1Q25 Transport Hardware & Markets Report

The Optical and Routing markets show signs of recovery, and tariffs aren’t yet affecting business.

1Q25 Preliminary Transport Hardware & Markets Report

The Optical and Routing markets show signs of recovery, and tariffs aren’t yet affecting business.

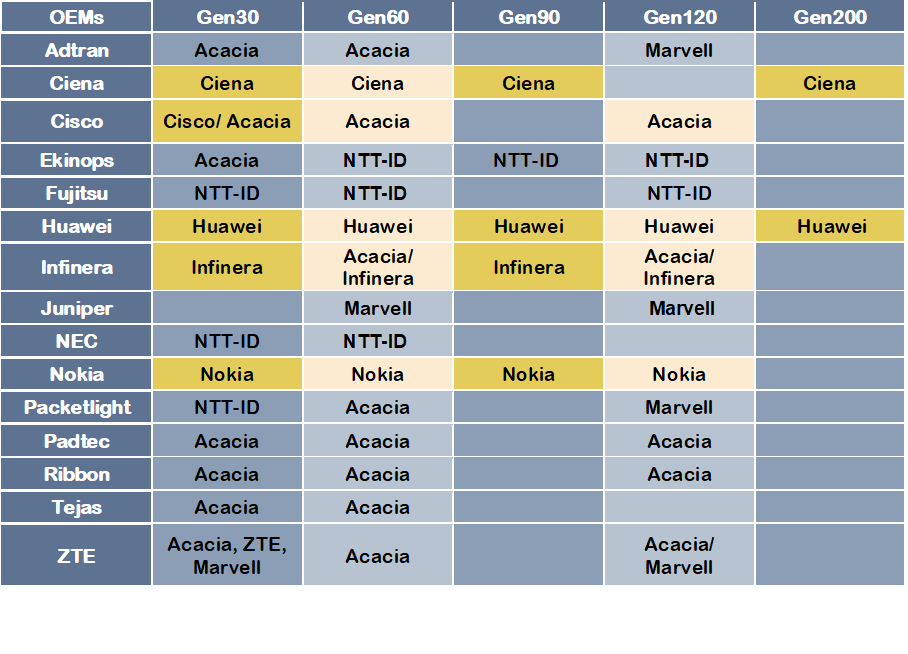

Tracking the Coherent DSP Supply Chain – 2025

Uncovering who uses which DSP, and which DSP vendors ship the most volume.

4Q24 Transport Hardware & Markets Report

Carrier caution has resulted in underinvestment, and networks are now running “hot” enough to require upgrades and expansion.

4Q24 Preliminary Transport Hardware & Markets Report

Carrier caution has resulted in underinvestment, and networks are now running “hot” enough to require upgrades and expansion.

3Q24 Transport Hardware & Markets Report

Optical spending by Cloud & Colo operators grew 7% worldwide, while spending by Service Providers declined -17%.

World’s First 800ZR Coherent Services with Juniper Networks

This first deployment uses an early release of Juniper’s JCO800 coherent optics in the PTX

3Q24 Preliminary Transport Hardware & Markets Report

Optical sales fall -14%, but are buffered by strong sales to Cloud and Colo operators.

Coherent Announces L-Band 800G ZR/ZR+ Pluggable Transceivers

The transceiver leverages the Coherent L-band 140 Gbaud IC-TROSA, and demonstrated at ECOC2024 in a Juniper PTX.

2Q24 Transport Hardware & Markets Report

Optical sales fall -18% as carrier inventories take longer to deplete than anticipated.

2Q24 Preliminary Transport Hardware & Markets Report

Optical sales fall -18% as carrier inventories take longer to deplete than anticipated.

1Q24 Transport Hardware & Markets Report

Ex-China, revenue drops as service provider spending continues to stall.

1Q24 Preliminary Transport Hardware & Markets Report

Ex-China, revenue drops as service provider spending continues to stall.

Coherent, Juniper, and Marvell Demonstrate 800ZR System at OFC24

Mentioned: Scott Wilkinson on 800ZR pluggables volumes

4Q23 Transport Hardware & Markets Report

Cloud Spending on Optical Transport Jumps 46% in 4Q23, Traditional Service Provider Spending Remains Weak

4Q23 Preliminary Transport Hardware & Markets Report

The market slides ex-china as service provider spending stalls.

3Q23 Transport Hardware & Markets Report

The optical market grew 4% – cloud operators continue to invest in transport and vendors are still shipping against large backlogs.

3Q23 Preliminary Transport Hardware & Markets Report

The optical market grew 4% – cloud operators continue to invest in transport and vendors are still shipping against large backlogs.

2Q23 Transport Hardware & Markets Report

Optical sales slowed due to inventory absorption and macroeconomic concerns, but routing sales continued to grow.

2Q23 Preliminary Transport Hardware & Markets Report

Supply chains loosen up and revenue ramps, some service providers express hesitation.