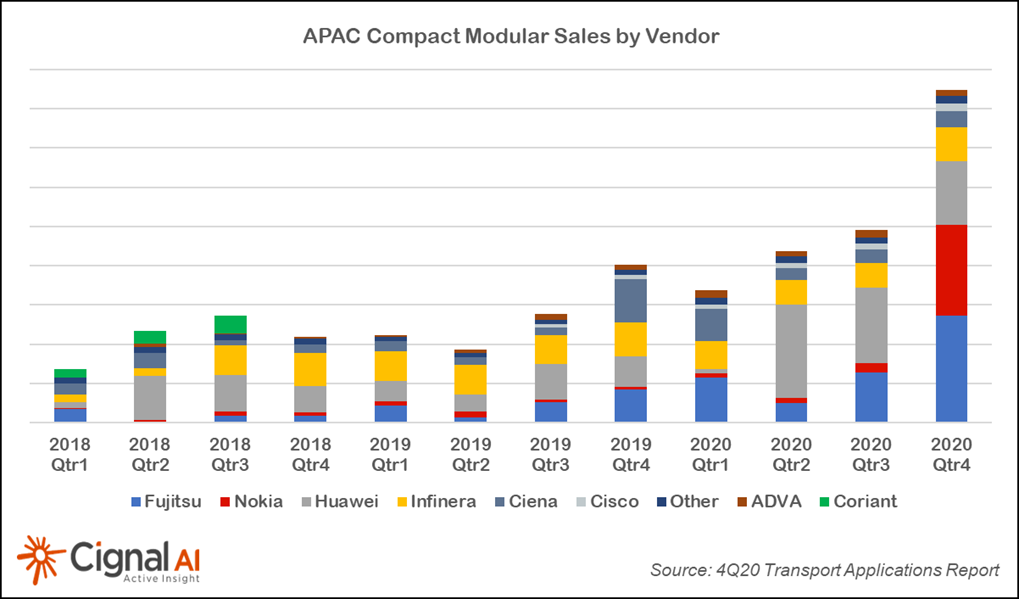

The Growth of Compact Modular in APAC

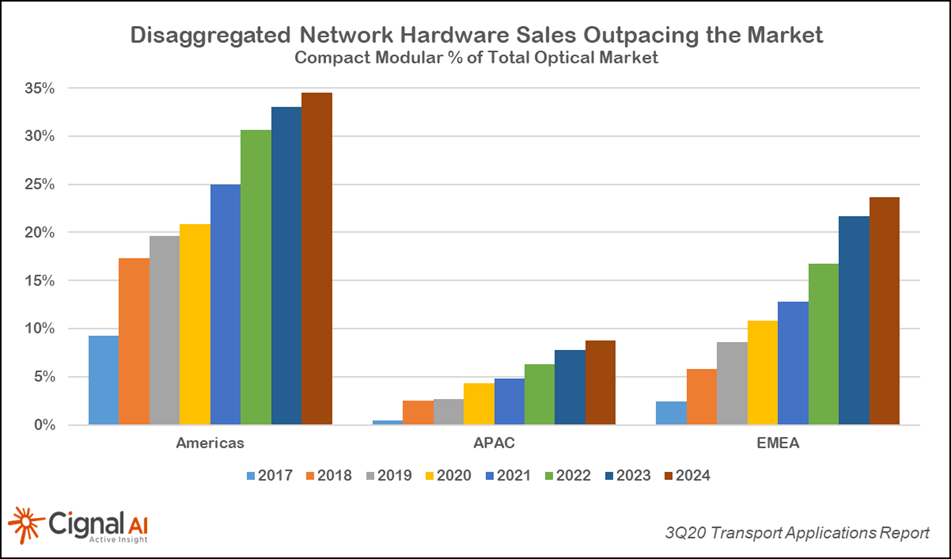

Compact Modular sales (and hence disaggregation) have historically lagged in APAC versus the rest of the world, so APAC’s sudden and extraordinary growth over the past few quarters means that something has changed and deserves a closer look.

4Q20 Transport Applications Report

4Q20 Compact Modular sales significantly outperformed the overall optical market, as APAC sales more than doubled and surpassed EMEA sales for the first time. 400ZR forecasts for 2022 and beyond were increased based on growing operator interest.

Ciena 1Q21 Vendor Summary Report

Ciena’s revenue decline this quarter was steeper than our forecast, but the company is poised to grow revenues based on the success of its WaveLogic 5e 5th generation coherent technology.

4Q20 Transport Customer Markets Report

North American Traditional Telco spending on optical and packet hardware declined significantly in the 4th quarter, due to a dramatic reshuffling of capex spurred by the pandemic during the first half of 2020. Meanwhile, APAC Cloud & Colo spending exploded. Long term, hardware sales in all markets are predicted to return to growth in the second half of 2021.

4Q20 Transport Hardware Report

North American optical and packet transport spending plummeted in North America as Tier 1s concentrated COVID-related capex in the first half of the year.

Infinera 4Q20 Vendor Summary Report

Infinera originally expected its ICE6 technology to enter the market in the second half of 2020. The company’s current guidance now indicates a 2H21 arrival. Infinera reports a strong order pipeline but has not specified exactly when the first ICE6 will ship for revenue.

400ZR+ First Field Trial

Windstream announced it performed a field trial of Acacia 400ZR+ modules in Cisco compact modular equipment. This is a notable event because it is the first public trial of extended reach 4th gen pluggable coherent 400ZR+ modules and the first demonstration of 400ZR+ modules using the larger CFP2 format.

Nokia 4Q20 Vendor Summary Report

Nokia fared better than its largest competitors in 2020 as it ended the year flat YoY but carrying significant momentum – especially in routing – as it heads into 2021.

Juniper 4Q20 Vendor Summary Report

Juniper exceeded expectations in 2020, a notable feat as the overall market was difficult for switching and routing. Much of the company’s success comes from its recently diversified customer base away from Tier 1 concentration.

Cisco 4Q20 Vendor Summary Report

Cisco’s transport product line had a tough 2020 as the company introduced new products in the middle of a pandemic. Sales also declined sharply in Q4, reflecting a slowdown in the NA market.

Fujitsu 4Q20 Vendor Summary Report

Fujitsu’s revenues shifted from NA to Japan in 2020 as legacy platform revenue has declined. However, the company’s compact modular strategy is taking off in Japan and will grow in NA in 2021.

2021 Outlook: Optical & Packet Transport

This report provides a summary of Cignal AI’s current outlook for the year. Creating forecasts for 2020 was uniquely challenging and forecasting the expected return to normal by the end of 2021 is also very complex.

Ciena 4Q20 Vendor Summary Report

Ciena’s sales declined last quarter, primarily due to weakness in NA optical sales. Gen5 coherent (800Gbps-capable) port shipments topped 3600 shipped to date.

3Q20 Transport Applications Report

Compact modular sales grew much faster than the optical market overall, with significant growth in APAC this quarter. 400ZR and ZR+ modules began sampling with several hundred modules shipped for evaluation.

3Q20 Transport Customer Markets Report

North America transport hardware spending growth shifted dramatically this quarter from Cloud & Colo operators to Incumbents. APAC Cloud & Colo optical sales grew again.

3Q20 Transport Hardware Report

Third quarter results were better than forecast, especially in EMEA where both optical and packet hardware spending increased. North America spending declined while China spending was flat and Japan spending growth continued unabated.

Cisco 3Q20 Vendor Summary Report

Cisco’s results and forecast this quarter were more optimistic than last quarter. Optical and packet sales slowed, but an uptick at the end of the quarter hinted at a better than expected finish for the year.

Nokia 3Q20 Vendor Summary Report

Nokia had an extraordinary Q3, with overall growth significantly higher than the market. Much of this growth came from Q2’s delayed sales.

Infinera 3Q20 Vendor Summary Report

Infinera’s optical and packet sales grew in Q3 and the company set expectations for continued growth in Q4, running counter to earlier industry forecasts of a slowdown in the second half.

Juniper 3Q20 Vendor Summary Report

Juniper defied forecasts of a flat to down second half of 2020 by posting one of its best growth quarters in recent history in Q3.