In every Cignal AI Optical Component Report last year, we highlighted that coherent pluggables now represent the primary source of telecom bandwidth growth. Their dominance will continue in the coming years, particularly as they are increasingly used in AI interconnect and make the move from metro to long haul applications. This report illustrates the trend and magnitude of pluggables’ dominance – especially in 2024. It also highlights the companies that are positioned to take advantage of it.

The Numbers

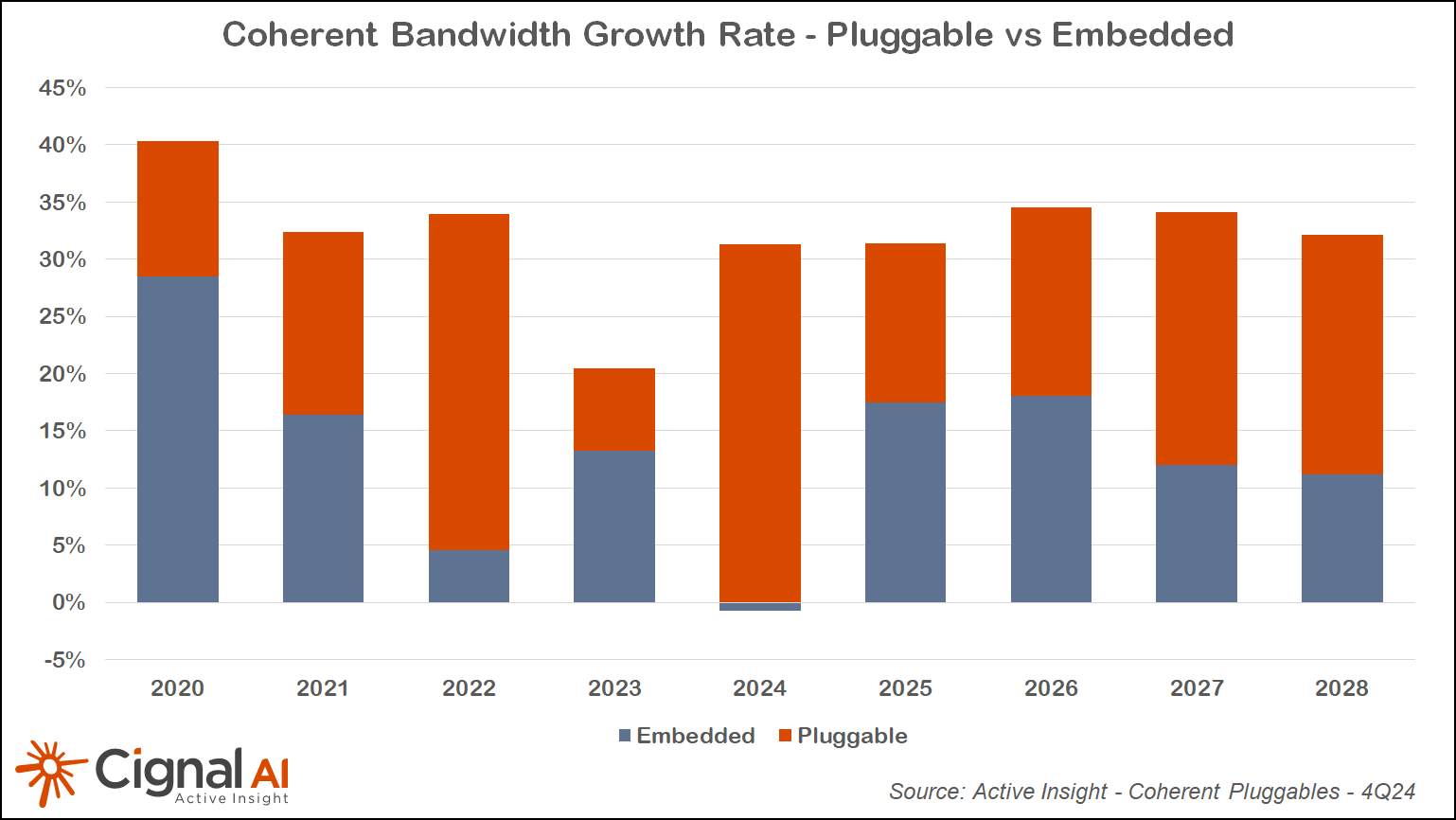

When one combines the bandwidth from all pluggable and embedded solutions, the results are striking (see diagram below). In 2024, all of the bandwidth growth came from pluggable optics as aggregate bandwidth from embedded optics declined YoY. Going forward, bandwidth growth from pluggables will continue to be at least 50% of the total even as new embedded solutions capable of >1Tbps speeds ramp. Pluggable bandwidth growth will further surpass 50% in later years.

- 400G pluggables dominated 2024. According to Cignal AI’s Transport Hardware Report, spending by traditional network operators declined overall in 2024, while growth came from Cloud & Colo operator

sspending on DCI – where 400G pluggables are used. While some embedded solutions (800G and 1.2T+) also grew slightly YoY, lower-speed embedded solutions all declined YoY. - Before 2022’s introduction of 400ZR optics in form factors designed for direct switch and router installation, bandwidth growth was almost entirely served by embedded optics. In 2023, the growth of 800G embedded solutions coupled with a decline in 100G/200G pluggables pushed embedded growth up relative to pluggables, but this dynamic changed drastically a year later.

- In 2025, 1.2T+ embedded solutions will contribute significantly to bandwidth growth as those solutions continue to be introduced, However, pluggables at 400G and 800G will also thrive, thereby balancing the scale between embedded vs pluggable growth.

- After 2026, telecom bandwidth growth will be overwhelmingly dominated by pluggables as 400ZR shipments continue with a long tail and 800ZR/1600ZR are deployed in both metro and long-haul networks.

The Vendors

Marvell and Acacia/Cisco are the established players in 400G pluggable optics sales, though Ciena joined as a significant supplier of 400G pluggables in 3Q24. While many other vendors offer 400G pluggables (most using Marvell’s DSPs), none rival the shipment volume of these top three.

- 400G pluggables (400ZRx) should continue to be a big part of bandwidth growth through 2027, favoring the current top three 400ZR vendors (Cisco/Acacia, Marvell, and Ciena).

- Marvell’s 800ZR DSP and modules have at least a 12-month lead on all competitors, a first to market strategy that worked well for the company at 400ZR. However, by coming out early, Marvell did not include the later ratified 800ZR+ standard PCS, which could impact opportunities on long-haul routes. Marvell – and its DSP customers – point out that most links are bookended and that the Marvell DSP has a proprietary mode that will provide comparable performance to the standard.

- Ciena and Cisco/Acacia have already demonstrated their own 800ZR modules and will cede the market share they established with 400ZR reluctantly.

- As pluggables move to higher rates (800G/1.6T), traditional equipment manufacturers are working to break the 400G stronghold that the top three vendors have established by aggressively targeting pluggables with their own DSPs. Infinera has been very public about its plans to deliver 800G pluggables and its win with a major hyperscaler to deploy 800ZR, while Nokia has always prioritized pluggable optics as part of its internal development for its own equipment. The combined company could be a strong contender at 800ZR.

- As China ramps up its AI buildouts, native equipment vendors Huawei, ZTE, and Fiberhome look to capture some of the pluggable coherent market. Chinese operators have not traditionally bought third-party pluggable optics, so there is less opportunity in those builds for pure component suppliers, even Chinese suppliers.

- Component suppliers like Coherent and Lumentum have already demonstrated 800ZR modules (based on the Marvell DSP), and they intend to leverage their laser expertise in building these increasingly complex modules.

Conclusion

Going forward, embedded solutions at the 1.2T, 1.6T, and higher will continue to contribute to bandwidth growth, but pluggables will keep overall WDM bandwidth growth in the 30-40% range. Companies well-positioned with 400ZR will continue to benefit from the move to pluggables. Equipment OEMs will enter the market in a more material way at 800ZR as they leverage their high-speed coherent DSP expertise and redirect efforts into the new, high-speed pluggable optics.