Optical Applications Report Reveals Market Share for Coherent 100G Shipments and Rapid Growth in Compact Modular equipment for Second Half of 2017

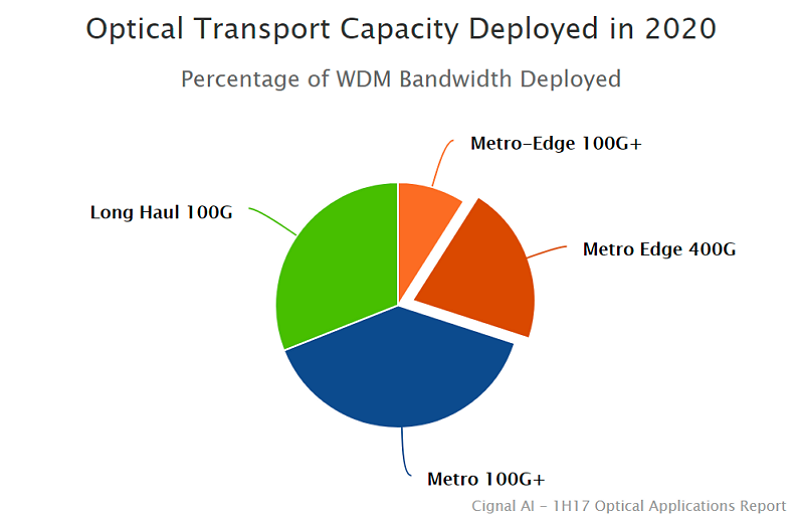

BOSTON (September 18, 2017) – Cignal AI, a networking component and equipment market research firm, issued the industry’s first comprehensive analysis measuring the anticipated growth of coherent 400G WDM. Forecasts in its recent Optical Applications Report estimate that this technology will account for almost one-quarter of all deployed WDM bandwidth in 2020. The Applications Report also predicts that revenue for equipment originally designed for the data center interconnect (DCI) market will reach $1 billion by 2019, as these systems become widely adopted outside of traditional DCI applications.

“Cignal AI has close relationships with equipment and component manufacturers, as well as end users, and these relationships give us a unique insight into the optical equipment market. From this vantage point, we can forecast emerging technologies such as coherent 400G WDM usage,” states Andrew Schmitt, lead analyst for Cignal AI. “Pluggable 400G ZR modules should enter the market by 2019, and they will be the final nail in the coffin for 10G WDM networks.”

Produced twice a year, the Optical Applications Report examines market share through the first half of 2017 and provides forecasts in three key markets: 100G+ coherent WDM, compact modular equipment used for DCI and advanced packet-OTN switching hardware. Key findings in the report include:

100G+ Coherent WDM

- 400G coherent WDM volume starts to ramp this year, led by Ciena deployments and then followed by other suppliers six to nine months later.

- The introduction of small form factor 100G and 400G pluggable models will spur the largest optical market transformation since the “Optical Reboot” of 2012-2015 by virtually eliminating most 10G WDM deployments from the world’s optical infrastructure.

- Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021.

- Cisco is growing 100G port deployments faster than all other vendors in the market.

- Despite widespread expectations to the contrary, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

Compact Modular Equipment

- Equipment originally designed for DCI applications is rapidly evolving into applications outside the datacenter. Incumbent, wholesale and cable operators will adopt these stackable systems with open software models to build disaggregated optical networks. Using “DCI” – which is an application – to classify an equipment type no longer makes sense. Cignal AI has changed its category name and definition appropriately to “Compact Modular”

- Spending on compact modular equipment more than tripled in the first half of 2017, compared to the same period last year. Ciena, Cisco, and Infinera are the market share and technology leaders for this sector.

Advanced Packet-OTN Switching

- Large incumbent operators continue to grow deployment of these systems. Despite its complexity, advanced packet-OTN switching remains the best approach for unifying many customers and applications on a single transport infrastructure.

- Revenue for packet-OTN systems grew in the double digits in the first half of 2017, compared to the same period last year.

- Verizon’s deployment of these systems is increasing and will affect vendor market share more materially in the second half of 2017.

About the Optical Applications Report

The Cignal AI Optical Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, compact modular and advanced packet-optical switching hardware. Deliverables include Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report features revenue-based market size and share for the hardware categories and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Fujitsu, Huawei, Infinera, Inphi, NTT Electronics (NEL), Nokia and ZTE.

Full report details, as well as articles and presentations, are available to users who register for a free account on the Cignal AI website. If you have questions or are interested in purchasing the report, please contact us.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.