Fujitsu 4Q21 Vendor Summary Report

Fujitsu’s North American revenues finally returned to growth as wireless fronthaul and compact modular revenue grew.

Lumentum 4Q21 Vendor Summary Report

Although Lumentum posted revenue declines in both Telecom and Datacom, segments the company is optimistic about long-term growth in the two markets.

Ciena 4Q21 Vendor Summary Report

Ciena has a record revenue quarter – and record backlog as supply chain challenges continue.

3Q21 Transport Customer Markets Report

Cloud operator and traditional telco spending leads rebound in North America

Marvell 4Q21 Vendor Summary Report

Marvell’s Industry Analyst Day provided excellent insight into the company’s views on the roadmaps for intra-datacenter and pluggable coherent optics.

3Q21 Transport Applications Report

Compact Modular equipment sales continued to surge while Chinese coherent port shipments stalled.

3Q21 Optical Components Report

Initial Optical Components report, in Beta – for access to the report, please contact [email protected].

3Q21 Transport Hardware Report

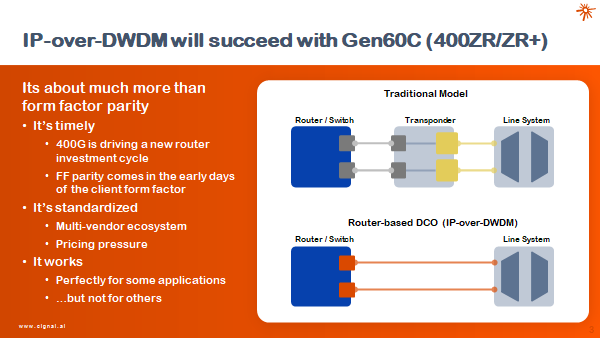

Optical forecasts were reduced by $1.1B worldwide in 2025 due to a shift of coherent optics into router-based DCO’s.

Infinera 3Q21 Vendor Summary Report

ICE6 ships in volume, but supply chain challenges keep revenue flat.

II-VI 3Q21 Vendor Summary Report

Despite supply chain issues, II-VI expects revenue growth in optical communications and consumer components.

400ZR IPoDWDM – Market Impact and Forecast

How will the adoption of 400ZR and ZR+ pluggable coherent modules impact Metro WDM equipment spending?

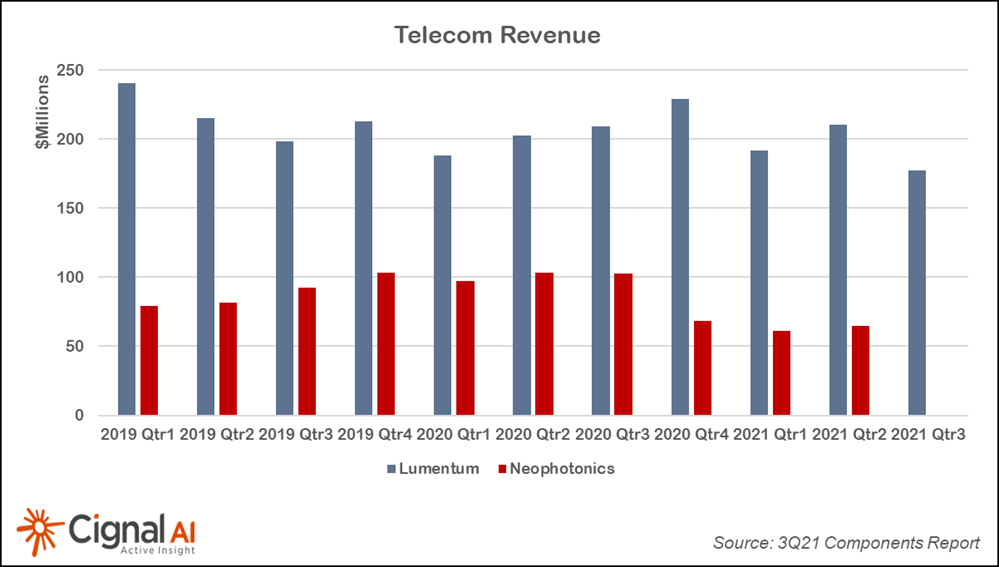

Lumentum 3Q21 Vendor Summary Report

Lumentum’s revenue above guidance was overshadowed by the announcement to purchase Neophotonics.

Lumentum & Neophotonics Merger

Cignal AI’s observations on the proposed merger.

Nokia 3Q21 Vendor Summary Report

Nokia’s optical business declined against an elevated 3Q20, while packet sales continued their steady growth.

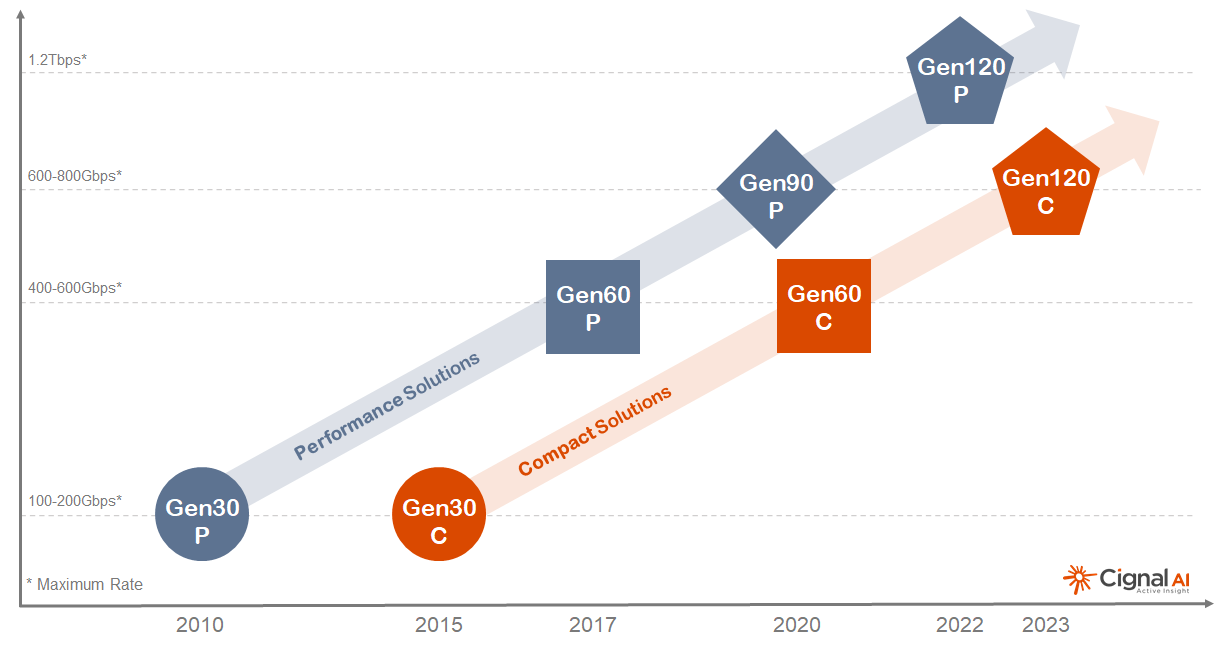

400ZR vs 800G – Classifying Coherent Technology

The historical classification of coherent optical technology (Gen1, Gen2, etc.) is no longer sufficient. Therefore, Cignal AI will now recognize and classify coherent DSP technology by its maximum baud rate and whether the DSP is optimized for Performance or Compact applications.

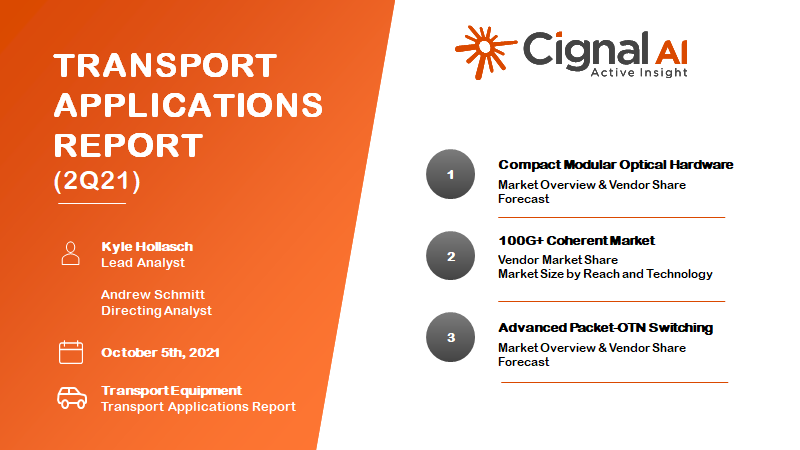

2Q21 Transport Applications Report

Compact modular sales again outperformed the overall optical hardware market while Packet-OTN sales declined. 400ZR is shipping but is supply limited.

Cisco/Acacia Announces 1.2Tbps DSP and Coherent Module

Development moves past 90+ GBaud directly to 120+

Ciena 3Q21 Vendor Summary Report

Ciena starts out the second half of 2021 strong, but supply chain headwinds threaten further growth.

2Q21 Transport Customer Markets Report

Optical spending by North American Traditional Telco carriers declined YoY; Cloud & Colo optical spending worldwide slowed as NA spending stalled.

2Q21 Transport Hardware Report

First-quarter 2021 worldwide optical hardware spending was down slightly YoY, Chinese optical hardware spending was down significantly.