Volumes Expected to Triple in 2022

BOSTON (March 31, 2022) – Shipments of 400ZR/ZR+ modules surged in 4Q21 as Cisco (Acacia) and Marvell rapidly scaled production capacity, according to the 4Q21 Transport Applications Report from Cignal AI.

However, demand from Cloud Operators is still exceeding supply, which will be increased this year as vendors such as Ciena, Neophotonics, and II-VI grow production. Cignal AI expects that shipments of 400ZR/ZR+ modules will triple in 2022 as cloud operators such as Microsoft, Amazon, and Google are joined by traditional network operators such as AT&T, Windstream, and COLT rolling out high volume deployments.

“Both webscale and telco operators are making fundamental changes to their network architectures due to the availability of pluggable 400G coherent modules,” said Scott Wilkinson, Lead Optical Component Analyst at Cignal AI. “Module shipments are ramping up quickly, with more than half of all shipments to date coming in the 4th quarter.”

More Key Findings from the 4Q21 Transport Applications Report:

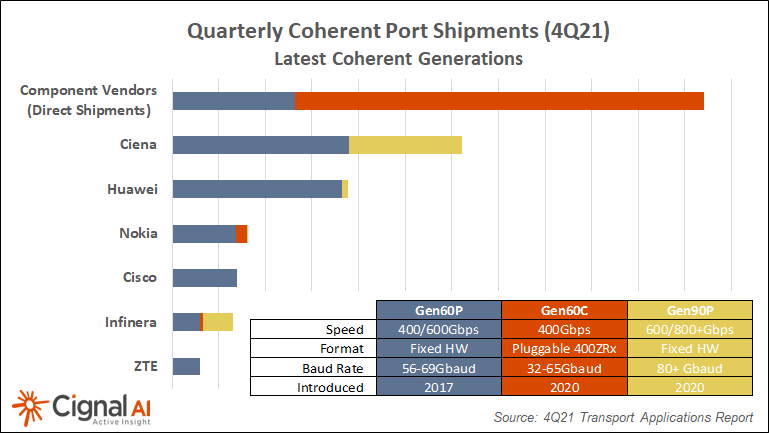

- Direct shipments of coherent ports to operators are growing rapidly as pluggable coherent modules reshape the supplier landscape.

- Shipments of Gen60C pluggable 400ZR modules remain supply-constrained, with only two vendors supplying almost all of the volume to date.

- Ciena remains the largest supplier of cutting-edge Gen90P 800G capable coherent ports, although Infinera’s ICE6 product shipments are increasing rapidly.

- Compact Modular revenue in North America grew by +25% in 2021 and now represents over a third of optical hardware shipped in the region. Ciena is the market leader in this category.

- Only Huawei saw Packet-OTN sales increase during 2021. Nokia’s continuing investment in its OTN portfolio has made it the leading western vendor of OTN, and the company is best positioned to win business from Huawei in Europe.

About the Transport Applications Report

The Transport Applications Report provides perspective on the transformative product segments of the optical and packet transport markets, including comprehensive market share and forecasts of compact modular, packet-OTN, and optical line systems as well as coherent port shipments.

Vendors examined include Adtran, ADVA, Ciena, Cisco, Ekinops, Fujitsu, Huawei, Infinera, Marvell, NEC, Nokia, NTT Electronics (NEL), Ribbon and ZTE.

Clients can join a live presentation of the report results today at 11 AM ET by registering at the website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and its end customers. Our work blends expertise from various disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase ReportSales: [email protected]

Web: Contact us