Cignal AI Report Enhanced with Vendor Share of All Customer Markets

BOSTON (July 23, 2019) – Cloud and colo operator spending on optical communications hardware continued to spur market growth in the first quarter of 2019, according to the most recent Optical Customer Markets Report from research firm Cignal AI. Cloud and colo spending increased over 50% in North America, offsetting declines in other regions, with Ciena continuing to lead all sales to cloud operators.

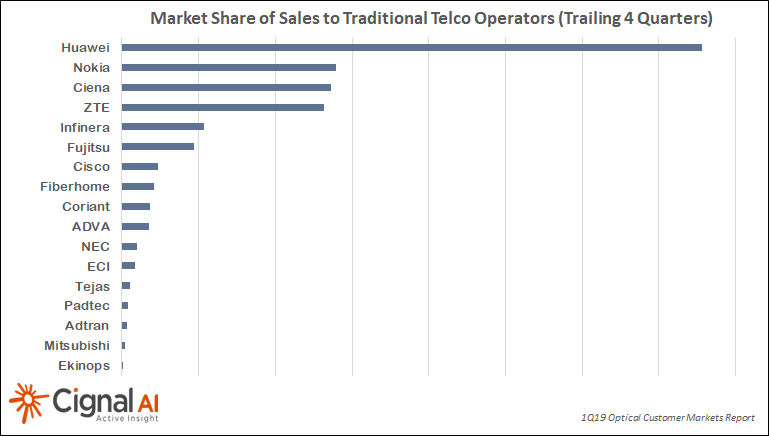

In EMEA, traditional telco (incumbent and wholesale network operators) optical spending recovered and will grow by double digits during 2019. Spending growth by these operators is slowing in APAC as total spending reaches record highs. Huawei continues to lead this market in APAC, EMEA, and CALA, while Ciena leads in North America.

“Optical spending in North America continues to shift from traditional telco providers to the cloud and colo operators,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Despite traditional telco operators accounting for most spending, the rapid growth in cloud spending combined with traditional operators now adopting cloud architectures has permanently changed supplier R&D priorities.”

The Cignal AI Optical Customer Markets Report is issued quarterly and quantifies optical equipment sales to five key customer markets: Incumbent, Wholesale, Cloud and Colo, Cable/MSO, and Enterprise and Government.

The latest report is now enhanced and includes optical equipment vendor market share for all customer markets as well as updated forecasts through 2023.

Additional findings in the 1Q19 Optical Customer Markets Report include:

- Ciena Waveserver Ai market share continues to increase as cloud & colo spending grows. New compact modular platforms targeted at this market are entering the market in 2Q19 with Cisco, Infinera, and Nokia among those expecting stronger sales in the next quarter.

- North American cable/MSO spending declined in the first quarter. However, moderate growth is still expected in 2019.

- Enterprise and Government spending shows pressure from consolidation and Cloud and Colo encroachment and isn’t expected to recover in the next two years.

About the Optical Customer Markets Report

The Cignal AI Optical Customer Markets Report tracks optical equipment spending by end customer market type. It provides forecasts based on expected spending trends by regional basis. The report includes revenue-based market size and share for all end customer markets across all regions.

Vendors examined include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu Networks, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, TE Conn, Tejas Networks, Xtera and ZTE.

Quarterly report deliverables include an Excel file with complete data set, live Superdashboard view of all data, PowerPoint summary of highlights and Cignal AI Active Insight market event news briefs. Full report details, as well as free articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us