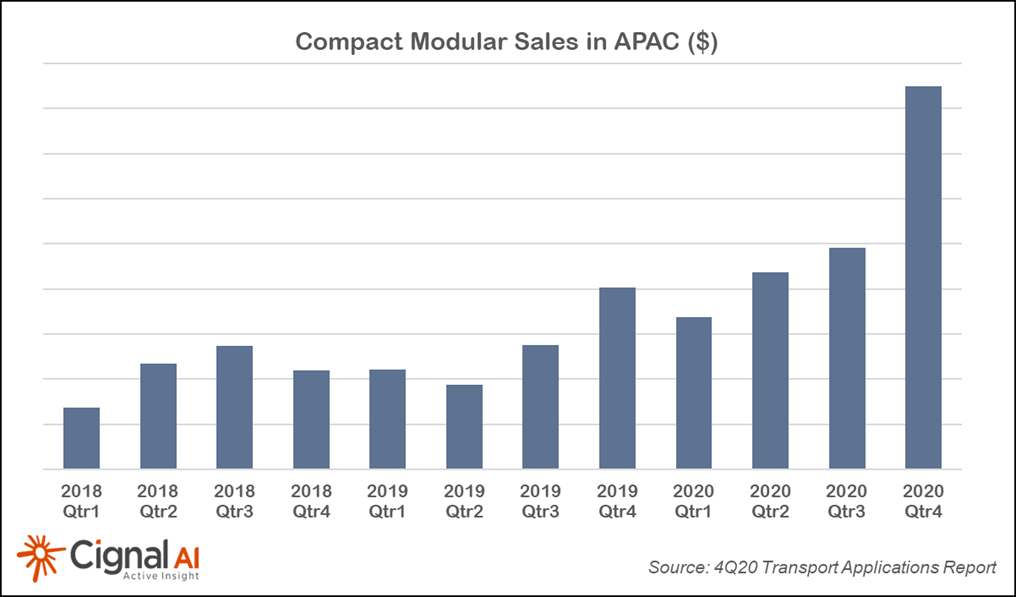

Cignal AI’s 4th quarter Transport Applications Report highlighted the rapid growth of Compact Modular revenue in APAC at the end of 2020. This growth suggests an increase in disaggregated network deployment in the region.

Compact Modular sales (and hence disaggregation) have historically lagged in APAC versus the rest of the world, so APAC’s sudden and extraordinary growth over the past few quarters means that something has changed and deserves a closer look.

This Active Insight report provides deeper examination of Compact Modular and disaggregation in APAC and in China. Cignal AI is making this report available to non-clients and have therefore removed some axis detail from the charts. Please contact us if you have additional questions or observations to share.

This report focuses on:

- The growth of optical spending by APAC Cloud & Colo operators during 2020, including increased acceptance of disaggregation, white box deployment, and momentum in China towards building their own networks.

- Exceptional optical spending growth in Japan leading to increased sales of Fujitsu’s 1Finity system to Incumbent operators that traditionally have eschewed disaggregation.

- Nokia’s success with Chinese webscale operators that are more open to purchasing from Western vendors than the Chinese Incumbents.

- Growth in Huawei’s sales of Compact Modular systems to Chinese OTTs.

Compact Modular

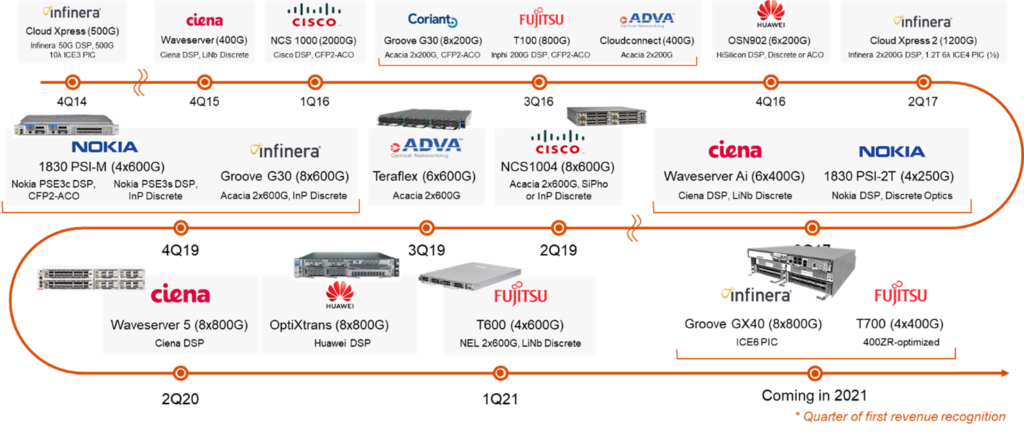

Compact Modular optical systems are small, purpose-built devices designed for use in disaggregated networks. Examples include the Ciena Waveserver, Infinera GX, Nokia PSI-M, ADVA Teraflex, Fujitsu T600, and Huawei OptiXtrans platforms.

Cignal AI tracks sales of Compact Modular systems and uses this category as a proxy for the growth of disaggregation in network designs. The results are published on a quarterly basis in our Transport Applications Report. For more details on Compact Modular system definition and systems included, see the Transport Applications Report.

2020 Compact Modular Sales in the Asia-Pacific Region

Compact Modular is a small portion of optical sales within APAC for several reasons, including:

- Cloud & Colo operators, typically the first to embrace disaggregation, purchase network bandwidth from incumbent carriers in the region rather than building networks in-house. This is particularly true in China, where fiber is considered a regulated national resource and long-distance networks must be built and maintained by incumbent operators.

- Although Japanese Incumbent operators are interested in disaggregation, they have considered the operational and software hurdles of managing a network with multiple pieces of equipment and vendors for each function to be too high.

- China Mobile & China Telecom, by far the largest volume purchasers of transport hardware in the APAC region, have shown little interest in optical network disaggregation.

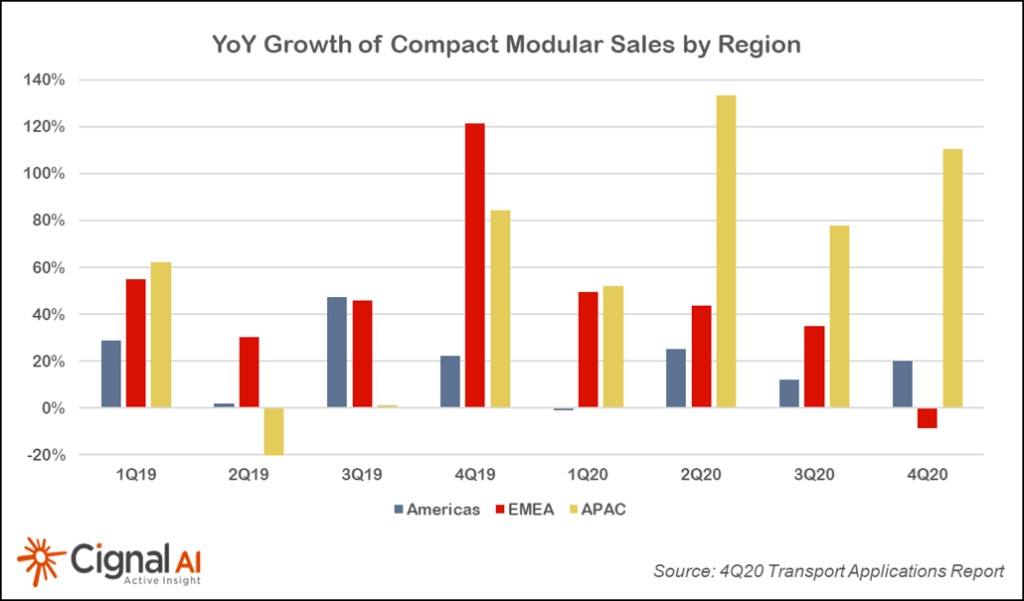

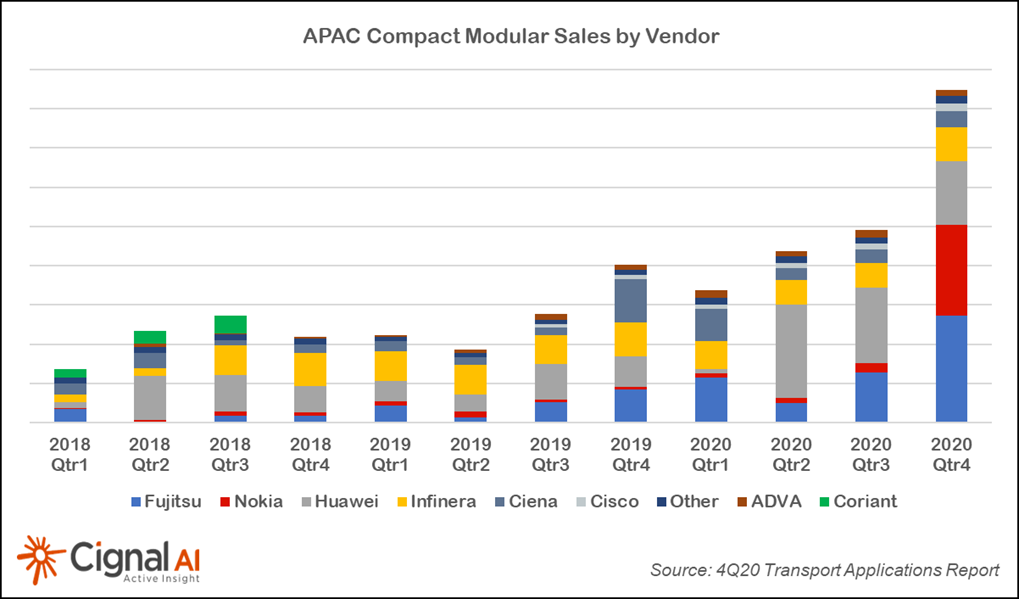

However, Compact Modular sales in the APAC region grew dramatically at the end of 2020, and outpaced growth in all other regions (see graphs). In fact, during the fourth quarter, APAC Compact Modular sales surged past EMEA sales for the first time.

What Changed?

After discussions with vendors and operators, Cignal AI identified two primary drivers for the growth of Compact Modular sales in APAC:

- Purchases of equipment by Cloud & Colo operators rose, which led to more Compact Modular sales. Some of the largest webscale operators in the region, including Tencent and Alibaba, have recently spoken publicly about their migration to disaggregated networks.

- Optical sales in Japan grew dramatically last year, benefitting Fujitsu, which had bet heavily on disaggregation with its 1Finity product line.

Vendors entrenched in the region (e.g., Huawei in China and Fujitsu in Japan) particularly benefitted from increased Compact Modular sales. Nokia also grew sales in the region by focusing on Cloud & Colo operators, primarily in China.

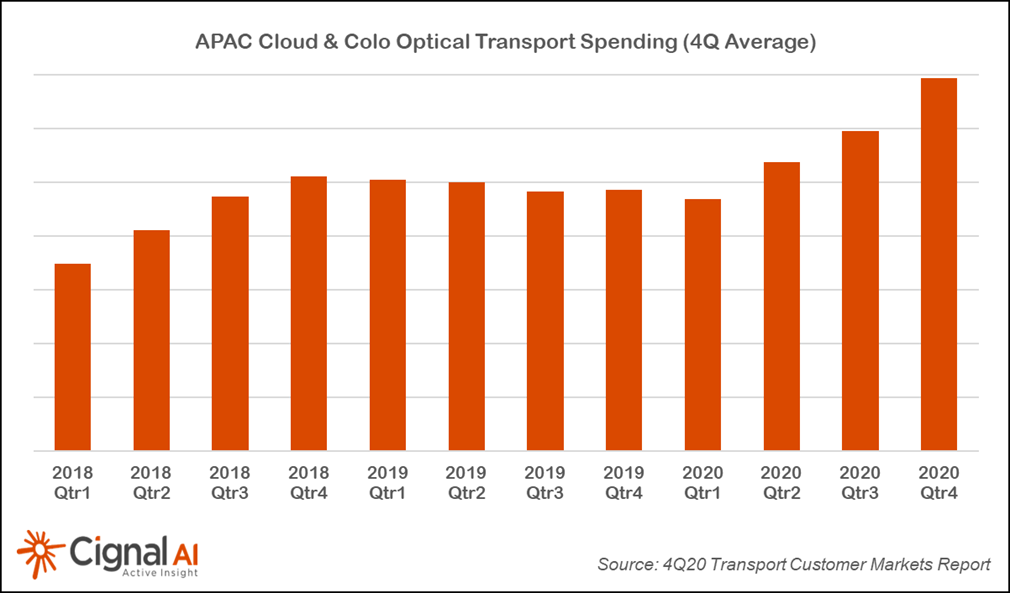

APAC Cloud & Colo Optical Spend Grew in 2020

As shown in the graph below, spending by Cloud & Colo operators in APAC grew during Q4 but at a slower rate than total Compact Modular sales. This suggests that other types of network operators contributed to Compact Modular growth.

The largest Cloud & Colo operators in China are the webscale operators Alibaba, Tencent, and Baidu. As with North American webscale operators like Google and Amazon, details of their optical deployments are closely guarded. However, some recent publications and company announcements provide insight on how these operators are disaggregating their optical networks.

- Tencent contributed its own “white box” compact modular line system design (OPC-4) to Open Compute in 2019 (source: opencompute.org). In April of 2020, Tencent described its line system (OPC-4) and transponder (TPC-4) white box designs in a press release (source: sohu.com). Since then, the company began deployment of the platforms in its network and began purchasing several thousand 400Gbps capable CFP2-DCO ports for deployment this year. Note that white box compact modular deployments are not currently counted in the Transport Applications Report, and growth of compact modular in the region would be even higher if whitebox systems were included.

For more details about Tencent’s white box program, see the Active Insight report The Impact of Tencent’s Optical White Box Efforts.

- Alibaba is also exploring white box transponder systems. In a June 2020 article in the Journal of Optical Communications and Networking (source: ieee.org), Alibaba described its “open and disaggregated optical transport networks for data center interconnects.” The article’s authors described point-to-point and ROADM-based networks for data centers in metro area. They also stated that the company has developed its own “open optical transport systems for DCI applications.”

- In June 2020, Nokia announced a deal to provide optical DCI hardware to Baidu and Tencent (source: nokia.com), leading to Nokia’s growth in the region (see below). Baidu is significantly smaller than Tencent or Alibaba and therefore has less impact on the overall DCI market in APAC.

- Cloud & Colo operators in China have started to purchase some optical equipment for themselves in order to build metro and long haul networks that are officially owned and operated by Incumbents. This marks a significant change from the established norm under which only the Incumbents purchased equipment for long haul networks. If this shift endures, purchases of compact modular equipment by the Cloud & Colo operators will increase over the long term.

1Finity Finally Caught on in Japan

Fujitsu placed an early bet on disaggregation with its 1Finity disaggregated hardware platform. 1Finity sales have consistently lagged those of Fujitsu’s legacy products as the vendor’s customers were reluctant to embrace disaggregation. However, the enormous growth in optical equipment spending in Japan over recent years (WDM Metro sales were up nearly +70% in 2020) has primarily benefitted Japanese vendors. These customers are purchasing Fujitsu’s latest equipment, and 1Finity sales more than tripled YoY in the 4th quarter.

As shown in the figure below, Fujitsu’s 1Finity growth in Japan accounts for a significant portion of the growth in APAC Compact Modular sales in 2020. However, Fujitsu’s sales went entirely to Incumbent network operators, not Cloud & Colo operators. This is evidence of Japanese telco operators’ increasing acceptance of disaggregated network designs.

Nokia’s Success with Chinese Webscale Operators

Nokia claimed the second largest share of Compact Modular sales in APAC during Q4, despite having less than 8% of the overall optical hardware market in that region. Nokia’s APAC Compact Modular sales rose by more than 40x YoY in the 4th quarter as the company capitalized on DCI contracts with Tencent and Baidu as well as 11 other, smaller Chinese webscale operators. Webscale operators in China are more willing than Incumbant Chinese telcos to use western vendors’ network equipment. Nokia has a long history of success in supplying network equipment in the region (through legacy Alcatel and Lucent contracts) which it is leveraging to grow business at these new emerging network operators.

Huawei’s Regional Growth

Huawei’s Compact Modular sales doubled YoY during the 4th quarter, growing less than Fujitsu and Nokia but still at a very impressive rate, considering the company’s total optical hardware sales in the region were up less than 10% in Q4. The company has not indicated individual customer wins but states that over the top (OTT) network operators are largely responsible for the growth.

Conclusions and Forecast

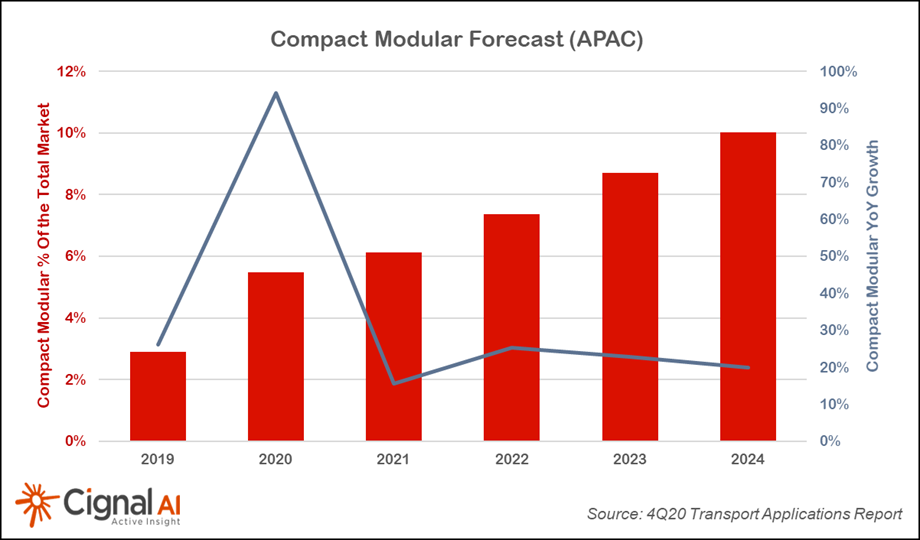

About 40% of the recent growth in APAC Compact Modular sales is due to extraordinary optical hardware growth in Japan, which Cignal AI expects to moderate going forward. As Japanese hardware growth slows, growth in sales of Futjisu’s 1Finity Compact Modular system will also cool, tempering Compact Modular growth in the region. However, growth with Cloud & Colo operators should continue to drive increased sales overall.

The move by the largest Chinese Cloud & Colo operators to disaggregate their networks and implement Compact Modular optical systems will continue to spur Compact Modular sales growth in the region. Huawei and Nokia have both reported strong sales to Cloud & Colo operators as they begin to build their own networks.

Cignal AI forecasts Compact Modular growth to slow during 2021 from its 2020, primarily due to cooling sales in Japan. However, as a percentage of the total optical market, Compact Modular sales are expected to rise to nearly 10% by 2025. When combined with the underlying growth of the APAc optical hardware market, this suggests a 5-year CAGR of more than 30%.

As Chinese webscale operators like Tencent and Alibaba move to white box deployments, Cignal AI’s reported Compact Modular numbers in APAC will be too low as those internal builds are not counted as vendor sales revenue. While the impact is minimal now, Cignal AI will work with local contacts and component suppliers to estimate long-term migration trends towards disaggregation.

The wildcard in this forecast is the Chinese incumbents, which make up a significant majority of optical hardware sales in the region. To date, Chinese incumbents have not deployed disaggregated networks. However, Compact Modular systems are being evaluated in incumbent labs, and should the incumbents make a move to disaggregation, the center of Compact Modular sales worldwide will quickly shift from NA to APAC.