Vendor Summary Reports examine recent quarterly results and items of interest about key vendors in the optical market. Occasionally we also write in-depth profiles of companies that we think are interesting. This vendor report covers Applied Optoelectronics’ 1Q23 results reported Jun 13, 2023.

Founded in 1997 with its US headquarters in Sugar Land, Texas, Applied Optoelectronics (AOI) is one of very few optical component makers with its own US-based manufacturing capabilities. With quarterly revenues of around $50 million, AOI is dwarfed by North American competitors Coherent ($1.2 billion) and Lumentum ($380 million) but the company has managed to carve out a successful niche for itself in the datacom and telecom optical components market.

AOI recently made news with the announcement last September of its intention to sell its Chinese manufacturing facilities and the revelation in its recent 8K filing that Microsoft has tagged the company to develop datacenter lasers to Microsoft’s specifications.

In this report, we cover:

- AOI’s Product Mix: What the company makes, primarily in the datacenter and MSO markets.

- AOI’s Vertical Integration: How owning its own manufacturing, especially its US manufacturing facility, sets AOI apart.

- Sale of Chinese Manufacturing: The reasons behind AOI’s decision to sell its PRC-based manufacturing and path forward.

- Microsoft Partnership: What is included, why Microsoft chose AOI, and why AOI sees this partnership as validation of its high-yield, US-based VCSEL manufacturing process.

- CHIPS Act: The company’s plans with regard to the US CHIPS Act.

- Quarterly Results: How AOI fared in 1Q23 overall and in the optical components areas included in Cignal AI’s reports.

Product Mix

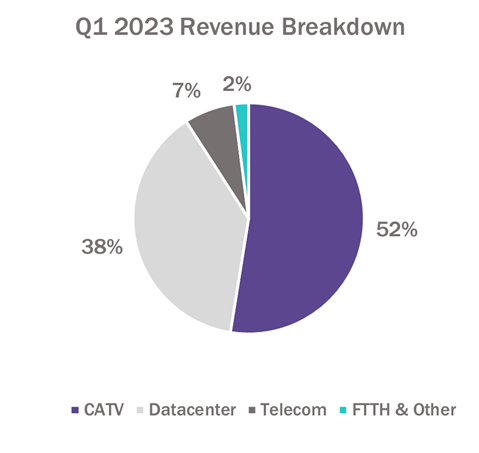

Much of AOI’s strength lies in the CATV/MSO market, which accounts for about half of its revenue. Despite the company name, not all of its products are optical, including electrical amplifiers for the CATV market. The company has an Atlanta location, which has been advantageous for talent acquisition in this area as Cisco has wound down its former Scientific Atlanta location.

On the optical side, AOI manufactures DFB lasers designed for the broadband MSO market, mostly O-band (1310nm), but with some C-band and CWDM offerings as well. AOI has optical components designed to enable cable companies upgrade to DOCSIS 4.0 and 1.8GHz operation. Cable companies are just starting these upgrades, and AOI is well-positioned to benefit, as the competitive market is much smaller than it was a decade ago with CommScope as the main supplier remaining (no more Scientific Atlanta or Arris).

In addition, AOI offers DML lasers for telecom and datacom applications and sells datacom transceivers at 100GbE, 200GbE, and (recently added) 400GbE rates. In Q1, 78% of corporate datacom revenue came from 100Gbps products, with 6% from 40Gbps and 8% from 200 and 400Gbps products.

Source: AOI 1Q23 Investor Presentation

Vertical Integration

AOI is, at the moment (see Sale of Chinese Manufacturing below), a fully vertically integrated company. AOI owns manufacturing facilities in Texas, China (PRC), and Taiwan, where the company performs a full range of functions from wafer fabrication to device manufacturing to transceiver assembly. The company’s investor presentation lists molecular beam epitaxy (MBE), Metal-Organic Chemical Vapor Deposition (MOCVD), proprietary Silicon Photonics capability, significant automation, and “Light Engine Assembly” among its internal capabilities.

The company sees its vertical integration as a competitive advantage, allowing it to keep costs low and respond quickly to unique customer demands. AOI includes customer NRE (funds provided for specific product development) as a key source of income enabled by its vertical integration.

AOI’s Texas facility has the capability to produce about 1.5 million lasers per month when at full capacity. That amount will increase to 2.5-3 million per month after the company transitions to a 4-inch wafer process (see Microsoft below). Those numbers are maximum capacity, which is rarely met as production lines are tweaked and maintained, but they demonstrate a capability to meet current and near-future demands with existing US-based facilities.

Source: AOI 1Q23 Investor Presentation

Sale of Chinese Manufacturing

In September 2022, AOI announced its intention to sell its manufacturing facilities in China to Yuhan Optoelectronic Technology (YOT) for $150 million, less a holdback amount. AOI will retain its laser portfolio and manufacturing sites in Texas and Taiwan. There are two main reasons for the sale: (1) eliminating the remaining PRC component of the company and (2) focusing on the area (lasers) where AOI has a compelling advantage.

AOI’s competitive advantage is in its semiconductor fab, not in the assembly of components, which is the focus of the PRC location. By divesting from the assembly fab, AOI will no longer need to invest in that part of the process and can instead focus on upgrading its laser capabilities. Also, by eliminating its remaining manufacturing in China, AOI will not have to cope with increasing and unpredictable tariff and trade pressures between China and Western countries, eliminating a challenge that a company of AOIs size is likely ill-equipped to deal with long-term.

AOI will retain the ability to manufacture AOCs (see the Microsoft agreement below) in its Taiwan and Texas facilities. AOI also expects to continue to use the YOT manufacturing capability for its CATV products, about 80% of which are manufactured in PRC. The other 20% are manufactured in Taiwan, and AOI could expand that capability if needed in the future. YOT will use the PRC manufacturing facilities to make datacenter transceiver products, and AOI expects that YOT will continue to use the AOI laser produced in Texas and Taiwan in those products.

AOI plans to use the proceeds from the sale to service its outstanding debt, which is currently around $130 million, and invest in business expansion. The deal is scheduled to close in 2023 or early 2024, pending regulatory approval in the US and China.

There is risk in AOI’s divestiture decision. If other companies with deeper pockets can match AOI’s laser manufacturing capabilities, perhaps at a lower price or with more long-term security, then AOI’s remaining value will disappear. The company sees its agreement with Microsoft as validation that its unique capabilities and US facilities have long-term value.

Microsoft Partnership

In an 8-K filing produced before releasing its 1Q23 results, AOI revealed that it had signed a development deal with Microsoft to make lasers for datacenter applications. AOI’s manufacturing in the US was critical to the deal’s success.

Due to political tensions and recent supply chain issues, Microsoft is looking to diversify its supplier base with a specific focus on moving manufacturing out of China. Microsoft, which has been an AOI customer for 10 years, was looking for a partner to develop VCSEL-based active optical cables (AOCs) for datacenter and AI applications at 400G and 800G. The original agreement with AOI, inked in December, was just for the lasers. The agreement now includes manufacturing of the cables themselves.

What did AOI bring to the table that its much larger competitors did not? First and foremost, AOI has US-based manufacturing capabilities. With some NRE investment from Microsoft, AOI’s Texas plant can crank out lasers in the US at rates that meet Microsoft’s needs. Second, AOI claims to have a manufacturing process that increases the yield of its laser chips.

All semiconductor lasers for Datacom are made of the same materials using the same basic designs. Those designs are more complex at higher speeds (400/800Gbps), limiting the number of fabs that can build these sophisticated designs, but the structure of lasers is similar across manufacturers. For short-distance lasers like VCSELs, differentiation comes primarily from cost. And the primary driver of cost is yield – how many working lasers can be made from one semiconductor wafer. AOI views the Microsoft agreement as proof of its claims that its VCSEL process for 400/800G has a superior yield that will lead to lower overall costs for AOCs.

The NRE from Microsoft will allow AOI to move from a 2-inch wafer process to a 4-inch wafer process. Larger wafers can yield more devices per manufacturing run, but they require all the equipment in the manufacturing line (lithography, epitaxy, ion implantation, etc.) to be upgraded to a larger size. With the investment from Microsoft, AOI is in the process of making those upgrades to its Texas facility. Microsoft has pledged $4 million for this NRE tranche, and AOI has reported that $3 million has been paid to date.

AOI said on its latest earnings call that the new product development will take several quarters to complete but the company believes that the upgrade will lead to long-term improvement in capabilities and a unique position for the company’s US-based manufacturing.

CHIPS Act

One would imagine that, as a semiconductor manufacturer in the US, AOI is a prime candidate for CHIPS Act funding, which is designed to boost domestic semiconductor manufacturing capabilities. However, AOI maintains some skepticism, as the CHIPS Act investments are aimed at much larger companies.

Under the CHIPS Act, the federal government provides 10-15% of the cost of building or expanding semiconductor manufacturing capabilities, but that investment comes with regulatory strings attached. Those strings would be a small part of the 10-15% investment for a billion-dollar company, but they may outweigh the benefits for a company like AOI that will be making incremental upgrades to its capabilities that would likely not total more than $20-30 million.

What AOI is excited about in the CHIPS Act is the 25% refundable tax credit for building US manufacturing capabilities. AOI has not made any decisions or public statements on the CHIPS Act overall but will certainly be taking advantage of this benefit of the law.

Quarterly Results

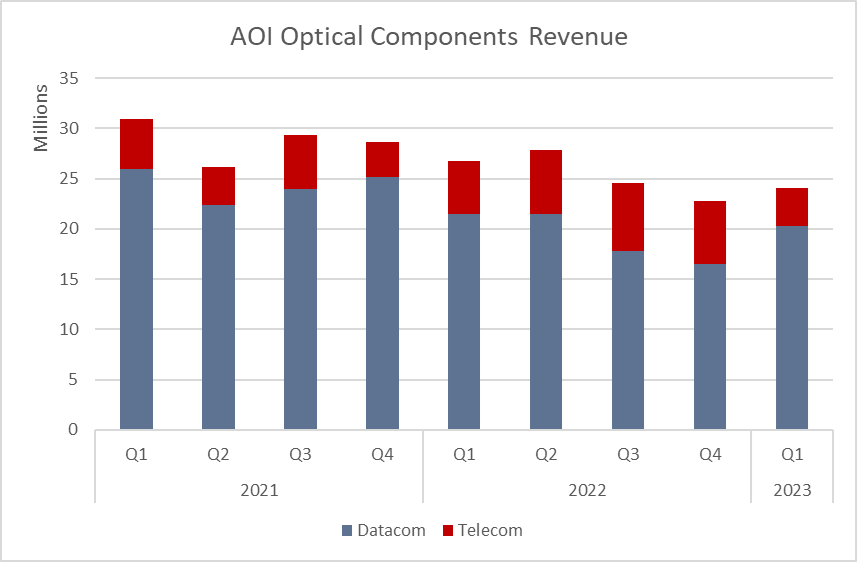

AOI’s optical components revenue and high-speed datacom transceiver shipments are reported in Cignal AI’s Optical Components Report.

- AOI’s MSO and telecom laser revenue is counted as Telecom component revenue and AOI’s transceiver and datacom laser revenue is reported as Datacom revenue.

- AOI’s datacom optical component revenue is all optical while AOI’s telecom optical revenue is about 10% of the total telecom business, which is why AOI’s public revenue ($53 million) does not match the revenue reported in Cignal AI’s reports ($24 million).

AOI optical components revenue reported in Cignal AI’s 1Q23 Optical Components Report

- On its quarterly investor call, AOI reported revenue of $53 million, up 2% YoY.

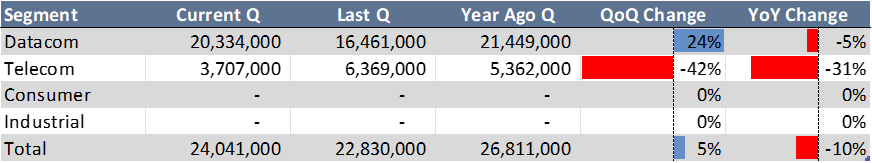

- The optical components data counted by Cignal AI (which does not include, for example, electrical power amplifiers for MSOs) was down -10% YoY. The smaller Telecom segment (15% of optical components revenue) was down more than -30% YoY.

- AOI stated that the company has exited several low-profit legacy products, shifted R&D away from low-margin projects, and has actually increased prices with some customers to improve gross margins.

- The inventory absorption problems experienced by the rest of the optical components industry have also shown up at AOI. CEO Thompson Lin said on the quarterly earnings call, “Recently we were notified of some inventory build-up with certain CATV customers which we expect will negatively impact our Q2 revenue.” Note that optical components are a small part (about 10%) of AOI’s MSO revenue.

- AOI’s QoQ revenues were down -27% compared to a record Q4. The company blames the QoQ reduction primarily on the Lunar New Year in China. One would imagine that the renewed company focus outside of the PRC will help to eliminate these dips in the future.

Conclusions

AOI is uniquely positioned within the optical components market as a relatively small and nimble company with US-based manufacturing capability. This capability – along with AOI’s high-yield VCSEL process – led to the recent win at Microsoft, which validates the company’s vertically integrated strategy. Also, AOI’s focus on the MSO market, where competition is now more limited, should pay off over the next few years.

Concerns about AOI center mostly around its size. With the recent consolidation in the optical components business, the behemoths Lumentum and Coherent, not to mention Chinese competitors Innolight, Accelink, Eoptolink, and others, dwarf AOI. While being a niche player with unique capabilities (e.g., its North American MBE fab) opens doors for AOI, the competition could pivot in its direction and damage its advantages. However, building successful semiconductor manufacturing, especially in North America, takes significant capital investment and expertise, and AOI should be able to retain its unique charms for years to come. Whether or not those charms remain part of a small company or are absorbed into a larger one is yet to be seen.