Demand for 400ZR pluggable optical transceiver modules to exceed supply in 2021

BOSTON (January 20, 2021) – Global compact modular revenue grew 24 percent in the third quarter of 2020 (3Q20) over the prior year, versus just 7 percent growth for the total optical market, according to the latest Transport Applications Report from market research firm Cignal AI. Cignal AI defines “compact modular” as small form factor optical hardware that is designed for use in open and disaggregated networks.

“Compact modular is gaining popularity with a wider set of network applications and operators due to the continued adoption of disaggregation outside cloud and colocation,” said Scott Wilkinson, lead analyst at Cignal AI. “The market saw extraordinary growth in Asia Pacific over the last two quarters, with sales in the region now approaching those of EMEA.”

Meanwhile, the 400ZR market is getting underway, with several hundred modules shipped for testing and evaluation in 3Q20. “The demand pipeline for 400ZR remains strong and operators are pleased with the prototypes under evaluation,” said Andrew Schmitt, directing analyst at Cignal AI. “Acacia had a huge quarter thanks to a large buildout at Amazon AWS.”

More Key Findings from the 3Q20 Applications Report

- Although Ciena reported a flat quarter overall for optical sales, its compact modular sales were up 18 percent year over year, and the company maintained its market leadership by a wide margin

- Compact modular sales in APAC grew by more than 75 percent in the quarter; Huawei (mostly in China), Fujitsu (in Japan) and Nokia all more than doubled their sales in the region

- Year-over-year sales of packet-OTN equipment grew only in APAC this quarter, and sales in North America declined by more than 25 percent

- Overall compact modular sales growth is forecast to decelerate to low single digits in 4Q20 as capex budgets evaporate, especially in North America

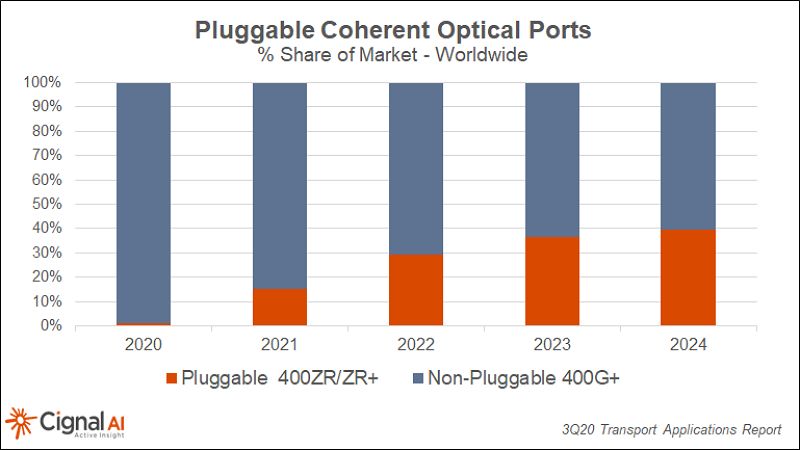

- Pluggable coherent optics are projected to account for 40 percent of the high-performance optical market by 2024

- Shipments of fixed 400 Gbps+ coherent ports jumped 65 percent sequentially, to over 35,000 ports in the quarter

About the Transport Applications Report

The Cignal AI Transport Applications Report includes market size, market share and forecasts for revenue and port shipments for optical equipment designed to meet specific applications, including coherent optical technology, compact modular and advanced packet-OTN switching hardware. Vendors examined include Acacia, Adtran, ADVA, Ciena, Cisco, Ekinops, Fujitsu, Huawei, Infinera, Inphi, NEC, Nokia, NTT Electronics (NEL), Ribbon and ZTE.

Webinar Tomorrow

400ZR – Impacting Networks in 2021 and Beyond

400ZR is here. Get ready for the 2021 rollout with an update on the market opportunity for pluggable coherent technology from Cignal AI. Hear from Inphi and Arista on 400ZR production status and Microsoft and Teliacarrier on operator evaluations and deployment plans.

Join us live on Thursday, January 21, 2021 at 11 a.m. (Boston/New York). Register here.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us