Cignal AI Raises CY18 200G and 400G Coherent Forecasts

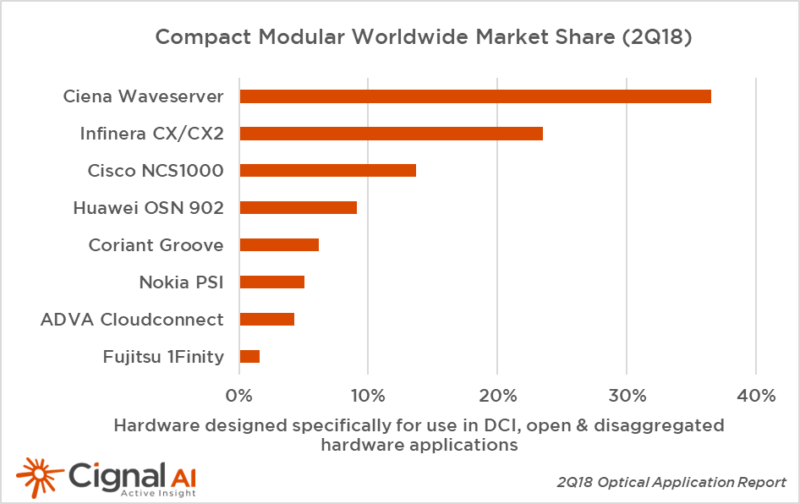

BOSTON (September 24, 2018) –Compact modular equipment vendors reported record revenues in the second quarter of 2018, according to the latest Optical Applications Report from networking component and equipment market research firm Cignal AI. This category measures hardware designed specifically for use in DCI, open & disaggregated hardware applications and is on track to top $1 billion in revenue this year. Cignal AI has raised its CY18 forecast for 200G and 400G coherent port shipments and cut its 100G coherent forecast.

“Operators are rapidly adopting second and third generation coherent technology as they seek to lower their cost per bit and achieve better performance. This has resulted in higher than expected demand for 200G and 400G speeds this year, at the expense of first-generation coherent,” said Andrew Schmitt, lead analyst for Cignal AI. “Compounding this trend is the growing adoption of 200G CFP2 DCO modules, which allows coherent technology to integrate with switches and routers more easily than earlier solutions.”

Further analysis is detailed in Cignal AI’s Optical Applications Report, which is released quarterly. The latest 2Q18 issue updates market share for the second quarter of 2018 and provides forecasts in three key markets: compact modular equipment, advanced packet-OTN switching hardware, and 100G+ coherent WDM port shipments.

Other key findings in the 2Q18 report include:

- Ciena and Huawei Top Compact Modular Market Growth – In this record quarter, Ciena and Huawei were the fastest-growing vendors in the compact modular segment. Ciena benefits from its third-generation coherent technology, while Huawei was lifted by greater adoption from Chinese cloud operators. New entrant Nokia also grew share in its second quarter of serving this market.

- Packet-OTN Market Grows with Incumbent Adoption – More incumbent network operators are using packet-OTN switching hardware to upgrade their transport networks. In North America, this segment grew 30 percent year-over-year as result of more deployments by Verizon and other large incumbents. Growth was also significant in EMEA and India, where Nokia has taken significant market share.

- Third Generation Coherent Gaining Momentum – Even though the overall market slowed in 2Q18 as a result of ZTE’s shutdown, other vendors experienced healthy sales growth. Third generation coherent solutions are picking up steam with Ciena’s 400G offering doing well. Acacia, Huawei, Nokia, and NTT Electronics based solutions will reach the market within the next two quarters to challenge Ciena’s lead.

About the Optical Applications Report

The Cignal AI Optical Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, and compact modular and advanced packet-OTN switching hardware. Deliverables include Excel file with complete data set, PowerPoint summary and Optical Equipment Active Insight.

The report features revenue-based market size and share for the hardware categories and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA, Ciena, Cisco, Coriant, Cyan, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Inphi, Juniper Networks, NEC, Nokia, NTT Electronics (NEL), Padtec, TE Conn, Transmode, Xtera and ZTE.

Full report details, as well as articles and presentations, are available to clients who register an account on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report

Sales: [email protected]

Web: Contact us

Link to Release