Vendor Summary Reports examine recent quarterly results and items of interest about key vendors in the optical market. Occasionally we also write in-depth profiles of smaller companies that we think are interesting.

Are you the owner of a network equipment manufacturer who’s looking to sell your company? If so, then please call Didier Brédy, CEO of Ekinops – because he’s looking to buy. How does a small French networking equipment manufacturer find itself with a wad of cash burning a hole in its pocket? Through a disciplined focus on the geographies, customers, and technologies in which it’s high-touch sales and engineering capabilities add the most value, Ekinops has grown rapidly and done so with healthy margins. However, its core strength – designing and manufacturing its own coherent interfaces – and its primary market – small and mid-sized network operators – are both about to be disrupted by the widespread adoption of pluggable, interoperable coherent modules.

Company Background

Based on the Brittany coast in Lannion, France, Ekinops got its start during the post-bubble telecom winter of 2003. A pair of former Alcatel engineers had the idea of putting FPGAs together with discrete components to help optical equipment manufacturers outsource some of their R&D in the face of the brutal cost-cutting that was wracking the industry at the time. The venture wasn’t successful, but it provided a starting point for the company’s expansion into optical systems upon the arrival of Brédy in 2005.

With 20 years of experience in telecom – most of it in the US – Brédy was able to raise funding and redirect the company’s focus to the WDM systems market, which was rapidly maturing in the mid-2000s as carriers began to migrate from SONET/SDH and 10G was hitting its stride. Focusing on the US market, Ekinops’ WDM system gained early traction with Global Crossing, Clearwire, and PEG Bandwidth.

Ekinops went public in 2013 with only €15M in revenue. Since then, it has achieved growth through a combination of organic market success and three acquisitions, most notably an access router vendor in 2017 (accounting for roughly half of company revenue) and the OTN business of Padtec (more on that later). Ekinops’ 2022 revenue grew 23% to €128M, with a bit less than half of the total coming from sales of optical transport gear. Roughly a third of company revenue comes from its layer 2/3 voice and data access devices, and the remaining 15% from its software portfolio which includes virtualization, SD-WAN, and management products.

Customer and Geographical Focus

Ekinops credits much of its success to providing its customers with a product and a customer experience tailored to their unique needs. The big optical vendors design their gear for the largest markets – Tier 1 carriers, hyperscalers, and cable MSOs. From the perspective of small network operators, their products represent a premium brand, often carry a premium price, and are burdened with features they don’t need. In contrast, Ekinops offers product focus and simplicity and brings a high-touch sales model valued by small operators who tend to lack the expertise and resources found in larger companies. Ekinops offers these customers a turnkey experience, from network design to equipment staging. The company’s sales are mostly direct, as it has chosen not to sacrifice intimacy for scale by expanding through resellers.

The types of customers targeted by Ekinops – Tier 2/3 operators, enterprises, universities, and municipalities – travel in small circles. They participate in the same consortiums and trade shows, where they share their experiences. With a reputation for product quality and attentive service, this word-of-mouth marketing has been key to Ekinops’ growth. The US, which has a much longer tail of small optical network operators than Europe, has been the company’s engine of growth for several years.

Engineering

Ekinops’ optical transport platforms, known as Ekinops360, are right-sized for its market. While they lack the scale and cutting-edge line system technology of their larger competitors, the solution is mature and features a surprisingly exhaustive set of aggregation and transmission line cards. The portfolio includes 2RU and 7RU WDM chassis, three OTN chassis topping out at 2Tbps, and a family of line system white boxes. The common thread running throughout Ekinops’ portfolio is its internally designed and manufactured coherent line cards.

Coherent interfaces account for 60-70% of total optical networking hardware revenue, and this is where Ekinops has focused much of its engineering resources. Unlike most small optical vendors that partner with subsystem manufacturers (predominantly Acacia) for complete optical modules, Ekinops designs and manufactures its own embedded transceivers from discrete components. By selecting and integrating the DSP (they’re known to partner with NEL), TROSA, lasers, and other components, it can better manage its supply chain while balancing performance and cost according to the needs of its customers.

A good example of Ekinops’ design capabilities is support for bidirectional, single-fiber operation. Single fiber operation (where TX and RX share the same fiber using different wavelengths) is a feature valued by many cost-conscious, fiber-constrained operators not concerned with maximizing fiber capacity. But it’s not commonly available from the large vendors, for whom the business case to address this small slice of potential customers just isn’t there. (Most coherent interfaces use a single ITLA for both transmission and coherent reception. Bidirectional operation requires a second laser). But for Ekinops, it’s a way to leverage its engineering capabilities and differentiate its products to better suit the operators it targets, and most of its interfaces support such a mode.

Ekinops’ corporate agility and engineering skillset came in handy during the pandemic and subsequent supply chain crisis. It adopted a policy of never turning down the procurement of necessary components, regardless of price, and to deliver systems to its customers at any cost – a practice that engendered customer loyalty and allowed it to increase prices accordingly. Ekinops’ practice of executing its own discrete board-level designs also paid off. Combined with in-house manufacturing which sits alongside engineering in Brittany, Ekinops was able to re-design and manufacture updated hardware in a matter of weeks.

Ekinops’ most successful coherent product is its Gen30P 200G WDM interface, which remains popular among cost-conscious operators. The company offers Gen60P 400G/600G interfaces and is building a Gen120P 1.2T module based on NEL’s latest DSP. As one might expect from a vendor specializing in board-level coherent designs (and in contrast to similarly sized European optical vendor Smartoptics), Ekinops is somewhat skeptical of IP-over-DWDM and remains committed to the value of embedded optics. But this isn’t merely a defensive position. Its target market of small telcos is understandably wary of the complexities IP-over-DWDM can introduce and sees an ongoing role for OTN, particularly among carriers’ carriers, which are a key segment for the company. But Ekinops’ preference for embedded optics isn’t dogma, and it also offers line cards based on merchant CFP2 pluggable modules.

Networks and Products

A common growth path for Ekinops has been to sell its coherent interfaces for use over existing line systems. Long before open line systems became popular, these were called alien waves, and customers in Ekinops’ target markets have been deploying them for over a decade. (Anecdote: The author was formerly a sales engineer for a large network equipment manufacturer where he was involved in selling a 10G/ROADM solution to a research and education network in the mid-2000s. On a sales call with the client several years later, he was eager to discuss the company’s new 100G offering only to be told that they had already deployed 100G over the existing network – 100G from Ekinops.)

Since then, Ekinops has steadily moved upstream from alien waves and simple point-to-point designs to more sophisticated ROADM and metro aggregation networks. Its customer base has grown in tandem from small intra-state operators to regional carriers – it now boasts a North American carrier with a presence in 16 states as a customer.

This market expansion has been fueled in part by the 2019 acquisition of the OTN switching platforms and engineering team of Brazilian equipment manufacturer Padtec. The addition of OTN switching was initially to gain a seat at the table in the tenders of large operators. But it’s since proven popular among smaller operators and wholesalers as a tool to provide service protection, bandwidth optimization, aggregation, and interoperability – even in the USA where OTN is considered passé among IP-centric Tier 1’s, hyperscalers, and MSOs.

This raises the question of why Padtec, the only optical vendor local to CALA (a ripe market for OTN), would sell its switching business. The answer is simple – it chose not to compete with Huawei. The Chinese giant’s renewed emphasis on “OTN to Everysite” combined with a refocus on regions that are less sensitive to geopolitical pressure has resulted in an aggressive sales push in CALA, including a close partnership with struggling Brazilian national carrier (and Padtec compatriot) Oi.

With cash to spend and an OTN opportunity in a US market free of Chinese competition, Ekinops was a natural fit for the business. In Europe, where Huawei remains strong, Ekinops positions the solution as a non-Chinese alternative in the OTN aggregation space, particularly in the customer-facing access portion of the network. Further testimony to the potential OTN opportunity in North America is Ekinops’ resale partnership with Fujitsu, a company with a history of successfully incorporating gear from other manufacturers into its portfolio.

The ETSc6 2Tbps OTN Switching Platform

Financial and Regional

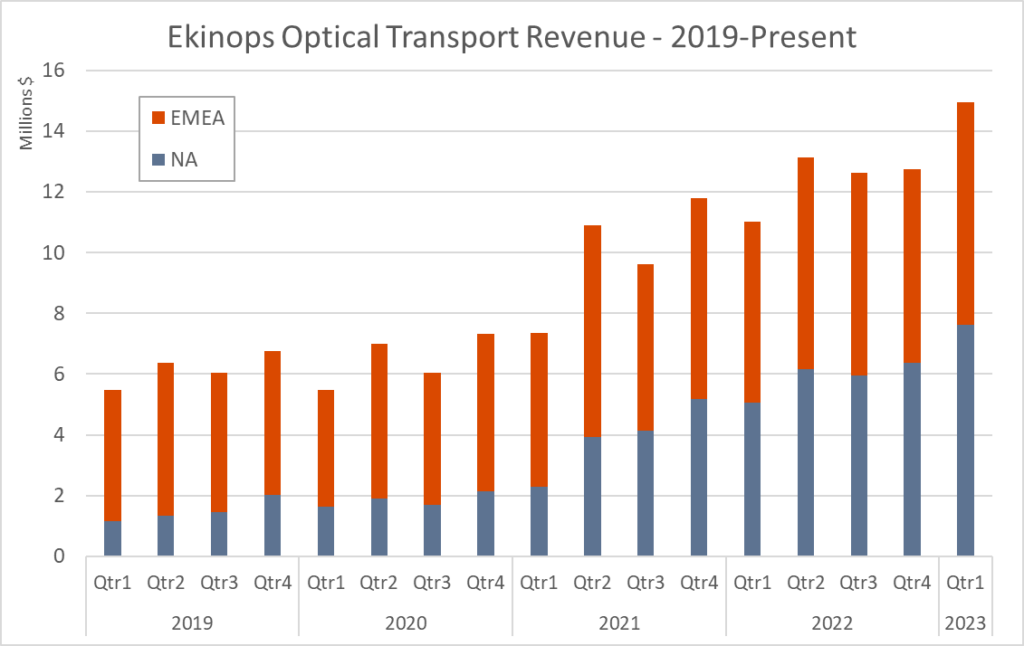

Ekinops’ 2022 optical transport revenue grew nearly 30% to $50M, evenly split between the US and Europe. Its US business is on a more rapid growth trajectory, increasing by over 50% in 2022 compared to less than 10% in Europe. Oddly, Ekinops does little transport business in its home country of France, with its European revenue coming predominantly from Germany and Eastern Europe.

Upon the announcement of its acquisition of Padtec’s OTN business in 2019, Ekinops declared that its aim was to triple optical transport revenue within five years – a goal it achieved in less than four.

Conclusion

France-based Ekinops is a case study in targeted innovation and market discipline. It’s proof that even in the hyper-competitive, margin-challenged business of optical networking, there are pockets of opportunity in which focused vendors can differentiate and thrive. But Ekinops will be forced to adapt. In a market rapidly evolving toward disaggregated platforms, merchant pluggable optics, and IP-over-DWDM, its in-house coherent development will become less of a competitive advantage. OTN switching shows surprising resilience in certain carrier networks, but the market forces pushing IP as the universal switching and aggregation layer are powerful and likely to displace OTN in the long run (at least outside of APAC). Still, whatever the future of optical technology and network architectures, there will always be customers that more attuned and responsive vendors can win over. As long as Ekinops maintains its focused corporate culture and positive reputation among customers, it’s likely to continue its success.