1Q22 Transport Hardware & Markets Report

First-quarter 2022 North American optical and packet sales continue to rebound despite supply-chain constraints. Excluding NA, both hardware categories declined in 1Q22.

4Q21 Transport Hardware & Markets Report

Fourth-quarter 2021 worldwide optical hardware spending increased 3.5% YoY. Declines centered in APAC for the second consecutive quarter, while all other regions grew YoY.

3Q21 Transport Hardware Report

Optical forecasts were reduced by $1.1B worldwide in 2025 due to a shift of coherent optics into router-based DCO’s.

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

2Q21 Transport Hardware Report

First-quarter 2021 worldwide optical hardware spending was down slightly YoY, Chinese optical hardware spending was down significantly.

1Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined steeply YoY compared to a heavily frontloaded 1Q20, but show signs of longer term recovery. Cloud & Colo optical spending worldwide slowed as NA spending stalled in 2020 and APAC is just beginning to take off.

1Q21 Transport Hardware Report

First quarter optical spending was down compared to the Covid-impacted 1Q20. Packet transport sales, which suffered a year ago from operational issues, increased sharply.

4Q20 Transport Customer Markets Report

North American Traditional Telco spending on optical and packet hardware declined significantly in the 4th quarter, due to a dramatic reshuffling of capex spurred by the pandemic during the first half of 2020. Meanwhile, APAC Cloud & Colo spending exploded. Long term, hardware sales in all markets are predicted to return to growth in the second half of 2021.

4Q20 Transport Hardware Report

North American optical and packet transport spending plummeted in North America as Tier 1s concentrated COVID-related capex in the first half of the year.

Juniper 4Q20 Vendor Summary Report

Juniper exceeded expectations in 2020, a notable feat as the overall market was difficult for switching and routing. Much of the company’s success comes from its recently diversified customer base away from Tier 1 concentration.

2021 Outlook: Optical & Packet Transport

This report provides a summary of Cignal AI’s current outlook for the year. Creating forecasts for 2020 was uniquely challenging and forecasting the expected return to normal by the end of 2021 is also very complex.

3Q20 Transport Customer Markets Report

North America transport hardware spending growth shifted dramatically this quarter from Cloud & Colo operators to Incumbents. APAC Cloud & Colo optical sales grew again.

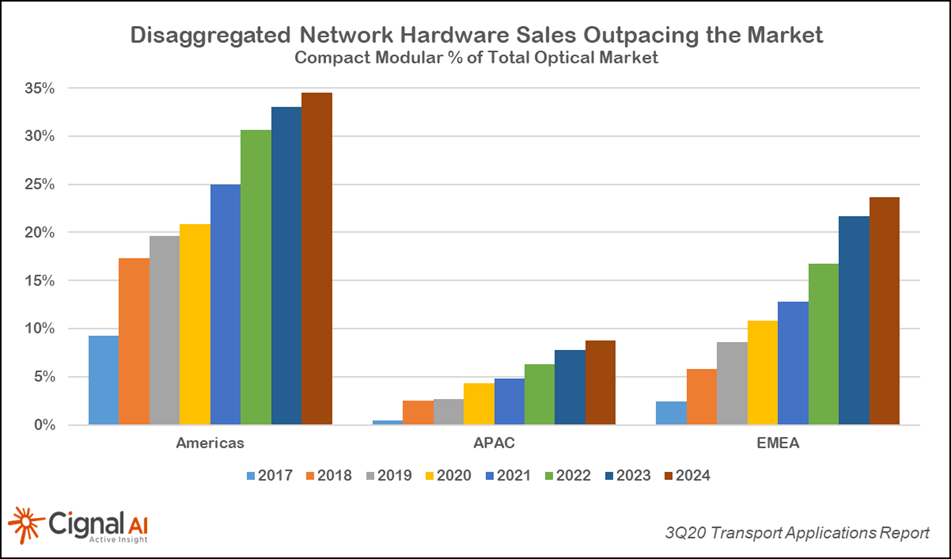

3Q20 Transport Hardware Report

Third quarter results were better than forecast, especially in EMEA where both optical and packet hardware spending increased. North America spending declined while China spending was flat and Japan spending growth continued unabated.

Juniper 3Q20 Vendor Summary Report

Juniper defied forecasts of a flat to down second half of 2020 by posting one of its best growth quarters in recent history in Q3.

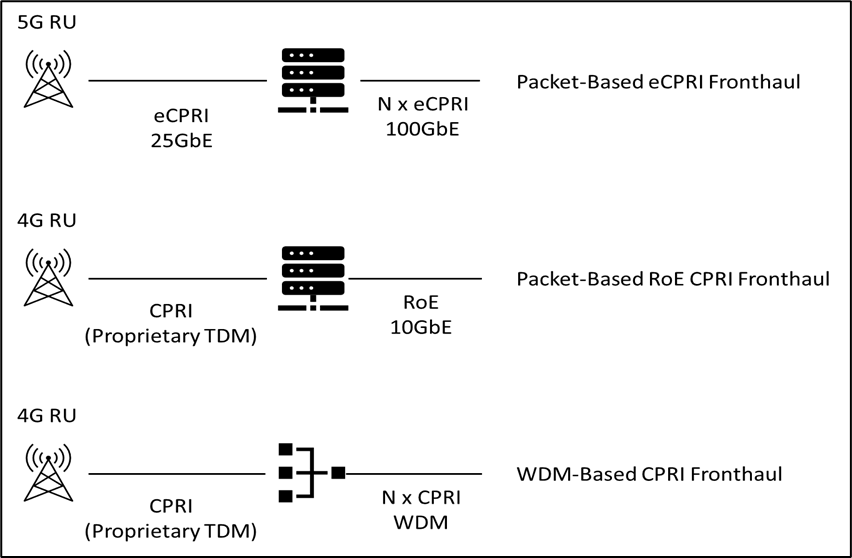

5G Optimized Packet Transport for Mobile Fronthaul

The diverse requirements of 5G require both the radios and the network supporting the radios to be updated. This report covers advances in 5G packet fronthaul and includes an overview of existing vendor solutions.

2Q20 Transport Customer Markets Report

Cloud & Colo optical spending in North America cooled while spending in APAC was unexpectedly strong this quarter.

2Q20 Transport Hardware Report

Second quarter results were mixed. Forecasted growth in Q2 from sales pushed out of Q1 did not materialize as anticipated and carriers indicated that annual CapEx will not be increased – suggesting a flat to down second half of the year.

1Q20 Transport Customer Markets Report

North American Incumbent optical spending was up almost 50% YoY while Wholesale, Cable/MSO, and Cloud spending all declined this quarter.

1Q20 Transport Hardware Report

Vendors generally claimed a 5-10% reduction in sales due to COVID-19 operational issues this quarter. While demand increased, the inability to get parts, manufacture equipment, and deliver to end customers reduced sales in all areas.

4Q19 Transport Customer Markets Report

Cloud & Colo optical spending growth cooled in the 4th quarter but still led growth for the year with Ciena as market share leader. North American Incumbent and Cable/MSO optical spending came back strong in the 4th quarter.