Cignal AI has increased its pluggable 800G (800ZR/ZR+) forecast for units based on new feedback from multiple industry sources and verification from the supply chain.

Reasons for the Change

As AI models are being spread across multiple sites due to space and power limitations, hyperscalers plan to deploy 800ZR/ZR+ pluggable modules to interconnect them. Led by Meta, which has been vocal about its need for 800ZR+, 2026 demand will expand faster than originally anticipated.

These modules operate at rates around 120GBaud (Gen120C) and offer performance comparable to traditional embedded modules at 400G and 800G. Meta will be the primary and lead customer, but not the only consumer of 800ZR+, which is designed for longer distance operation. Most of the major hyperscalers will use 800ZR/ZR+ modules in some capacity. Even hyperscalers (e.g. Microsoft) who are skipping the 800G pluggable module generation and waiting for 1600ZR are investigating the use of Gen120C modules operating at 400G (aka 400G-ULH).

The new capacity demand driving the increase in forecast is entirely due to additional DCI required by hyperscalers and will use the higher performance ZR+ standard. Greater 800ZR+ demand will cannibalize 400ZR+, 800G embedded, and 1.2T+ module shipments.

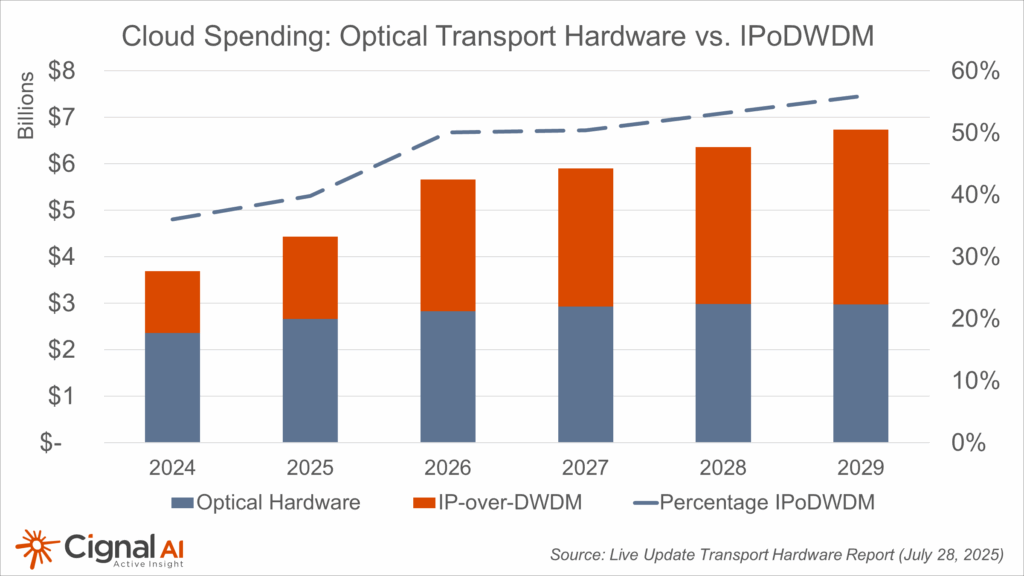

Hyperscalers will deploy these 800ZR+ optics in an IP-over-DWDM architecture, in which coherent modules are hosted directly within a router or switch instead of a dedicated optical transport platform. Pluggable coherent optics used in IP-over-DWDM, predominantly 400ZR/ZR+, are already a $2B market in 2025, accelerating to nearly $5B by 2029. As hyperscalers rush to connect AI data centers at higher speeds and over longer distances they will represent 80% of IPoDWDM deployments. This trend towards pluggable optics is steadily supplanting sales of traditional optical hardware among the Cloud & Colo market segment.

Differences from the 1Q25 Optical Components Report Forecast

Clients log in to access full report